October 5, 2015

The Oil market may balance in Q4 2015 — the global oil “supply glut” is a carried-over error

Commentary by Robert Balan, Chief Market Strategist

"People are beginning to see significant declines in production figures as a result of the declining rig count, and you can expect that trend to continue through the balance of the year."

Andy Lipow, president of Lipow Oil Associates LLC, Houston

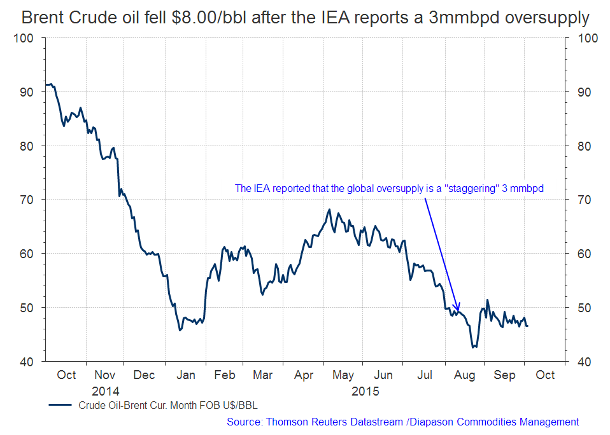

In mid-August, the IEA came out with a report saying that Q2 2015 global oil supply exceeded demand by a "staggering" 3 million bpd. We question the IEA data of 3 million bpd surplus during that period. This report started the meme of a glut in global oil supply which was amplified by the media. The report triggered a sell-off of circa $8/bbl bringing in the 2015 low of $42.50 in spot Brent Oil. However, the IEA's estimate of +3.0 million bpd surplus during 2Q 2015 does not add up with existing global oil inventories. That seminal data is being carried over by the agency, and is still being carried over, and continues to be reflected in supply-demand equations, contributing to the prevailing bearish sentiment on crude oil (please see chart of the week below).

Here is the point of our case: OECD inventories and floating storage combined only increased by 90 million barrels in the quarter. If the IEA is correct about the Q2 surplus, then the agency has to explain how 170 million barrels of oil vanished without a trace. Experience shows that most media journalists and prognosticators are willing and ready to provide an opinion, but don't feel obligated to tie that opinion back to any actual data. Its likely that they have relied on the opinion of other external sources but they have not looked at any actual data; or if they have done so, they have accepted IEA and EIA data sets without crosschecking with other information. This is further exacerbated by the fact that the weekly EIA US production numbers include a significant amount of estimation because they have to. There is no real time oil production data available so the EIA does the best that it can – and that is extrapolating whatever current numbers they have on hand and by seasonality adjustment factors. We have no doubt that the IEA operates in the same manner. The IEA actually used the word "staggering" to describe the assumed supply overhang – one of very few instances in which we saw a reporting agency used hyperbole. The IEA believes that from April through June of this year the daily world supply of oil exceeded the daily demand by 3 million barrels per day.

