September 28, 2015

The Platinum and Palladium price trend divergence will outlive the VW scandal

Commentary by Robert Balan, Chief Market Strategist

"Diesel, which predominately uses a platinum catalyst, may be damaged as an option for car purchasers because of the Volkswagen emissions scandal, which would conversely be a win for palladium."

Ross Norman, chief executive of Sharps Pixley

Prices of the Platinum Group Metals (PGMs) have started to stabilise in recent times. PGM prices have fallen roughly 30 percent since the middle of 2014, after the US Dollar initiated its 5-quarter surge until April 2015. Platinum fell from circa $1500 per troy ounce to $936; palladium declined from circa $900 to $608 during the same period. It's note-worthy that even as the twin PGMs declined, their downward trajectories diverged. Platinum's sell-off was more persistent with a prominent downward slope, while Palladium held relatively better with a series of ladder-like declines. Simply put, palladium has held up better during the PGM washout. The characterization is that Palladium has had better relative strength.

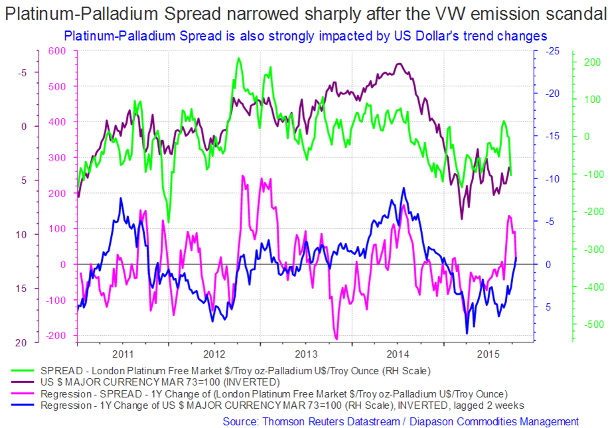

That stronger relative strength was further underlined by the Volkswagen emission fiasco in the US. Platinum fell 4% after the scandal broke out, although it recovered some of its losses in recent days. On the other hand, Palladium prices surged 8% to a 2-month high after the news of the fiasco. Impressive as the divergence was on the nominal prices, it was spectacular on the Platinum-Palladium spread (see first chart of the week below).

The spread narrowed sharply, the biggest move of its kind in a year. And there is further potential narrowing of the spread if the scandal extends to Europe. VW was accused by the US government of installing a “switch” software which is able to configure variable emission outputs. According to a report, ”the switch senses whether the vehicle is being tested or not based on various inputs including the position of the steering wheel, vehicle speed, the duration of the engine’s operation and barometric pressure,” and adjusts the catalytic outputs accordingly. So efficient was the fixed data that the real results, in comparison, could be 30 to 40 times worse than the contrived figures. Shares in the firm have collapsed more than 35% at some point after the scandal hit and cost ex-CEO Martin Winterkorn his job.

The next question is whether that kind of emission rigging is also prevalent in Europe, and if the other German car-makers also rigged their emission softwares improperly. In Europe, more than 50 percent of cars registered have diesel-powered engines. This is crucial to the spread because Platinum is used in catalytic converters used in diesel-powered engines, while Palladium is extensively used in converters used in gasoline-powered engines. Some car industry analysts are suggesting that this could be the end of diesel cars, implying ascendancy of gasoline-powered cars in Europe. This is unlikely however, but nonetheless, the immediate aftermath will be a lower ratio in the sales of diesel-powered vehicles relative to gasoline-powered ones. That will favour Palladium over Platinum in the near-term at least. And if other German car makers are similarly using emission-rigging methods, one can expect that the Plat-Pall spread could narrow even much further.

