October 19, 2015

Mexico and Brazil oil auction failures plus Capex reductions - the longer term implications

Commentary by Robert Balan, Chief Market Strategist

"Mexico is fighting global headwinds that could hurt the outcome (of a new auction). Oil prices have slumped more than 50% in the past year and companies from ConocoPhillips Co. to Marathon Oil Corp. are slashing investments."

Fadel Gheit, analyst at Oppenheimer & Co. New York

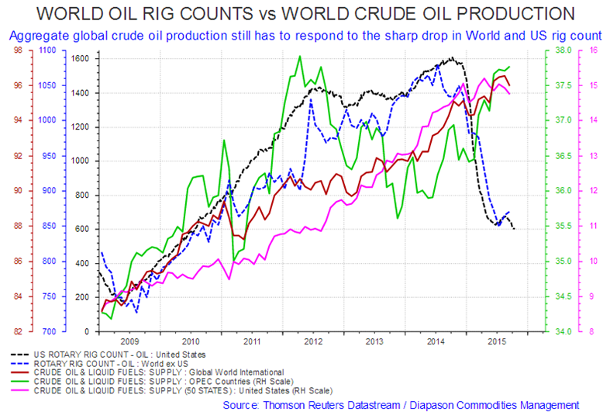

The most talked about trend since the oil price collapsed more than a year ago, was the spectacular decline in drilling that occurred in the shale patch in the US and in other parts of the globe. The oil rig count peaked in the US in July last year while rig count in the globe-ex-US peaked in October. The aggregate rig count world-wide fell from an aggregated high of 2,671 to 1,485 at latest count (see first chart of the week below) The US rig count this week fell by another 10, to a five-year low of 595 from a previous high of 1609 in October last year.

The second most talked about development in the US shale industry and global oil extraction was the long delay between the sharp decline in the global number of oil rigs and the corresponding decline in oil output. US production only started declining in May, which was 7 months after the US oil rig count peaked, and almost one year after the initial decline in oil prices. The US oil production peaked in April when it reached 9.7 mb/d according to the EIA, and production had by now declined to about 9.1 mb/d, according to the EIA's weekly report. A lot of analysts (including us) have issues with the weekly EIA oil production report but it does highlight the fact that US oil production has been on a downward trend in the past 6 months.

Prior to the sequential decline, US shale production has been admired for its resiliency and innovativeness, given the industry’s lagged reaction to sharply lower prices and collapsing rig counts. But with the sequential declines in output in full view, the resilience issue is now moot. At oil prices below $50/bbl, we now know that the US shale oil industry, in aggregate, will shutter the shop and shrink.

US shale oil accounts for less than 5% of the global oil market, so sometimes one wonders how disruptive the industry has become to be the proxy target of Saudi Arabia’s campaign to eliminate the marginal oil producers that are contributing to a global supply glut. But it was not the size of the market share that made the difference – it as the super-rapid growth in US shale oil which was the key factor driving the collapse in oil prices last year. By itself, US oil production increased several multiples of the expansion rate in global oil demand. The efficient production techniques and novel financing structures found in the US shale industry also have the potential to be copied or adopted by other countries which have potential shale oil properties and therefore can have a lasting impact on global oil market dynamics. These reasons may have contributed to OPEC’s decision to play hardball.

The sheer disruptiveness of the US shale production juggernaut explains the determination of the Saudis and OPEC to protect their market share, and their determination to force down shale oil output a couple of notches or so. It also tells us that total oil production in the US will have to come further before OPEC relents on its strategy to strangle marginal shale oil producers in the US. Therefore US oil output and drilling activity will continue to decline, even as the global oil demand starts to pick up. The financial condition of US shale oil producers will also continue to deteriorate the longer prices stay at current (circa $50/bbl) levels.

But it is not just the US shale oil producers which are hurting. If the price of oil were to stay in the $50/bbl range for some time, global petroleum supply would not be able to meet demand in the longer term. Production would decline almost everywhere, even in some countries in the Middle East, unless we see a significant rise in the price of oil. The immediate causes of output decline will be cuts in capex and drilling activity due to drying up of funding. So far we have counted up to $240 bln of cancelled projects, and that is only in the case of oil and energy majors. There is currently very lacklustre desire to invest in oil projects in the longer-term horizon. We have new evidence of this being the current case from two major failed auctions in Latin American oil properties.

The Mexican oil property auction was the first to fail. The Mexican government was estimating a maximum of $17 billion worth of investments on the concessions they put up for auction. However, out of fourteen blocks, only two received qualifying bids, with total expected investment worth only $2.6 billion. This was a big disappointment for Mexico, as the government was hoping to reboot the country’s declining oil industry by inviting foreign investments.

The Brazilian offer of oil exploration concessions was also met with lacklustre reception from oil companies. Out of the 366 blocks offered, the government managed to auction off only 37. The Campos basin, touted by many as having billions of barrels in proved reserves, received no bid at all. This auction failure is unlikely to impact Brazil's production right away, but in time it will have an effect. If oil prices remain low at current levels, further future auctions in Brazil or in Mexico will most likely be met with the same indifference.

