January 11, 2016

Outlook for global growth and risk assets in 2016

Commentary by Robert Balan, Chief Market Strategist

"The market reaction to what’s been happening in China has been hugely overdone. The uncertainty hasn’t dissipated -- it only takes one or two things to go wrong and we’re back to where we started -- but investors are finally looking at things with a clearer head.” Peter Dixon, Commerzbank AG, global equities economist, London

If there's one key takeaway from last year's developments in global markets and economies, it is that they were all linked – they were all part of the same overarching construct and were impelled by the same set of factors. We have to understand this and accept that general concept so as to formulate a framework for market expectations for 2016. The other consideration to include in a 2016 framework is that the high liquidity phase fostered by the global monetary policy cycle which has dominated financial markets since the trough of the Great Financial Crisis (GFC) in Q1 2009 is set to peak soon. According to Citigroup, central bank asset purchases, which serve as lubricant to the global financial system, have already dipped below zero (on a net basis) for the first time since the GFC.

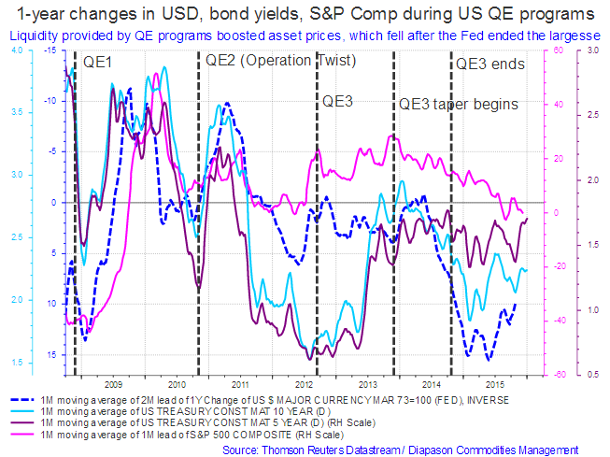

The global monetary policy cycle has dominated investment outcomes in recent years, fostering rising prices for both equities and fixed income, and for commodities as well at certain points of the cycle (see the first chart of the week below). But now, for the first time in six years, markets seem to begin reflecting actual economic activity – industrial production, factory orders, exports, imports and services sectors, loan issuance, etc. – in much greater degree than during the uptrend of the liquidity cycle. As the global liquidity wave crests, business and inflation cycles should gain in importance and will have more bearing on asset prices. A transition from liquidity-based valuation frameworks for all asset classes to those based on real macroeconomic factors will inevitably foster market volatility this year. Moreover, these cycles appear to be out of sync which may further exacerbate volatility, arguing for nimble and careful navigating in 2016.

The business cycle likely went through a brief but sharp hiccup in late Q4 2015 to early 2016 due to issues emanating from EM economies, but global growth has already reverted to trend. We expect an uptick in global growth by H2 this year. An extension of the global business cycle is essential for further gains in risk assets. Economic growth is needed to boost activity and revenues, as corporate profit margins are under pressure in many markets, and equity valuations no longer cheap across the globe. Stability and subsequent uptake in growth in China is part and parcel of our expectations for an extension of the global business cycle as from H2 2016. China matters a lot because the country has accounted for one-third of global growth since 2010 (IMF), and probably even more through its multiplying effect on the EM economies. China’s shift to a consumer-driven economy model was largely responsible for its domestic growth slowdown, which was also instrumental in putting the brakes on the global business cycle, as well as subsequent spillovers which negatively impacted emerging market economies and commodities. The slowdown in aggregate global growth enhanced the allure of the US Dollar, and its subsequent appreciation further depressed EM assets and commodities in a second-round feedback loop. But these negative factors may be mitigated by a recovery in Chinese activity in H2 (see China story below). Some measures that China may take in the interim, including systematic yuan devaluation, may add turmoil to the markets in H1, but should ultimately help put a floor on China's growth downtrend. China should be in a position to contribute to global growth in H2: results for individual countries this month do not support widespread fears of a hard landing in China.