There are other reasons for the spread to transcend the VW scandal and narrow even further. Financial Times reported recently that improvements in gasoline engine efficiency had already begun to have an impact on demand for diesel cars. The FT said that only in the UK and Italy were diesels holding steady or rising. However, FT also reported that the ascendancy of gasoline engine powered vehicles recently stalled due to a dramatic fall in diesel fuel prices relative to gasoline following the commissioning of 2 new refineries in Saudi Arabia, which had flooded the European market with cheap diesel. But with so much uncertainty over how revised emission tests will allocate appropriate tax penalties for real emission figures (which are conceivably higher than current test data), the sales of diesel-powered vehicles will necessarily be lower than if the test-rigging scandal had not occurred.

The Plat-Pall spread can also be impacted by macro drivers. For one, it is strongly impacted by the inverse trend of the US Dollar – put another way, the spread has a very strong negative correlation to the US Dollar. That has been skewed over the past week, but if the US Dollar strengthens from here, then the Plat-Pall spread will likely continue to narrow. But if the USD falls from here, then the Plat-Pall spread could widen somewhat.

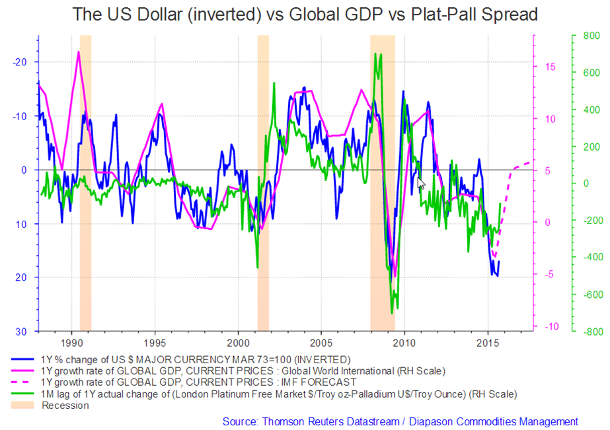

Why is there a strong inverse link between the spread and the US currency? It is because the spread filters out the commonality (industrial usage, substitutability, etc.) between the two PGMs. What is left behind is the degree of exposure of these two PGMs to the global business cycle, which is well-proxied by the US Dollar in its inverse (see second chart of the week below). Palladium is more correlated to global growth and to the inverse of USD Platinum. The Plat-Pall in a way leads the inverse of the USD and Global GDP – meaning that if the lead of the spread is correct, then the USD is set to weaken and Global GDP is set to rise. This development will have beneficial knock-on effects on PGMs and other cyclical commodities.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The time of reckoning for many US shale oil companies will come from now on

Despite the crude price falling more than 50 percent from last year, capital markets have generally remained accessible to US shale oil companies. But the time of reckoning is fast approaching. The next hurdle which faces many US oil companies comes on October 1, 2015, when their borrowing base are reset, i.e., the valuation of their oil and gas reserves that banks use to determine how much they will be lent, are determined.

But even now, the flow of capital to shale oil is slowing – Financial Times reports that "US exploration and production companies sold $10.8bn of shares in the first quarter of the year, but that dropped to $3.7bn in the second quarter and under $1bn in July and August, according to Dealogic." Even more alarming according to FT, "those companies were selling an average of $6.5bn worth of bonds every month in the first half of the year, but the total for July and August was just $1.7bn." The noose is tightening.

The bases for borrowing are generally set twice a year, in spring and in autumn. The new levels, which should take effect from October 1 will very likely reflect significantly lower valuations than the one agreed in the spring. This suggests that less money will be lent to shale operators, which in turn, should curtail oil production accordingly. This continues the peculiar relationship between the financial sector and the shale oil industry. Funds from the financial sector drove the shale industry to spectacular growth, so it is symmetrical that the financial sector will also drive the industry to contract and consolidate, and become more efficient and more formidable and disciplined competitors to OPEC.

It does not mean however that the US shale oil industry, which has been responsible for rapid surge in US oil production since 2009, is going to die. There are strong companies in the patch that have healthy balance sheets, low operating costs, or both – these are the ones which should be able to ride out the downturn and the reckoning on October 1. Those companies with high costs or high debts, or both, face a bleak future after October 1. Clearly, easy money and the lack of other qualified investment opportunities for capital had led to over-lending and the subsequent overshoot in US oil production growth. But weaker companies will be culled in this consolidation cycle. Already 16 US oil production companies have defaulted this year.

