September 14, 2015

China’s real risk to world finance is a botched dismantling of its FX controls

Commentary by Robert Balan, Chief Market Strategist

"The move to change the daily fixing mechanism is a step towards renminbi liberalisation as China moves towards the Impossible Trinity paradigm, where the opening of China's capital account is forcing it to choose between retaining monetary autonomy (or controlling the interest rate) and controlling the exchange rate. Clearly, Beijing is choosing to retain monetary autonomy by letting go of the exchange rate. . . . Beijing's reform of the fixing regime shows it believes it is time to sever the renminbi's tie with the US dollar. Arguably, this is a statement of confidence rather than a sign of weakness."

Chi Lo, South China Morning Post, 13 September 2015

China's surprise devaluation of its currency last month unnerved a lot of investors for various reasons. Many investors interpreted the move as a signal that the economic distress has reached the government pain threshold. Others speculated that the devaluation was a desperate attempt to boost growth by improving China’s export competitiveness. But the threat to markets is not currency or trade wars, two concepts that are anachronistic in an era of global supply chains. What can be gained from lower currency value on the export swing can be lost on the resource and component import roundabout. Having a currency advantage was nice to have, but not the be-all of China’s devaluation this time around. It was also true that after a promising start in Q1, global growth weakened in Q2 2015, and so weak global demand is central to our argument as to why exports in China and elsewhere have been lacklustre. In that environment, a cheap currency on its own, alone, cannot deliver a meaningful boost to exports.

Every investor by now is familiar with the high level of corporate and regional government indebtedness in China, but few stop to analyze what is at the other end of the balance sheet equation – the assets that were acquired with that high level of debt. Economists Tom Orlik and Fielding Chen findings: “As of 2013, total assets were about 900 percent of gross domestic product, versus debt of about 220 percent. Assets have climbed since 2008 – the last time census data helped flesh out the picture. The data reflects China’s status as a nation of savers, at both the household and national level, and the rapid appreciation of asset prices over the last decade."

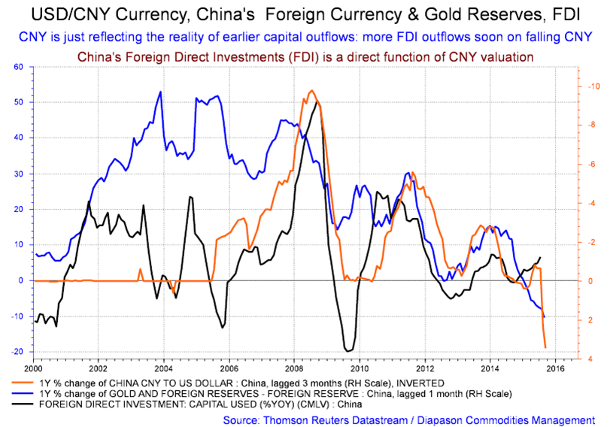

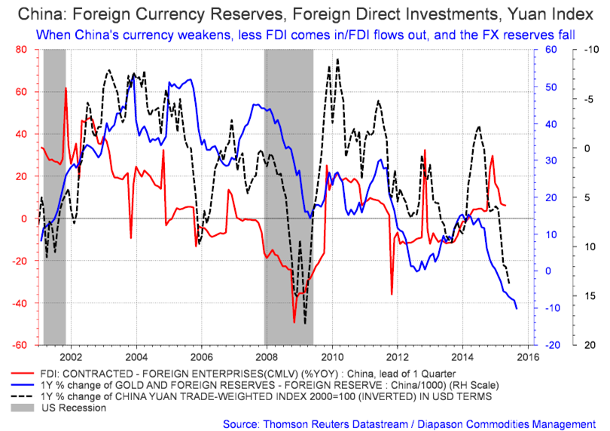

What is interesting is the finding that real estate and bank deposits are the biggest household assets, accounting for 70 percent and 24 percent respectively in 2013. For those investors unsettled by the plunge in China's equities, the macro-economic risk is minimal – stocks accounted for only 2 percent of total household assets. We believe that the most significant threat from China to world finance will come from China’s dismantling its exchange controls over the next few months. To support the government’s long desired goal of CNY internationalization and transforming it into a global reserve currency, China must allow true capital account convertibility and allow the CNY exchange rate to be set by market forces. The PBoC governor has in fact publicly set a target date of end-2015 for achieving "basic" convertibility or, in his words, making the CNY more "user-friendly."

It is the likelihood of huge volatility in CNY exchange rates and in capital flows that is the issue in this regard. Think about this – the central bank has been tightening rules about CNY outflows after a surge of flight of capital coming from its own citizens. Imagine what would happen when all those exchange barriers are taken away. If 10 percent of the 1.35 billion people in China for instance decide to swap part of their CNY holdings for foreign currencies, global markets will be deluged by huge CNY sell orders from China the minute the floodgates open. There is a very close link between the currency and capital flows; what is worse is the presence of a feedback process between the two variables which tend to exacerbate volatility in both under extreme duress. That magnifies the risk to the global economy, particularly if the exchange rate of the CNY collapses.

