December 7, 2015

China plans state purchases of copper and this may produce a cycle trough in base metals

Commentary by Robert Balan, Chief Market Strategist

"The global copper market will be close to balance next year, with output reduced by two million tonnes or more as smaller producers cut production.”

Ivan Arriagada, CEO of Antofagasta Minerals, November 25, 2015

Base metals prices have rallied off six-year lows last week on hopes that Chinese producers will cut production, and that the NDRC will sop up excess stocks of base metals to stem further declines in prices. Copper prices surged 4.1% on these reports but the market gave up some of those gain after some investors judged that the up-trend news is countered by expectations of a deeper economic slowdown in China. Media reports indicate that Chinese authorities are planning state purchases of copper to support prices near the lowest in years. Bloomberg also reports that Chinese regulators are considering as well a probe of short-selling in metals. In addition, Chinese nickel producers are meeting this week to decide upon output cuts, after a group of 10 zinc smelters last week announced they would cut production. To underline these base metal supportive moves, the China Nonferrous Metals Industry Association has reportedly asked China's National Development and Reform Commission (NDRC) to buy up stocks of excess metal.

The last time China's State Reserve Bureau (SRB) intervened in the metals markets to check falling prices was during the deepest point of the 2008 global financial crisis. The SRB at that time started purchasing copper after the price of the metal collapsed. The SRB buying was one of the factors that sent the price of copper to an all-time high during 2011, which ignited a frenzy of capacity expansion among copper and base metals producers, which is now being held responsible for the current excess supply. In the first seven months of 2015, the global copper market had an 8,000 tons surplus, compared to a deficit of 563,000 tons during the same period a year earlier. It did not help that producers have become myopic, deciding to preserve market share. Analysts estimated that circa 20% of copper output is loss-making because producers have been expecting prices to recover, and are unwilling to cut production, opting instead to cut costs.

Copper prices have now been under pressure for several quarters, following the slow slide in China's economic growth. China is the worlds’ top copper buyer, accounting for about 40% of global copper purchases. Much of that purchased copper goes into manufacturing and construction, China’s primary drivers of growth, where activity has slowed in recent quarters. To add to copper's woes, the US Dollar has strengthened, weakening commodities in general as inverse function of commodities being denominated in the US currency. Add to that the Fed's intention to raise interest rates (possibly this month), which many see as strengthening the US Dollar further (although we have issues with this linear supposition). In response, many investors and hedge funds increased bets on lower copper prices in the near future, which eventually drove copper prices to six-year lows recently.

The primary driver of lower copper prices was mostly down-trend sentiment. The copper fundamentals are nowhere that bad. The Lisbon-based International Copper Study Group (ICSG) latest report forecasts that the copper market would balance in 2015 and move into a small deficit in 2016. The ICSG's forecast is based on the observation that demand growth have been outpacing production growth. ICSG's current forecast is also more constructive than April report, when the agency said that there would be a copper surplus of 360,000 tons in 2015 and 230,000 tons in 2016. Not surprisingly, contrarians and big money investors, such as Carl Icahn, on the other hand, have taken bullish bets on companies such as Freeport-McMoRan, with a view on a future recovery of copper prices, and on a total overhaul of companies' capex, salary structure and high production costs. Freeport-McMoRan and Glencore (the world's biggest resource company) have already announced production cuts in the wake of the long slide in prices. Freeport-McMoRan is one of copper's lowest cost producers, and yet felt the need to curtail production. It follows that many high cost miners will eventually cut production as well. That is indeed happening in China.