Absent a significant oil price increase, it seems impossible to reverse what now seems to be an accelerating trend of capex decline. Cuts in capital spending are set to continue, even accelerate, with companies almost daily announcing cuts in present projects and even more future capital allocations. Schlumberger, the world leading supplier of technology, management and IT solutions to the energy industry, said in a conference call that the market outlook for oil reserves looks challenging as they expect additional reduction in activity. The service company also stressed that financial pressure on many of their customers, where a year of very low oil prices is now exhausting available cash flow, and corresponding capital spending, are leading these energy extraction companies to take a very conservative view on 2016 on many exploration and production (E & P) budgets. Sclumberger’s experience is not unique — we can show other examples from major E&P companies.

Cuts to spending make economic sense in the short run (and may even be the only option for the survival of smaller oil companies), but they also set the oil industry up for stagnant production in future years. This is the condition that the industry is faced at present. There are still projects being completed, but once that projects backlog begins to clear, there will be very few, if any, major sources of new supply to replace the output that is being lost every week. Deepwater projects at the Gulf of Mexico, the Arctic, and offshore Brazil took years to develop, five years on average, even longer. Not drilling now means there is no new oil coming online in 2020 – 2025 period. The issue is not only for long-term oil outlooks – the near-term presents it own set of problematic conditions in the supply outlook. Schlumberger said: “The fundamental balance of supply and demand continue to tighten driven by solid GDP and growth, and reduction in supply. We expect this trend to continue, and as the oil market further recognizes the magnitude of the industry's annual production replacement challenge, this will gradually translate into improvements in oil prices going forward.” We believe that once the oil market balances in early 2016, with global growth rising moderately over the next two quarters at least, oil prices should take off rapidly by late 2016, and could become parabolic starting 2017.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

China is transitioning into a consumption growth model successfully

There were some surprises in China's Q3 GDP announcements today. GDP rose 6.9% from a year earlier, beating the median forecast of economists of 6.8%. The service industry expanded further by 8.4 %, versus 6% for secondary industry (manufacturing), and 3.8% for primary (investments). The quarter-on-quarter growth rate was steady at 1.8%. Most importantly, consumption contributed 58.4% to GDP growth in first nine months of the year.

Many well-meaning economists have been arguing that China needs to shift its economy from investment and heavy industry toward consumption. And indeed, the current government have taken steps to accelerate such a transition which was started by the previous government. As the transition continues, it is inevitable that investment will slow as China matures into a developed consumption-based economy. The difficulty is in assessing whether the transition phase is proceeding too slowly or too quickly. The difficulty in judging the pace of the make-over is what is contributing to market volatility. If we have a yardstick against which to measure the pace of the transition, there will be less market displacements. We believe that the transition is proceeding well, and that sentiment is echoed elsewhere. Here is what Financial Times have to say:

" . . . services growth remained strong in the third quarter, with nominal growth falling only slightly to 11.9 per cent annually from 12.1 per cent in the second quarter. Stagnation continued in the industrial sector, however, where nominal growth was roughly flat at 0.2 per cent, down from 1.6 per cent in the second quarter. The statistics bureau does not break down real growth figures by sector. Economists agree that a long-term slowdown in Chinese growth is inevitable due to structural factors such as a shrinking labour force and the end of "catch-up growth" as China completes the transition from a rural to industrial economy."

We believe that Q3 2015 is the inflection point when consumption has become the key driver of the Chinese economy. This is why we believe so: (1) the People Bank of China will likely cut benchmark interest rates again before the year is over, as well as make another reduction in banks' required reserve ratio (RRR); that would be in addition to a series of five rate cuts since November and three RRR cuts during the first nine months of 2015; (2) the real estate sector has had a modest recovery, with property sales (in floor area terms) growing 7.5 per cent in the year to September, up from 7.2% growth in the first eight months of the year; prior to that, property sales had contracted for 17 consecutive months through June on a year-to-date basis; (3) the first week of October (called "Golden Week" festival) saw very strong sales at restaurants and retailers, up over 11% month on month; movie theatre growth during this week was an astounding 200% increase relative to similar periods in 2013 and 2014; and, finally (4) Chinese stocks rose to an eight-week high following a government announcement to reorganize the telecom industry, which investors believed will accelerate reforms of State-owned companies (SOEs) to stem slowing economic growth; the Shanghai Composite Index climbed 2.3% to 3,338.07 points at Monday's close, the highest level since Aug 21.

In the final analysis, personal consumption reflected by retail sales growth is the arbiter whether or not China's transition to a consumption growth mode is proceeding well or not. In this respect the data has been stellar. Overall retail sales have been up more than 10% in the first none months of 2015 -- it grew faster than the overall economy. Key consumer sectors as in durable goods, e.g. furniture, white products and home electronics are up more than fifteen percent compared to last year. For sceptics doubting the numbers, Apple CEO Tim Cook's bullish appraisal about his own company's China prospects amid the panic of the late August market selloff is an eye opener. Nike also said that China sales grew by 27% in the most recent quarter - the strongest market segment in a very strong quarter overall for the company.