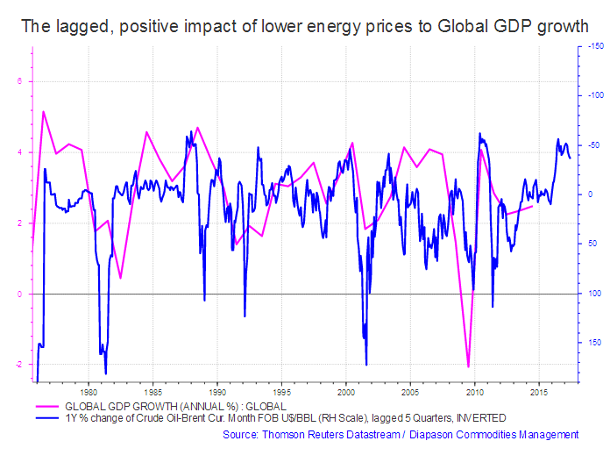

The knock-on effects of sharply lower energy prices over the past five quarters will have salubrious outcomes for global growth in Q2 this year. There is a strong correlation between oil prices and global GDP growth – the more compelling is on the negative side – every global recession in the past 50 years has been preceded by a sharp increase in oil prices. Most recently, the price of oil almost tripled, from $50 to $140, in the year leading up to the 2008 crash. In fact, the supposed cause for the GFC – the US housing market collapse – was only part of the story; higher crude oil prices also contributed to setting off the GFC event. On the other hand, falling oil prices have never predicted a global recession; on the contrary, on all recent occasions when the price of oil was halved (1982-1983, 1985-1986, 1992-1993, 1997-1998, and 2001-2002) faster global growth followed. The impact of sharply lower energy prices should start showing up in global GDP growth by Q2 this year (see second chart of the week below).

A powerful economic mechanism underlies the inverse correlation between oil prices and global growth. Because the world burns 34 billion barrels of oil every year, a $10 fall in the price of oil shifts $340 billion from oil producers to consumers (IMF). Thus, the circa $50 price decline since last year will redistribute more than $2 trillion annually to oil consumers, providing a bigger income boost than the combined US and Chinese fiscal stimulus in 2009. It is noteworthy to note that the "savings" from lower energy prices accrue to a demographic class which spends all of it’s saving on consumer items. It is fair to say that almost all of that "savings" will go into a global consumption splurge within the next few quarters. This tailwind from recent low energy prices should extend the global business cycle well into at least the end of 2017.

Many investors looking for risks in 2016 are focusing on China's slowdown, but there is an incipient trouble spot beyond slower growth in the world's second-largest economy – the risk that inflation will creep up, which would complicate the Federal Reserve's frequency of interest rate hikes this year. The Fed said they intend to raise rates from near zero gradually, but if the economy heats up, they may be pressured to rein in prices by raising up the cost of borrowing money. Simply put, US inflation ex-food and energy is on the march. The Fed's target for inflation is 2%. Core CPI inflation — the cost of goods minus food and energy — came in at 2.02% year over year in November from 1.9% in October. The only core inflation measure that's below 2% is the PCE deflator (the Fed's favoured gauge), and only because there had been some distortions in the index that was related to health care.

It is worthy pointing out that US money growth continues to expand at a 6.2% over the last 12 months. There is nothing that the Fed is currently planning which would slow money growth since there are ample excess reserves to support any lending that banks care to do. It is also therefore worth pointing out that US median inflation is currently at 7-year highs and rising. Core inflation is also rising in Japan (1.2%, ex-food and energy, up from 0.1% in October 2014), the Eurozone (0.9% ex-food and energy in December, up from 0.6% in January 2015), and recently even in the UK where core is up to 1.2% in November after bottoming at 0.8% six months ago. We had seen acceleration in money growth rates everywhere by mid-year last year, so we are now seeing core inflation moving higher. We expect core inflation gains to gain momentum by the middle of this year.

These are the general parameters of the various macroeconomic forces that would impact asset prices in 2016. In subsequent publications, we will discuss the likely evolution of key asset classes, given expectations of faster global growth in H2 2016, and a quicker inflation uptake by the middle of this year. By and large, we expect long bond yields to rise by early Q2, equities to make modest gains during H2 and for commodities, especially base metals, to post significant price recoveries during the second half of 2016. We will also review our scenario for the US Dollar and each commodity sector over the next few weeks.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist and Sammer Khatlan, Oil Analyst

The new China CNY devaluation and stock market sell-off: it is not summer of 2015 all over again

Despite widespread investors' angst of imminent peril encouraged by new declines in Chinese equity markets and the falling valuation of the CNY, China continues to defy market fears of a hard landing. So far, activity data has been flat to slightly lower, but growth “falling off a cliff” expected by many has not materialized so far. Many observers continue to regard Chinese economic data as fictitious, and indeed the official estimates of the absolute level of the growth rate seem dubious. However, the direction of change in the growth rate has been stable (improving noticeably since last August), and are now showing signs of heading towards the right direction. Hard landing risk for the Chinese economy in aggregate has diminished. The International Monetary Fund’s concern that China is now the global economy’s weakest link has therefore become moot.

