February 8, 2016

Gold’s outperformance: could it be different this time

Commentary by Robert Balan, Chief Market Strategist

"Stock market turmoil, a weakening currency and the lowest global prices in almost six years have helped boost bullion buying in China. Swiss exports of gold to Hong Kong and the mainland jumped 87 percent in December from a month earlier, underscoring the flow of metal from west to east. Demand in Asia, which accounts for more than 60 percent of global use, is fundamentally strong and should continue.” RBC Capital Markets, Bloomberg, February 3, 2016

Gold prices peaked in September 2011, but then there was a tremendous start in 2012, gaining more than 14% through the first two months of the year. By year-end, gold was well off of its late February highs. In 2013, gold traded sideways, with a weak year-end close. Gold started 2014 again with a bang; the first two and a half months had gold rallying by 14% to a peak of nearly $1,400 per ounce. Gold ended the year below $1,200. We saw the same pattern from January last year – gold added more than 10% to just above $1,300, only to end 2015 below $1,100 per ounce. Now, it is early 2016 and gold has risen from circa $1050 in November to near $1175 last week. Will it be more of the same sad story, or is it different this time?

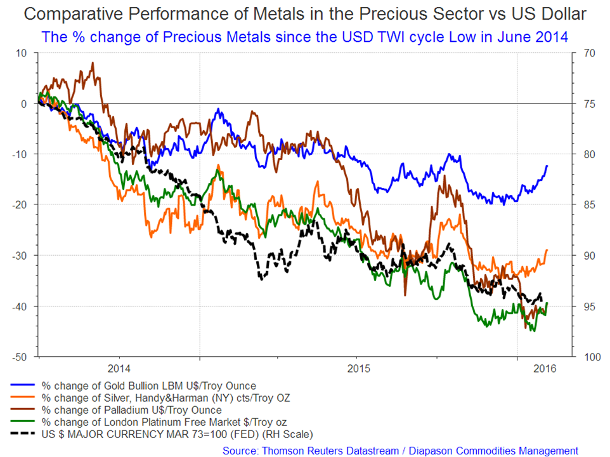

There are indeed signs that gold may be performing differently. The change is apparent within the precious metals sector, which has been collectively beaten down by the continuing US Dollar strength. Most of the components of the PM sector posted losses commensurate to the US Dollar’s gains, but gold’s losses were significantly smaller (see first chart of the week below).

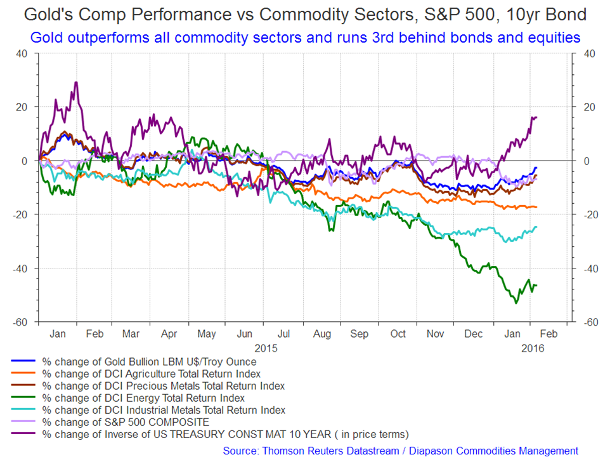

The same gold outperformance can be seen relative to other commodity sectors and financial assets. Gold handily outperformed the energy, base metals and agriculture sectors since the start of the year, but the real surprise is that gold even performed better than the S&P 500, and it has also been performing well in non US Dollar terms. The only financial asset which outperformed gold was US Treasury bonds (see second chart of the week below). The gold outperformance may be attributed to the same factors that made bonds the top performer – global finance has hit a turbulent patch. Bonds benefited as safe haven, and gold also rose up to the occasion. It also helped that the US Dollar’s uptrend paused, and had in fact weakened. But we do not believe that the weakness of the USD TWI was the source of gold’s outperformance – at least, not at this time around.