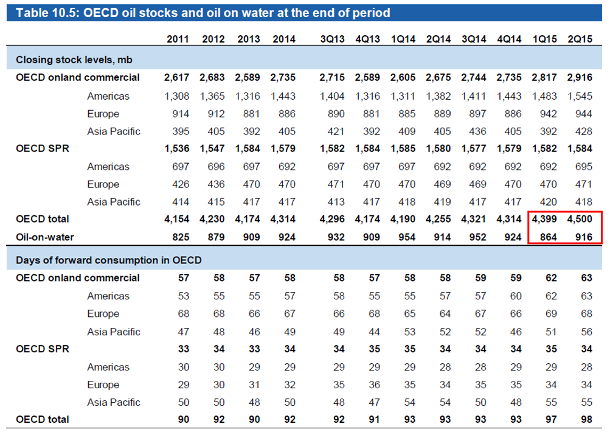

Here is why this situation was highly unlikely. The entirety of Q2 has 91 days in it (April has 30 days, May, 31 days and June, 30 days). If the daily supply of oil globally exceeded daily demand by 3 million barrels per day then inventory levels should have grown in Q2 by 91 days x 3 million barrels = 273 million barrels. The table below is from the August 2015 OPEC Monthly Oil Market Report. It shows the changes in OECD crude oil inventory levels over the past eight quarters, as follows: (1) At the end of Q1 2015, there were 4.399 billion barrels in OECD storage. At the end of Q2 that figure had risen to 4.500 billion barrels which is an increase of 101 million barrels, (2) add to that the 52 million barrels that the MOMR shows as increasing in oil floating around the globe and you get to an increase of 153 million barrels. Divide that by the 91 days in Q2 and the oversupply seems more like 1.68 million barrels per day and not 3 million barrels per day as the IEA suggests.

That there was oversupply during the period is not being debated, given the OPEC production increase which is really the proximate cause of abundant supply, and threw a wrench into the oil price recovery. This was exacerbated by increased production out of the shale oil patch, despite the sharp decline in US oil rig count. As the OPEC report pointed out, OECD inventories during that period was higher than normal. What we do question is the IEA suggestion that the surplus was 3 million barrels per day, instead of a more manageable 1.68 million barrels. The IEA data can not explain the discrepancy, probably because that overhang probably did not exist in the first place.

Here is why: the overstatement may have risen because it is possible that the IEA had missed the rollover in U.S. shale oil production which occurred in May (following the April peak in output); at the same time the IEA probably underestimated global demand which has surged by over 800 thousand barrels per day in the U.S. alone in 2015, and perhaps circa 2 million barrels per day globally. The worst part of it: the US-based EIA also overestimated US crude oil production in Q1 2015, which likely contributed to the mistakes committed by the Paris-based IEA. It is not far-fetched that the IEA had used the EIA’s data in their calculations, compounding the errors in their models (which are likely linear, further exacerbating the situation). The takeaway from this is that global supply continues to be impacted by the IEA’s big overestimation in August, and which continues to be carried along as the agency tries to spread out the overestimation over subsequent monthly data.

New drilling recently has not been keeping up with depletions. There will be less drilling activity when lower borrowing bases are implemented after October 1. The drop-off in shale output could be exponential. That could effectively balance the crude oil market; moreover, in December OPEC (Saudi Arabia) could declare victory, and rescind its strategy of flooding the market with oil. This will provide a long awaited redress for non-Middle East OPEC members, and provide some respite to Saudi Arabia’s burdened economy as well.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Cocoa continues to defy general commodity weakness as El Nino threats build-up

Cocoa bucked the overall bear market trend in commodities during much of the year for some good reasons. The dry weather pattern associated with the initial phase of the 2015 El Nino provided less-than-desired amounts of moisture for African cacao trees, which has triggered a six-month price rally. Despite the length of the rally, the shortfall is not likely to have been totally priced into the market. Even with the main crop harvest starting in West Africa soon, cocoa prices may yet shrug off any accumulation of new supplies.

Western African nations (the Ivory Coast and Ghana) produce nearly 73% of global cocoa production. Thus, supply issues in that region can have a significant impact on cocoa price. Indeed, in the Ivory Coast (the world's largest producer of cocoa) the main crop production is expected to be 100,000 metric tonnes less than last year's 1,720,000 metric tonnes harvest. Therefore, the 2015/16 crop year is expected to see cocoa at a global supply deficit of 100,000 tonnes or more. That is why cocoa prices have been rising steadily higher since early April.

True, a cocoa supply deficit does not mean there is not enough supply to meet demand. It only means that for any given crop year, the world used more cocoa than it produced. Some analysts say that we also have to take into account supplies in storage from years past. However, 2014/15 ending stocks will not be one for the records, and it may not be adequate to cover the current shortfall. Ivory Coast’s deficit of 100,000 tonnes of cocoa this year represents a 5.8% decline from last year's total harvest. It may be enough to keep the rally going further still.