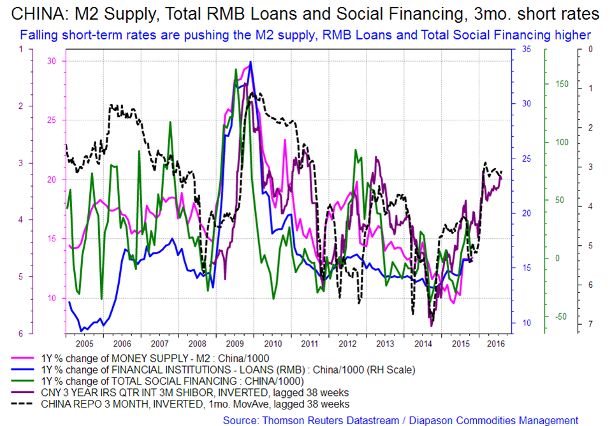

Many of copper's high cost producers are in China. China's National Bureau of Statistics (NBS) reported that domestic copper production in 2014 was 1.923 million tons. In the aftermath of sustained decline in prices, China's mined copper output dropped 10% in the first half of 2015 over the previous year, according to NBS. Other set of data also suggests ongoing decline in Chinese production. In September this year, China's imports of refined and semi-finished copper products soared 30% month-on-month. On a year-over-year basis, China's imports jumped 18%. This was to make up for the shortfall in domestic production. The previous weakness in copper prices and poor sentiment for the metal was due to weak industrial production data coming from China. But industrial production is a lagging indicator of growth. Chinese authorities have been implementing a slew of policy and regulatory changes to kick-start the domestic economy. The PBoC is expected to reduce benchmark rates and commercial banks' reserve requirement ratio further. The former is especially important as lower short-term rates tend to push the country's Total Social Financing and Total (in RMB) Loan levels higher, which in turn tend to boost the M2 money supply after a short lag. Short-term rates in China have been falling for the past 8 quarters, and for us it is just a matter of time before China's M2 money supply also rises in an even more significant pace (see first chart of the week below).

That should contribute to the ongoing build up in M2 money supply world-wide, which has positive impact on aggregate global growth after a short lag. But even more importantly, we believe that cyclical commodities such as copper and crude oil, are now tracking risk-on factors that can be proxied by China's M2 money supply. No causality is being implied in this case, but an M2 rise in China bodes well for cyclical assets nonetheless, in our opinion. The rising trend in global aggregate money supply, China M2 a lagging component thereof, may be indicative of improving prospects for global growth and other macro data which could eventually boost the price of cyclical assets, like copper (see second chart of the week below). With high cost copper producers in China and the likes of big miners like Freeport-McMoRan and Glencore announcing production cuts, the copper market fundamentals should improve going forward. Moreover, the headwind posed by potential further rise of the US Dollar may not materialize with the Fed opting for a slower policy tightening regime. And China's growth rate should stabilize soon, and could show recovery signs by H1 2016. Add to that the fact that copper's market price is now below historical cost of production. All of these factors suggest to us that the current recovery in copper prices could develop into a significant cycle trough for the red metal.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist and Sammer Khatlan, Oil Analyst

This is how the Fed tightens the policy rate in December

To lower the Fed Fund rates, even as little as 25 basis points, the Fed will have to remove a large amount of capital from the bank reserves in their balance sheets. It may be that $400-800 billion will be required to obtain the desired. That amount may look big, but it is relatively small compared to the total balance sheet of the Federal Reserve which is at $4.478 trillion.

The other tools that could be used to drain reserve balances include reverse repurchase agreements (reverse repos, RRP) and term deposit facility. While these operations would not substantially alter the overall size of the portfolio, they would affect the composition of the Federal Reserve’s liabilities, leaving less reserve balances and more of other items that compose the rest of the balance sheet. The RRP enables the Fed to lend its bonds over a short period to a host of non-bank institutions that comprise the shadow financing system. It also helps the Fed soak up cash in the financial system so that it can control overnight interest rates, and is a crucial part of its toolkit options when it starts tightening monetary policy, which we believe will start in December, this year.

