September 21, 2015

Production cuts are accelerating as the supply side responds to falling prices

Commentary by Robert Balan, Chief Market Strategist

"Just half a dozen new projects will be approved this year, says the Wood Mac report, and 10 or 11 in 2016, compared with an annual average of 50 to 60. “Deep cuts” in North America account for more than half of a 45 per cent fall in capital spending across the Americas."

Christopher Adams, Financial Times, September 21, 2015

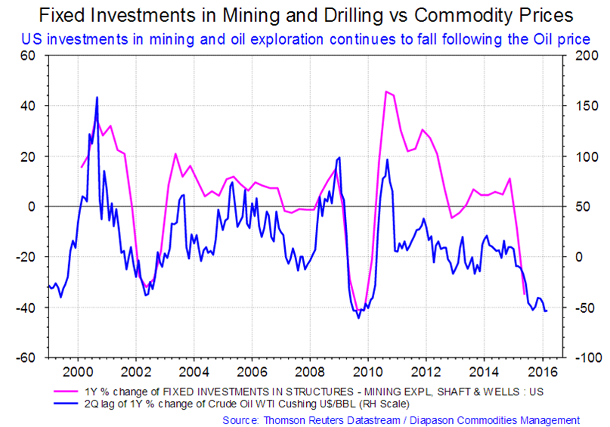

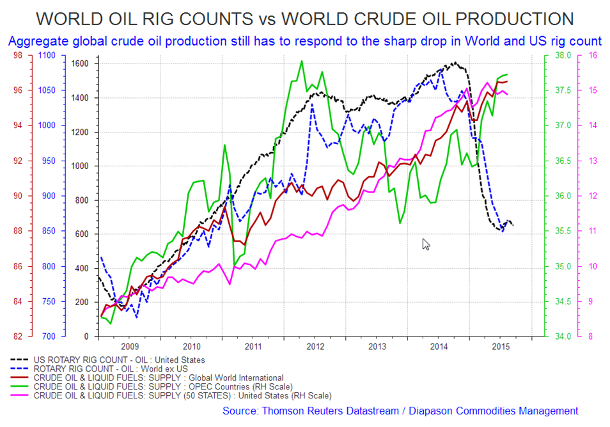

Commodity prices have been falling for several quarters now, leading to a sharp response from the supply side. A double-digit percentage drop this year is expected in capital investment by commodity producers, a decline that highlights the pain inflicted by falling prices on resources and on their company equity. In the past three months alone, there has been a long list of companies that have cut or have declared intention to cut or reduce capital expenditures. Late last month, Freeport, the world’s largest producer of copper and gold announced production cuts in response to depressed copper prices, which have slipped around 15 percent since their 2015 high of $6500/ton in May. This should reduce an estimated 70,000 tonnes of copper from global markets, and should help support prices. South Africa, leading producers of platinum and palladium miners, also announced job cuts and mine closures, as platinum has slipped more than 16 percent in 2015, and palladium by 25 percent. In the US, the sharp decline in Metals and Crude oil prices has been met with sharp cutbacks in investments in mining and oil exploration. Capex growth trails commodity and oil prices by only 2 quarters, so production volumes will soon decline sharply following the lead of investments (see first chart of the week below). The best example of capex being cut in the oil industry is the sharp decline in the number of oil rigs that service US shale oil production to their lowest point since 2003. The 59% drop in oil rig count experienced over the four quarters (with the number in operation falling from 1,592 to 652) has already started impacting oil production. US shale oil production is already falling 475 thousand barrel per day in just a few short months, thanks to falling rig count and the high depletion rates of unconventional wells (see second chart of the week below).