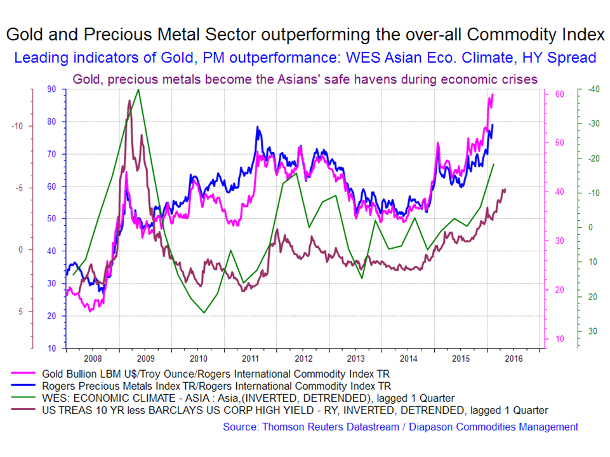

Asian economic surveys, credit spreads hints of gold outperformance

How will we know that it is not the US Dollar effect that primed gold’s current strength? We can substantiate this claim by resorting to the ratios of gold over other commodities or over commodity indices. A rational explanation of gold's relative outperformance has to start with the thesis that major movements in gold over commodity ratios are linked (inversely) with major changes in economic confidence. This is specially so in the case of the current economic crisis in Asia (e.g., China). It is said that in Asia, especially China, physical gold and platinum are the favored assets during the times when the domestic currency weakens – that has certainly been the case of the Chinese Yuan. There were reports of tremendous withdrawals of physical gold from the Shanghai Gold Exchange vaults since Q2 last year, when the Yuan started devaluing. And it was not just ordinary Chinese investors which were stockpiling gold. It seems that higher echelons of the Communist Party believe the international fiat monetary system is unsustainable. The Chinese government has been said to be adding gold to the FX and Gold Reserves on the sly. Whether true or not, the very large importations of gold with China as destination may have its origin in the global financial turmoil. One leading indicator of gold outperformance over the PM sector, and indeed, over the over-all commodity index, is the Ifo’s WES Asian Economic Climate Index (see third chart of the week below). The other leading indicator of gold outperformance is the spread between the 10yr Treasury yield and the US corporate's high yield index (see third chart of the week below). Credit spreads are one of the leading indicators of the degree of economic confidence; widening credit spreads generally signify falling confidence, and vice versa. Therefore, there is a logical, negative correlation between the gold/commodity ratio and credit spreads.

The price of gold could be bottoming as well

Deteriorating macro factors helped gold outperform since the start of the year. But the outperformance does not indicate whether or not gold has bottomed. The usual route in trying to answer this question is to go to the supply-demand equation. And indeed, gold output has been declining – understandable given the beating down of gold prices in the past five years. But supply-demand constructs can not pinpoint turning points in gold’s price. Instead we go back to the classic relationship between gold and the US Dollar – stronger US Dollar begets weaker gold prices, and vice versa. In effect, we need to understand when and why the US Dollar’s valuation is going to change profoundly.

One fascinating cue for US Dollar future performance is how central banks around the world change the proportion of their assets denominated in US Dollar and gold holdings. The so-called “dirty float” (the very high percentage of USD denominated assets in central banks’ balance sheets) started with the tsunami of petrodollars in the 1970s. However, petrodollars have lost some of their relevance, especially after the central banks launched various forms of Quantitative Easing programs. The surfeit of liquidity in global central banks’ balance sheets now dominate fixed-income markets, and petrodollars ceased as a major factor in determining long-term interest rates. With the low price of oil, the volume of petrodollars in central bank reserves also declined. This development may have lasting implications for gold and its price. If those USD dominated reserves fall significantly, it may open the way to a global central banks’ gold trading program, and higher proportion of gold in their reserves.

Accumulation of US Dollars in central bank balance sheets is nothing more than what any prudent investor would do – the US Dollar’s proportion to physical gold ebbs and flows with the strength of the US currency. But we may be seeing a USD peak soon. The rate of change of the USD TWI gains significantly slowed down since Q3 2015, and so by Q2 2016 (after half the base of a yoy comparison), the nominal value of the USD TWI should be peaking. That should be the time the 3YR ROC of the gold price (stripped of the business cycle) starts rising (the long lag due to the use of a longer base period). We are assuming that the nominal gold price will also bottom in Q2, concurrent with an expected peak of the USD TWI. Those relationships underline the impact of the Global and US FX reserves on the US Dollar TWI and Gold prices, and highlight the central banks' preference function for gold-over-dollar in their balance sheets.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist and Sammer Khatlan, Oil Analyst

Saudi Arabia’s reality check for Venezuela and Russia

For the past two weeks, nearly every day has seen headlines emerge from select oil producing states, calling or intimating for the possible coordination on crude production cuts. Last week the Venezuelan oil minister, Del Pino, stated that Iran, Iraq, Algeria, Nigeria and Ecuador would be receptive to an emergency meeting with Russia and Oman on oil prices. The initial rumour that Russia and OPEC could meet in February to assess a 5% output cut, prompted oil prices to recover nearly all of their losses suffered during January. The market is very short so the swift move from the lows was not a surprise but the poorly-worded headlines gave market players false hope.