When the Fed decides that it's time to raise interest rates, the other policy tool they can also use is the interest rate paid on bank reserves (IOER). The Fed used to pay zero percent interest on bank reserves, but that changed in 2006 when the Fed was authorized to start paying interest on reserves which they started doing in 2009. The IOER will establish a ceiling for the federal funds interest rate, while the interest rate embedded in the reverse repo facility will set a floor under that rate. Why are there so many possible ways that the Fed can technically influence short-term interest rates to go up? The Fed has expanded its balance sheet so much that it cannot easily drain enough money from the system to discourage lending, which is its traditional approach. The Fed had also concluded that it is no longer sufficient to influence the broader economy by merely working with commercial banks, so it wanted to strengthen its hold by working directly with an expanded range of lenders. So the Fed is forced to experiment, essentially on the run. And as a Fed official recently suggested, if the new approach does not work at first, the FOMC team of monetary mechanics “stands ready to innovate” until it does. One direct option in tightening policy is of course to reduce the banks excess reserves the Fed holds in its balance sheet. Raising rates without removing excess reserves will actually push inflation higher by causing money velocity change rate to rise; but it will also add volatility to financial markets during a period of the year that is already deficient on market liquidity, and with banks providing less market liquidity than ever.

However, the Fed’s recent actions suggest they will remove some of the excess reserves. Over the past four weeks, the amount of excess reserves in the banking system fell by circa $160 billion, to $2.532 trillion on December 2, 2015. The other operational factor causing bank reserves to fall was a $30.0 billion currency volume that left the banking system which was not replaced. The decline in reserve balances was exacerbated because of reverse repurchase agreements that the Fed conducted, in order to maintain the financial market conditions it desired, which were allowed to run off. At the same time, the Treasury's General Account (operating cash balance) at Federal Reserve banks, rose by $173 billion the past four weeks. So, it appears that the Federal Reserve wanted bank reserves to fall during the previous 13-week period and maintained this level in the system by an offset with funds flowing into the Treasury account. We have no doubts that in the coming weeks, further diminution of banks reserves at the Fed will occur; with more funds flowing into the Treasury’s operating cash balance. That practically confirms a Fed rate hike in December.

If the Federal Reserve really intends to raise its policy rate of interest after the December 16-17 meeting of the FOMC, it would be desirable for the Fed to modestly reduce reserve balances in anticipation of such a move. Thus, the ongoing decline in bank reserves of almost $160.0 billion over the past four weeks, and the growth in the Treasury’s operating cash balance, is a clear sign to us that the Fed does intend to raise the FFR in December.

Staying the course - why we shouldn’t be surprised by Saudi Arabia’s stance

After a meeting that overran by several hours, OPEC decided against any production cuts and the current 30mmbd ceiling was rolled over as no collective quota could be set. The fallout from the meeting has perplexed some, scared others and encouraged a few to ring the death knell for OPEC: their current strategy has not killed off non-OPEC, each Group member is under severe financial stress and the divisions in the ranks are so bad that a collective output quota could not be established despite a nearly seven-hour long meeting. The official communiqué exacerbated the negative sentiment, with the cartel sounding increasingly like a central bank with its loose, non-committal guidance (combined with a hollow output ceiling) when the market was craving for something transparent and definitive.