Despite endemic corruption and the often unilateral policies of the government, Chinese people have accepted the status quo in return for better living standards, which has been delivered by the Communist Party in the past several decades. Accepting the rule of an autocratic government and not desiring its overthrow, however, does not mean people will not hedge their financial wealth. They will, if given the chance – and dismantling FX controls in China will provide such an opportunity.

We believe that the CNY will have further to go to the downside next year on that basis alone. Indeed, China may have stated no wish to see the CNY devalue. But the relaxation of exchange controls and exchange rate controls is likely to result in significant downward pressure on the Chinese currency if there is a stampede for the doors – and we believe there will be. Between now and year-end, when China dismantles most of its FX controls, we believe that China will guide a much slower CNY devaluation compared to the pace that was seen three weeks ago. Given China’s “addiction” to FDI (which flies out at the whiff of a weaker currency), and considering that a weaker CNY will add billions more in debt to domestic corporate balance sheets which are largely US dollar denominated, the PBoC, on its own, is unlikely to devalue the CNY rapidly. This also hews close to the reaction function of a central bank that prefers incremental changes in its policy.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Commodities: big-time investors are buying as supply side cutbacks accelerate

A few giants in the investing world have been quietly making huge bets right now on commodities, an area analysts say continues to face some strong headwinds. So we ask: what do these investment titans know that bearish analysts do not know?

Three weeks ago, famed hedge fund manager Stanley Druckenmiller made a $323-million bet on gold, which has become the largest position in his family office fund. He also bought other commodity-related equities (miners, producers, etc) which brought his exposure to cyclical asset classes even higher. Recently, George Soros invested $2.25 million into coal producers Peabody Energy and Arch Coal, which champions an energy source which many analysts consider to be at the end of the line. Activist investor Carl Icahn also reportedly took an 8.5-percent ownership in copper miner Freeport-McMoRan which owns the largest agglomeration of base metal properties in the world.

Even Marc Faber, Dr. Gloom, Boom and Doom himself, is now championing the mining sector and precious metals. Dr. Faber’s take on the situation says global investors are running out of safe assets to invest in, and he suggested they revisit mining and resource companies, and the hard assets they produce. He reportedly said: “. . . (the) mining sectors, specifically precious metals and mining companies… like Freeport, Newmont, Barrick . . . have been hammered because of falling commodity prices. Now commodities may still go down for a while, but I don't think they'll stay down forever.”

The Fed rate hike initiation becoming less of a threat to commodities

Nonetheless, the impact that this might have on commodity prices may not be as dire as some analysts expect. To begin with, the Fed is likely to tighten policy only when there is a clear trend of strengthening economic activity, rising inflation pressures and relatively calm global financial markets. These are all positive for commodity demand.

Moreover, any Fed rate hike program will be drawn out, providing time for the markets to adjust to the new rate regime. One or two hikes have already been discounted in the US Dollar's valuation – the US Dollar could in fact weaken once the Fed implements the tighter regime. Moreover, the US Dollar and commodity prices do not always move in opposite directions. During the recent turmoil, both US Dollar and commodities were weak at the same time. This synchronicity could also happen on the upside.

Chinese, Indians snapping up Gold and Silver in a frenzy

Precious metals prices diverged in August. Gold and platinum outperformed silver and palladium. It is clear that the PGMs which have high cyclical components have been de-rated under the environment existing in August. Gold also benefited from a further turmoil in China’s stock markets that boosted safe-haven demand. A sharp decline of the US dollar and a fall in bond yields due to the panic over China also helped lift gold prices last month.

These are the recent developments in Gold: Last month, August 2015, India imported 126 tons of gold and 1,400 tons of silver, according to data from Infodrive India, Bullionstar reported last week. Gold import into India have been rising sharply after last year’s steep fall due to government import restrictions. Year-to-date India has imported 654 tons of gold, which is 66 percent up year-on-year. 6,782 tons in silver bars have crossed the Indian border so far this year, up 96 percent y/y. Gold import is set to reach an annualized 980 tons, which would be up 26 percent relative to 2014 and would be the second highest figure since 2008, according to Bullionstar.

Chinese investors are on a tear as well. The week up to August 28th saw Shanghai Gold Exchange withdrawals for the month to an unprecedented 302 tons, a new monthly record. All of these during August, which is usually one of the weaker months of the year for SGE deliveries. To make a contextual comparison, the world's second-largest gold producer, Australia, mined 272 tons of gold last year. Put another way, the SGE delivered nearly 50 tons more than the normal withdrawals from SGE in a single month. SGE only makes deals in physical gold – no paper gold elements were involved in those transactions. With Chinese demand already stronger going towards the tail end of the calendar year (November and December as the Chinese New Year approaches), it does look like there will be a huge new record in the SGE withdrawals this year.

Charts of the week: USD/CNY, China’s Foreign Currency and Gold Reserves, FDI; China Foreign Currency Reserves, FDI, Yuan Index

|

|

|

|