China certainly experienced a turbulent summer last year, and it is the memory of the markets' dislocation following the 2014 equity sell-off and currency devaluation that is generating a new defensive stance as the same issues flare up once again at the start of the year. However, last year's turbulence was due to several factors that are not necessarily extant today: economic weakness at that time, financial panic, and the official policy response to those problems. Even then, none of those factors on its own would have threatened the world economy – it was the official policy blunders in response to the crisis which posed the greater risk. The question now is whether the vicious feedback loop that happened in China over the summer will be seen again this time around. We do not believe so. For one, Chinese regulators seem to have learned from the experience.

Furthermore, there is now more acceptance of the inevitability of a China growth slowdown, which in itself should not be surprising or a cause for investor alarm. The IMF noted that China’s growth rate has been declining steadily for five years – from 10.6% in 2010 to a projected rate of 6.8% in 2015 and 6.6% this year (we believe that 2016 GDP growth will be closer to 7.0%). Many investors now accept that the deceleration was inevitable as China advanced from extreme poverty and technological backwardness to become a middle-income economy powered by external trade and consumer spending. It was this deliberate shift to a different economic model which set off the trend to the weaker growth rate we are seeing today in China.

However, even at a slower pace of growth, China contributes to the world economy more than before, because its GDP today is $10.3 trillion, up from just $2.3 trillion in 2005, when the breakneck pace of growth started. Simple arithmetic shows that $10.3 trillion growing at 6% or 7% produces much a bigger impact to the global economy than 10% growth starting from a base that is almost five times smaller. The implications of this base effect also means that China will continue to absorb more natural resources than ever before in nominal terms, despite its diminishing rate of growth. This is very important for investors to understand. Other facts that investors should internalize: the domestic equity markets and small currency adjustments do not have much impact to aggregate domestic growth prospects. Incremental weakening of the CNY, in fact, brings more trouble which is not offset by the positive effects of a slightly weaker currency on net exports. It is a one-time, large devaluation of the currency in the magnitude of, say, 25%, which will bring benefits in the long run, more than enough to offset the consequent fallout from such a large devaluation. The source of investors' fear regarding the CNY devaluation is in fact not on the devaluation per se, but on the possibility that such moves are being forced by the outflow of private capital which is getting out of hand. The extrapolation of that fear sees a China that could soon be suffering from a genuine exchange rate crisis, in which its enormous foreign exchange reserves could be quickly drained. As for Chinese equities, there is very little exposure of international investors to domestic equity markets, so fallout from sharply declining Chinese equities would only have local impact. The link between declining Chinese equities and a similar sell-off in developed equity markets is merely one of sentiment, and the so-called global co-variance factor stemming from fungibility of global capital.

As in most economies, it is the level of short-term interest rates, the amount of lending proffered by commercial banks, the total social financing portfolio and the growth of the money supply which will make the greatest impact on activity and domestic growth rates. However, in the case of China, these factors take longer than usual to contribute to growth. But many of the initiatives taken by the Chinese government after last year's currency and equity market fiasco will soon make a positive impact on Chinese growth as from Q2 2016. Such an event will have a significant impact as well on commodities in general and on the base metal and energy sectors in particular, especially the former. We also believe that global GDP growth will get a boost from the sharp decline in energy costs over the past five quarters (see main story above) , and so a China revival which coincides with a global recovery will likely weaken the US Dollar's allure. Global growth and consequent US Dollar weakness bodes very well for risk-taking again, and especially so for hard assets like commodities and precious metals.

Saudi Arabia vs. Iran: Putting the conflict in context

An intensifying political conflict between two of the Middle East’s most powerful countries, both of whom are major oil producers within OPEC, would, under ‘normal’ circumstances, provoke a spike in oil prices. By the close of the futures exchange market on the 4th January (the first trading day after the report of Shia cleric al-Nimr’s execution by the Saudi government), the Saudi-Iranian crisis was worth -$0.63/bbl Brent. Of course this was not the only news story influencing the market that day: the early +$2/bbl rally was eroded by China’s ongoing stock market volatility and the news that OPEC’s production increased in December 2015 to 32.14mmbd. However a day in which Libya’s already beleaguered oil infrastructure is under attack, combined with the aforementioned Iranian-Saudi conflict, resulting in a negative close, it certainly is a strange time in the oil market.