However, leaving the existing production policy unchanged made complete sense and was certainly in line with our expectations. We feel the negative reaction was overdone and it has been perplexing that so many analysts and market players were confounded with the outcome of the meeting. This strategy was formulated and led by Saudi Arabia; the direct and indirect rules of engagement were very clearly set and have been consistent for some time now: (1) The current oversupply was due to the “irresponsible production” of a few; (2) OPEC would not shoulder the burden of fixing the market; (3) Saudi will only favour a cut in production if shared between OPEC and non-OPEC; (4) Counter the non-OPEC resurgence by driving down global prices through supply; (5) Impact all high-cost curve producers, conventional and unconventional, to protect market share; (6) OPEC will defend its long-term share of the global crude market and increase where/ when possible. Saudi’s resolve has remained firm – whilst they have engaged and listened to fellow OPEC members, there has been zero appetite to change its position. No rhetoric from Riyadh or any of Saudi’s Gulf peers has suggested otherwise which made bets of a Saudi change in policy on this basis all the more baffling. Indeed the mid-week headline before the meeting that suggested supply cuts could happen, simply reflected Saudi’s long-held stance: only if all OPEC members are joined by non-OPEC. One of the main aims of Saudi’s ‘pump pump pump’ policy has been to curb the resurgence of non-OPEC, especially US shale. This job is no-where near complete so cutting output would have been akin to raising the white flag and certainly would have caused more long-term damage to the Group. Consider the impact had they cut production: the immediate reaction would have eased each member’s economic pain; but this relief would have been short-lived as higher prices would have spurred non-OPEC supply. Arguably this would have set a dangerous precedent as OPEC would be consigned to years of output cuts as high-cost non-OPEC conventional and unconventional production would continue to increase at every level of higher prices.

The ‘death knell’ commentators have been quick to highlight the record inventory levels and continuing oversupply, emphasising the failure of Saudi’s strategy. However this is short-sighted: there is always going to be a lag between capex reductions, collapsing rig counts and non-OPEC supplies falling. Saudi knows this and remain convinced that the strategy is working: OPEC forecast that global demand will increase in 2016 by 1.25mmbd and non-OPEC supply will contract by 0.13mmbd; non-OPEC supply growth of 1.7mmbd in 2014 has fallen 0.7mmbd this year and is expected to fall next year; US output growth has slowed to circa 0.3mmbd in 2015 from over 1mmbd in each of the past three years. Saudi argues that OPEC will fill the increase in global demand and will cover the reintroduction of Iran to the markets, whose return, in any case, is weighted towards 2H16. Saudi knew that the battle versus US shale and the rest of non-OPEC would not be over quickly. Certainly there have been developments that will have surprised them: for one, the resilience and innovation of the shale producers has meant that the US oil industry has not completely bowed to price determination. But 2016 will be key as US shale is down to its bare bones. The spring credit redeterminations will be significant as many companies are financially on their knees. This will give the Saudi’s a much clearer picture in time for June 2016’s meeting, and if they are starting to see a slowdown from non-OPEC then a December 2016 output cut could be on the cards. Timing is crucial for Saudi and it would only make sense to cut supply when they know it will have a considerable and lasting impact on prices – namely, as non-OPEC slows down further and the reality of so many upstream projects being cancelled/written-off finally dawns on the market.

The ‘ceiling’ element of Friday’s meeting underlines the lack of cohesion that characterises the Group. Whilst there is a ‘virtual’ ceiling based on capacity, rolling over the 30mmbd quota effectively buys Saudi’s strategy more time. It is unclear whether individual country quotas were discussed: attempting to agree on these would have been extremely difficult given the differing production capacities, financial positions and political motivations of each OPEC member. Since the Group has already been ‘cheating’ the current ceiling and the lack of real enforcement, pushing for individual targets would have been a minefield. The main reason why the ‘pump policy’ has remained intact is because effectively no-one can ‘fight’ Saudi Arabia on a financial or a production basis. Saudi does not seek to be altruistic, slashing OSPs aggressively to secure the heavily sought-after Asian market - successfully. This has forced its peers to do the same, pumping more and receiving less as they keep up with the kingdom’s moves. With Iran’s return on the horizon, Saudi is expected to continue to garner as much market share as possible to ensure that it remains in OPEC’s driving seat. Calls of Saudi’s demise have been greatly exaggerated. Friday was a real signal of intent to the market — this is Saudi’s song and everyone will dance to their tune as long as they want.

Charts of the week: Short-term rates in China have been falling, M2 should rise soon; China M2 is lagging component and can be indicative of improving growth prospects — copper

|

|

|

|