North American energy exploration and production companies have collectively cut their capital budgets this year by 41 percent, according to a new analysis published Tuesday by Moody’s Investors Service. The report also said that for some companies, the cuts will be even deeper. More than 20 percent of North American producers will cut capital spending by at least 60 percent, they said. Cutbacks in the oil industry are happening on a global basis, not only in the US. Oil & Gas U.K. in a report last week predicts North Sea capital spending will collapse from a record 14.8 billion pounds in 2014 to 7 billion or less within three years. Less investment will lead to less oil production, and job cuts. The group says that 65,000 jobs have been cut in the North Sea oil industry since 2014, which reduced the workforce to 375,000. Halliburton, the oil-field-services company, said it will cut its capital spending this year, as drilling activity slows because of falling crude prices. The Houston-based company will trim capital spending by $200 million in the second half of the year, which represents a 21% drop from last year, said Christian Garcia, the company’s acting chief financial officer. Royal Dutch Shell said on Thursday last week it will further reduce 2015 capital investment to $30 billion, down by 20 percent from a year ago as it expects the downturn in oil prices to "last for several years." Shell earlier in the year cut its capital expenditure, or capex, to $33 billion from circa $35 billion in 2014.

Another report also mentions that the energy and materials sectors, which include metals, mining, oil and gas, made up 39% of global capital expenditure in 2014. In 2015, investment spending from that group looks set to fall 14 percent, and it’s poised to drop another 5 percent in 2016, the report concluded. The sector has been hit hard by economic issues emanating from China, the biggest consumer of resources in the world. Among the hardest hit is Glencore, the world biggest resource company. Glencore said it has cut its maximum industrial capex for 2015 to $6 billion, which is lower than the $6.5-6.8 billion announced in February. Admittedly, the capex problem is focused on the energy and materials sectors. Falling commodity prices is what had led to the big cutbacks – it is estimated that the capex decline in this sector will be 14% in 2015. Excluding commodities, the rest of industry is expected to grow capex by 8%. But the commodity sectors were contributing in keeping global capex propped up —the twin sectors’ capex accounted for 39% of the total last year.

With so much capital expenditures being cut, there will be a severe negative impact on resource supplies over the next few years. We are already starting to see the impact of sharp cut backs in oil drilling rigs after crude oil prices fell significantly over the past quarters. US shale oil production has been falling weekly; US oil production has fallen 584K bpd from its 9.701M bpd high point in April this year. The biggest weekly decline so far was tallied last week US oil output fell by a massive 208K bpd, after adjusting for pipeline maintenance in Alaska. Weekly US oil production has now declined for six straight weeks at an average rate of 47K bpd per week. At this rate, if maintained, the oil market could see a balance before the year is over. Wood Mackenzie, the energy consultancy, expect capital spending on new projects to decline by between 20 and 30 per cent on average in the wake of the price oil slide. Wood Mackenzie calculates that $220bn of investment has been cut so far, about $20bn more than it estimated two months ago and much of it the result of projects being deferred. Such a decline in spending means that the oil price crash since last summer — the result of weaker Chinese demand, record US production and Saudi Arabia’s decision not to cut output — could resemble the savage capex downturn of the mid-1980s, they said. Despite comparisons with the 1980s, Wood Mac believes that deeper, structural shift in cost cutting to accommodate the low prices, is unlikely. “In our view oil prices will rise sharply from 2017, and there is a real risk that cost inflation pressures will then return,” Wood Mackenzie said.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Another take on the US Dollar's strength, and its future prospects

There has been many factors driving the US dollar rise from July 2014 to April 2015. The conventional wisdom suggests the usual reasons for a currency to appreciate: prospects of policy rate and growth differentials, safe haven destination, divergences in financial market outlooks between the US and the Rest of the World. Admittedly, the US economy and markets fitted the prescriptions ascribed to the US Dollar rally from July last year to April this year, but the strength of the rally seem somehow too strong for those reasons alone. Perhaps there are one or more unidentified factors that have contributed to the US Dollar's spectacular surge during the July 2014 - April 2015 period. One such factor may be the US shale oil boom.

The backdrop of this discussion started in Q1 2009, when the Great Financial Crisis (GFC) finally broke and the global economy begun to recover. After the trough of the GFC, commodity prices, and specifically oil prices, started to soar. Oil prices rose even more with the so-called "Arab Spring" convulsions of 2011. The rapid rise of oil prices sent most of the global economy into a sharp slowdown, devastating the Eurozone (which went on to endure a 3-year negative growth) and Japan, and most of the developed countries. The US suffered as well but on milder terms, because at just about that time, the shale oil bonanza started to take off.