For students of Middle Eastern politics, the rising tensions between Saudi Arabia and Iran are nothing new. Although hostilities have intensified in the last decade, these two states, alongside Iraq, traditionally fought for the title of regional hegemon. For centuries the rivalry has been characterised by a religious ideological conflict – Saudi prescribing to the Sunni Wahhabi interpretation of Islam and Iran staunch followers of the Shi’a branch of Islam. This religious layer has remained whilst newer elements such as cultural, economic and geostrategic rivalries have been added. The Arab Spring brought tensions to the fore as Saudi and Iran engaged in proxy wars in Bahrain, Iraq, Lebanon, Yemen and Syria, to undermine each other and cement influence in the ever-shifting regional politics. Recent developments in Tehran have seriously worried Riyadh: thawing relations with the US have been hailed by the West as beneficial for regional stability, so much so that Iran has been enlisted to help solve the Syrian crisis. In addition, the potential of sanctions being lifted under the nuclear deal removes the economic shackles that have kept Iran ‘weak’. Saudi’s concern is palpable as a financially unencumbered Iran, free of international pressure (assuming the nuclear deal is completely ratified) will allow Tehran to fully engage in its regional proxies. Indeed, Saudi’s failed military intervention of 2015’s Yemeni Civil War underlined its anxiety, with a tactic that felt more impulsive than strategic when diplomacy was clearly a superior option to diffuse and stabilise Yemen rather than airstrikes on the Iranian-backed Houthis.

The lack of any real geopolitical risk premium on oil prices right now, is due to production remaining relatively insulated from any violence. The current Iranian-Saudi conflict will unlikely drive up oil prices unless supplies are affected – however there are some considerations that must be noted. The proxy wars will intensify and could spill over into further territories. There could be more retaliatory attacks on Iranian and Saudi embassies across the Middle East, intensifying the instability and chaos in the region – this will feed through to oil market sentiment.

Riyadh will have no doubt been quietly satisfied with the war of word developing over Iran’s intended expansion of its missile programme. Although separate to the nuclear deal (and not in breach of the JCPOA), this could still result in the US pushing back sanction relief or adding new ones. Following Congressional pressure, the US administration has started preparing new sanctions targeting individuals and companies. With Iranian elections looming (February) and as the US Presidential elections pick up momentum, we fully expect ‘tenacious’ rhetoric being fired across both sides. Unlike Saudi, Iran does not have the foreign reserves needed to ride out the pain of the crude price collapse – an extension of sanctions, or additions, will only deplete Iran’s already distressed financial situation. The longer its oil fields go on without maintenance, the more aggressive the declines will become which will seriously hamper future output.

Certainly Iran needs revenue, as does Saudi, but officials from Tehran have already commented that they will avoid a price war with any rival producers and will only gradually lift exports once sanctions are lifted. Oil market strategy can operate independently of international relations. Arguably, Saudi is not overly-worried about this particular rivalry: the big picture is the threat of expensive non-OPEC production. Iran’s return to the market helps Saudi’s objective to fundamentally rebalance the market by undercutting the high-cost non-OPEC producers such US shale or Canadian oil sands. In terms of market share, Iran’s return may increase the supply glut but Saudi can use this to maintain its OSP campaign to corner volumes of Asian (especially Chinese) crude demand.

As described in last month’s Commodities Insight Weekly December 21, 2015, the market is max short and continues to view the oil complex with supply-tinted glasses. The opening trading week of 2016 has been characterised by thin liquidity (due to the holiday season) and with market players focussing on the global crude oversupply, it should be no surprise that the down move has remained intact. Unless the oil market begins to balance out or the Saudi-Iranian conflict directly impacts supply, we are unlikely to see crude prices pushed upwards. We expect tensions to remain elevated between Iran and Saudi, with sectarian divisions worsening, and both players continuing to undermine and destabilise each other through the various regional proxies. Political oil risk will remain primed and ready for the market to turn.

Charts of the week: Global monetary policy cycle and asset prices; impact of lower energy prices on GDP growth

|

|

|

|