Q3 2015 could mark a low point in China's growth trajectory this year. A recovery in Q4 2015, which we expect, will make a lot of difference. The comparison of current growth profiles always starts with the plus 14.9% GDP growth rate that China had in 2007 and 12.2% post the Great Financial Crisis (GFC). But few analysts include the fact that the present economy of China was 2.3 times larger than what it was before the GFC. So in absolute numbers the consumption levels of the current Chinese economy ought to be three times as much as before — and that includes consumption in raw materials, even with an industrial sector that is waning in its importance to the economy. Those industries have been as large as before and have likely become even bigger in absolute size, with corresponding increase in levels of raw materials used. So a transition of China's economy to a consumption mode need not signify a large-scale decline in raw material usage — it just means that the type of raw materials needed will necessarily have to change in their importance. Commodities will continue to have a relevance in China's transition into a consumer society.

El Nino watch: meteorologists say "it" is now too big to fail

The "massive" El Nino that is developing in the Pacific Ocean has been spawning a lot of adjectives and anecdotal stories on just how much potential power and impact it will have on global weather, trade, and agriculture products over the next few months. The LA Times bannered its El Nino story last week, as thus: "Massive El Niño is now 'too big to fail”. There were also anecdotal stories of warm-water sea snakes being washed up in California beaches, a testament of how much that region of the Pacific Ocean has warmed up over the last few months. This weather phenomenon is being described as both a "boon" and a "bane" - California is expected to get plenty of moisture later in the year, which will alleviate and perhaps break its four-year drought problem, but on the negative side, El Nino is expected to wreak havoc on agriculture in Latin America and in Asia.

This El Nino, which is still gaining strength, is characterized by rising sea-level ocean temperatures in the Pacific west of Peru, and a change in directions of the wind along the equator that allow warm waters to surge toward the Americas. And this time, it is being abated by the weakening of the global trade winds, which will amplify the El Nino's impact. Bill Patzert, climatologist for NASA’s Jet Propulsion Laboratory, said “it’s fair to say” that the current El Niño will be similar to the strongest two El Niños on record". Patzert also said that even if ocean temperatures were to start dropping now, El Niño would still have a significant impact on this winter’s rains" dropping in California. The impact of such climatic changes are more destructive elsewhere, as weather historically linked to it generally means excesses. Floods, huge snowstorms, and droughts are likely for many areas across the globe, such as those being seen already in Asia this year.

El Nino is inimical to agricultural commodities which depend on stable atmospheric growing conditions. Its impact will be magnified by the fact that many agricultural commodities are at multi-year lows, potentially generating price volatility. And we believe that the price volatility will be skewed to the upside. It might be wise to prepare for this eventuality, as weather-related price moves are notorious for moving quickly. The latest moves in the agriculture sector may be giving us some hints of things to come. The first El Nino related move was seen in rice prices. The rice market made a move between May and early October, and could be a sign of things to come in the agriculture space. Rice futures rose by 37% on fears of forthcoming shortages. Rice has always been a bellwether for El Nino related damage. This year, many rice-producing countries in Asia have already seen the negative impact of El Nino: it has triggered drought and prolonged harvesting season, as well as disturbed cultivation in rice paddy fields in Indonesia, the third largest rice producer in the world. The country has already explored the possibility of importing rice this year from Vietnam and Thailand. The Philippines is normally afflicted by drought during El Nino events, and have also already made precautionary measures of importing rise in Q3 this year. Drought conditions also prevail in India, the world's second-largest producer of rice, and have also caused shortfalls in this year's rice crop. India's sugar cane crop is also at risk if drought conditions persist.

Sugar is also showing signs of coming back to life. Since a peak at over 36 cents per pound in 2011, sugar prices have consistently moved lower, to as low as 10.13 cents, less than one-third its price four years ago. The world's largest producer of sugar is Brazil, and Thailand and India being major producers as well. All of these countries' sugar crops are at risk with a powerful El Nino. Although the strength of the US Dollar was the primary cause of sugar price decline in recent years, constricted supply will more than offset the strong exchange rate of the US Dollar this time around. The active month ICE sugar futures contract has rallied from 10.13 cents per pound in August to highs seen at circa 14.43 cents this month. The 42% rise in less than three months is likely telling us something, and it maybe just the initial price adjustment phase if El Nino negatively impacts sugar output this year.

Coffee has also been on a downward trend since making a high of $2.2550 per pound in October 2014. Coffee was down by over 27% at the end of September, and had the worst performance of all soft commodity for the year. But perhaps as a sign of things to come, ICE coffee bean prices rallied from $1.1455 to $1.376 per pound for over 20% increase in just three weeks (Sept 24 to October 12). Since then coffee lost some ground, but coffee has a history of being one of the most significant winners during the 1997 El Nino, one of the strongest of such events on record. El Nino effects on prices have always been commensurate to the level of intensity of the event. If we are to take the analysis of scientists tracking this weather phenomenon on its face value, it is may be time to hedge investors' exposure to any sharp rise in agriculture products.

Chart of the week: Rig counts vs crude production, globally

|

|