Even before the day of reckoning in October 1, the sharp decline in oil prices since November last year has already impacted capital expenditures in the shale oil patch. However, steep improvements in the productivity of the rigs used in shale oil extraction and in the wells drilled have enabled shale oil output to rise even with sharply lower number of rigs. The oil rig count in the US has since then fallen 59 percent from its peak last October. That, in turn, had an effect on the shale oil’s output, which has been falling since April – in a sharper trajectory in recent weeks. We expect the reduction of oil production from the shale patch to accelerate – Q4 2015 US oil production will likely run at a lower rate than in the same period last year.

Lower output from the shale oil patch will go a long way in balancing the oil market, which is currently plagued by oversupply, in large part due to OPEC's decision to try and keep market share. Slower oil output will enable increasing demand to work-off the supply overhang, which should consequently improve oil's price structure to a level which is sufficient in encouraging capital expenditures so as to forestall serious supply issues in the next few years.

There's a divergence between Western, leveraged paper gold traders and East Asia physical gold buyers

India reported its preliminary August gold imports recently. The figures show an import spike of 138 tonnes or around 5% of total annual gold mine production. This was the highest monthly purchase level in 2015 and which was significantly higher than average August totals (which are in general, historically slower than the rest of the year, as it pertains to Indian gold imports).

Bullion Star has compared the current and previous annual Indian gold demand relative to annual world gold mine production and found that current purchases are running even higher than in 2013, and that this year's purchases are second only to the series of monthly purchases that lead to the gold peak of 2011. Even more interesting development is the fact that Indian gold demand is surging despite a weak monsoon season which had hurt rural income. Much of Indian physical gold demand originates from the country's rural economy which has historically favoured holding gold in lieu of Indian rupees and bank accounts. So it is not too far-fetched to conclude that gold demand is surging in this sector despite lower incomes because the average Indian gold buyer finds that the current price of gold is simply too low to ignore. Also, the wedding season will be starting soon and key festivals Diwali and Dussera are only a few weeks away.

The following facts are crucial in certain metrics. The biggest drivers in the physical gold market are Indian and Chinese gold retail demand. In the case of India, the country produces almost no gold domestically and yet has become the second largest world importer of gold. Based on August data, current Indian gold retail demand is at much greater level than what is normal in the summer time. It may be just jewellers stocking up for the next gold-heavy Indian wedding season. Or the explanation could be Indian buyers simply purchasing gold due to irresistible low prices.

In the case of China, retail gold demand being tracked as deliveries out of the Shanghai Gold Exchange (SGE), is very strong in summer at a time when demand is usually weak. The flow of gold through the SGE year to date is already 36% higher than the whole of last year, and 13.5% higher than the level of 2013. Point to consider – 2013 was a record banner year. Another illustrative point: during a recent eight-week period, SGE withdrawals totalled 512 metric tons of gold. That is more than the corresponding global mine production of circa 492 tons over the same time frame. For 2015, it will get even better: Chinese demand usually become progressively stronger going to the year-end, as the Chinese New Year approaches. That is when China's retail gold consumption normally rises to its highest.

These developments on the physical side are the radical opposite in Western gold futures exchanges where the price of gold is languishing due to lack of interest. All we know is that if the trend for physical gold in East Asia continues, it may cause a physical crunch in the Western gold markets. We have already seen reports of tightness in the London gold market. In recent weeks, the cost of borrowing gold in London had headed sharply higher. We also saw Comex registered gold inventories dropping to some of the lowest levels on record, although this phenomenon might be related to some other market developments. These developments are worth watching because Swiss bankers used to be able to count on buying physical metal from the big gold ETPs. But with inventories in those funds probably scraping bottom, gold may be harder to come by this time around, which, in turn, could push up the price of gold.

Charts of the week: Platinum-Palladium spread narrows sharply after VW scandal; USD vs. global GDP vs. Platinum-Palladium spread

|

|

|

|