Shale oil began to positively impact the US economy in late 2011, as shale oil output ramped up. This started to displace imports. Oil imports declined sharply from 2011 through 2014, falling by more than 1 Mbpd / year. Some economists calculated the reduction of the import burden by 0.4 percent of GDP per year. As shale oil production rose almost exponentially, the US Dollar rode on its back, as the import burden was significantly reduced as well, culminating in a sharp reduction of the US trade deficit.

The reduction in the trade deficit had a tremendous positive impact on the US currency. The sharply narrowing trade balance has been a major factor for the US Dollar strength during the July 2014 - April 2015 period. This is very easy to show. US spectacular shale oil production has had a very positive impact on the US trade deficit, and the transmission is through the petroleum commodity item of the trade deficit. This was one of the most significant cause of the stronger US Dollar during the period discussed. The US currency was responding to the narrowing brought about by significantly smaller bill for crude oil.

So we now know that the fortunes of US shale oil have serious implications for the US Dollar. So if shale oil production in the US collapses, we know what will happen to the trade deficit – it will sharply widen again. That will bring about a much weaker US Dollar, as the trade deficit will start to widen again via the rise in petroleum commodity item of the trade deficit. Since 2005, the petroleum part of the trade deficit has taken on a good negative correlation vis-a-vis the US Dollar (see chart above) – when the petroleum commodity balance increases, the US Dollar weakens. This directly links the US Dollar with US shale output, so that when oil production declines, the US currency falls as well.

Copper has the best supply fundamentals among base metals

China's slowing industrial production and the lack (so far) of visible results from a series of stimulus packages have dried the incentives for investors to invest in copper, hence, supporting the price. However, a recent rally was triggered by the release of several supporting news, although it is still not clear whether these developments will support a real upward bull trend. Nonetheless, the fundamentals for copper are better than other base metals, and for that matter, most commodities. Here are the immediate reasons why: China does not control copper supply in the same extent as it does aluminium or steel. China is a net importer of copper, and in fact consumes 45 percent of global copper production.

There are other positive reasons which will take a while to develop. The most compelling ones come from the response of the supply-side to the low prices of commodities. For instance, Glencore plans to reduce copper output by 400 kilotons over 18 months in a bid to reduce costs. Reports came out last week stating that Glencore will halt production at its Katanga mine in the Democratic Republic of Congo (DRC) and its Mopani operation in Zambia for 18 months, as part of its new debt consolidation plan. The Katanga mine produces about 200,000 metric tons per year, roughly 20 percent of the DRC's copper output. The Mopani mine produces about 110,000 metric tons per year, roughly equal to 15 percent of Zambia's output. It is a testament to the bad sentiment towards commodities that those announcements have not produced a significant rally. Not long ago, such announcements would have caused a significant price rise in copper.

The main problem for copper, and source of its declining prices, is the slowdown in Chinese industrial production. But as the say, the solution for low prices is low prices, so those same low prices should eventually impact supply. That is exactly what is happening now to copper and the announcements of cutbacks in production. The extended period of low copper prices are now adding momentum to supply reductions. More significant in a longer term time frame for copper price support is the situation between Codelco and the Chilean government. Codelco says that to keep production flowing, it has to invest $25 billion over 5 years. However, the Chilean government has so far pledged just $4 billion in returned profits between 2015 and 2020. This is insufficient to meet Codelco's capex needs, adding to the company's technical, environmental and financial problems.

In summary, copper has solid medium- to long-term fundamental prospects, meaning those factors should kick in 2 to 3 years from now. In the short term, much will ride on China's growth for a short-term lift on copper's prospects. It also helps that the US Dollar is being steadily being undermined by the Fed's wavering determination to lift policy rates this year. During the last FOMC meeting, the Fed has mentioned issues in China as one significant reason for staying a rate hike. What was left unsaid was the unsteady prospect for US growth in the longer-term, as the metrics being watched by the Fed (manufacturing, among other) begin to lose momentum. We believe that the Fed will not raise policy rates this year, and that will help undermine the sentiment for the US Dollar. That should benefit commodities in general, and copper in particular.

Charts of the week: Investments in mining and drilling vs commodity prices; Oil rig count vs world crude production

|

|

|

|