There are a couple of caveats in this bullish outlook. A continued downgrade of the Ivory Coast or Cameroon crop would certainly push prices higher further from here. However, the current rally is weather related – and at a certain point, the market reaches a conclusion that the supply shortfalls have already been priced in. This market has had 6 months to price-in the impact of the El Nino event, which leads to lower cocoa bean yields; that may have been long enough. In addition, a number of other factors may also thwart the effects of the approaching El Nino.

Western Africa’s main crop cocoa bean harvest starts in September/October and continues through the first quarter of the following year. As is true in other agricultural markets, supplies at the harvest will be higher than at any other time during the year. This seasonality feature often translates into lower prices during harvest time. Indeed, cocoa prices had followed such a pattern in years past, although it could be different this year.

The other risk that we have to watch for is a complete decoupling of emerging economies from what we expect to be better global growth profile later in the year. While cocoa has managed to defy these factors for much of the 2015 year, the negative effect of these factors should become pronounced as cocoa prices continue to climb. Nonetheless, we expect cocoa prices to stay bid over the near-term at least, as the potentially strongest El Nino in history continues to undercut conditions conducive to cocoa bean yields, more than analysts have forecast.

Copper and base metals may also start taking cue from global growth in Q4 2015

Major lower-cost copper producers have increased copper production, but some of them have run into trouble due to base metal prices that continued to fall. All the huge commodity producers have their earnings evaporate under those conditions. As an example, in Q3, Glencore PLC suspended its dividend and diluted shareholders' equity. The company announced that it intends to close some operations and pay down debt, sending its equity price to a virtual collapse. Shares of Glencore have become the worst performing stock on the London stock market this year. Shares of other producers, BHP Billiton and Rio Tinto have also fallen to very low levels relative to just last year.

The culprit is of course the price of copper and other base metals. And a weak global economic outlook, particularly as it pertains to China, and a still elevated US Dollar, have all contributed to the down-trend market action in the copper and base metal markets. China so far had remained the key factor in the recovery of copper and base metal prices.

The Chinese government and central bank have taken significant measures to kickstart the economy, but so far the results are paltry. Thus far in 2015, China has cut interest rates three times. Economic activity seemed to be improving when the Chinese domestic equity market plunged in July, erasing all traces of recovery in its aftermath. The government introduced new rules and regulations to inhibit or ban selling and instituted measures to encourage buying of equities. Even in the face of these new developments, equity prices have remained soft, the prices of base metals staying soft as well. China in summer floated a $1 trillion Yuan bond for infrastructure projects all over the nation. Then, in late August, China devalued the domestic currency, the Yuan, in a move which shocked the world. All these moves were taken in hopes of stimulating the domestic economy and the nation's exports so as to hit the target growth rate of 7%.

The world had been dependent on Chinese growth for many years now, so continuing slowdown in that economy has translated to difficult circumstances around the globe. A Chinese slowdown, for instance, has severe, negative impacts on the economies of commodity-producing nations like Australia, Canada, Russia and Brazil. Hence, base metal prices, resource companies and commodity producing countries have all become very sensitive to Chinese economic developments.

There are signs of better times for copper and the base metals. The U.S. Federal Reserve Open Market Committee, during their September meeting, decided to leave the short-term interest rate unchanged. Many market participants had expected a rate hike, taking the Federal Reserve's word at its face value that policy rates will be raised sometime during 2015. This has curtailed the US Dollar ascent. Recently the September labor data proved very disappointing, leading many observers to the view that policy rates will not be raised in 2015. This has taken down the US Dollar a notch, but it had recovered of late. We concur with the view that the Fed will not raise policy rates this year, so we expect the US Dollar to continue weakening from here. That should provide copper and the base metals (and the entire commodity sector) some respite.

We also expect the global economy to make a recovery going into year-end. In line with that, base metal prices will likely take a cue from the global economy in Q4. The Chinese economy will continue to influence prices for the rest of 2015, but the rest of the globe should start impacting copper and base metal prices as well. This, to us, will be a sign for improved prices for the base metal sector during the last quarter of the year.

Chart of the week: Brent fell $8/bbl after the IEA reports a 3 million bpd oversupply

|

|