It is difficult to not view the recent machinations for a meeting over crude production cuts as a desperate PR stunt. Venezuela’s public and private calls for an output cut are nothing new; indeed, they have been calling for action for two years. However these calls have been ignored time and time again by Saudi Arabia and its GCC allies. The current economic and political situation for Maduro has now hit extreme crisis levels as oil prices dropped below $30/bbl – indeed the pain on oil producers around the world is severe and the resulting financial desolation is encouraging favour for joint production cuts. Venezuela seized this opportunity and it was the slight nod from Moscow that strengthened Del Pino’s resolve to pursue the public endeavour to compel Saudi and its GCC allies to act. On reflection, the headlines only gained any real traction on crude prices when Russia began to chatter. Whether lazy or sensationalist reporting, the invitation to meet and discuss output cuts with OPEC did not come from Saudi – it came from Venezuela.

Repeated calls from Caracas for an emergency meeting have been echoed by Ecuador, Algeria and Angola in recent weeks, yet nothing was heard back from Saudi. In what has been a hyper volatile oil market these past 18 months, Saudi’s oil policy has not moved. In the last two weeks, oil prices have moved aggressively, especially after the initial ‘Russia-OPEC 5% output cut’ rumour, yet again Saudi said nothing. Riyadh’s silence has spoken volumes. The only comment that was made in relation to Saudi was an indirect one, from a ‘stateless’ OPEC delegate: “Saudi has no proposal to cut output 5%”. That Russia’s Deputy Prime Minister for Energy ended up contradicting the Energy Minister when he stated no official cut was on the table, underlined the anxious and hyperbolic nature of the PR exercise.

It remains our contention that the main purpose of Saudi’s ‘market share’ strategy is to squeeze North American producers, and in particular, US shale. Cutting output now would bail out US producers just as the Gulf-OPEC strategy is showing results: the 60 leading US independent oil and gas companies have a total net debt of $206bn versus $100bn at the end of 2006; as of September 2015, nearly 20% of these companies had debts that were more than 20 times EBITDA. Moody’s placed 69 US-based energy companies on its credit downgrade watch; a third of the 155 US oil and gas companies covered by Standard & Poor’s are rated B-minus or below, meaning they are at high risk of default. More than 30 small companies that collectively owe more than $13bn have already filed for bankruptcy protection so far during this oil price down turn. Close to $90bn in budgets across American producers are expected to be cut – this is a 51% drop from 2014 levels. It is being reported that North American oil and gas producers are losing nearly $2bn every week at current prices. Considering all this and how much time and economic pain Gulf-OPEC have endured so far, why relinquish its position now when they can see the finish line?

For Riyadh, the big picture threat is US oil. This threat supersedes Saudi’s distrust of Russia to cut oil production (Russia has not followed through on promises of cuts on several occasions, notably the oil crash of 2001 and in 2008, favouring to increase exports on both occasions and leaving OPEC to shoulder the burden of output reductions) and the divergent geopolitical stances on Iran and Syria.

We do believe that Saudi will cooperate with other producers only when the market conditions are right for them to do so. The difficulty with US shale is that the industry is many, many private firms with their own self-serving business aims/goals. Unlike OPEC or countries like Russia, there is no one US body/organisation to agree on production cuts. Therefore the only course of action is the current one – drown out inefficient, high-cost producers by flooding the world with low-cost oil.

Assuming Venezuela’s non-GCC OPEC meeting does go ahead, what can realistically happen? Agreeing on a number to cut by that will satisfy 8 different countries, will be extremely difficult. Even if one is agreed (and we believe this is HIGHLY unlikely), would they dare try and outpump Saudi and its allies? Iran has already stated that it would not join an immediate OPEC cut. Without Riyadh’s support, what can meaningfully be achieved?

The manoeuvres of recent weeks by Venezuela and Russia will not have been well-received by Saudi. Riyadh’s response to all this has been emphatic – there was no need to comment on the gimmicks. Instead, Saudi again lowered its latest OSPs on its Light Crude to Asia to further cultivate its already dominant market share. We believe the strategy will remain; they are in this for long-run.

Dollar decline not warranted in the short term, but highly likely in H2 2016

The US Dollar lost ground against all the major currencies last week, which was somewhat of a surprise. There was a general anticipation of a stronger US Dollar performance following the BOJ recent surprise rate cut and the ECB's likely reassessment of its monetary policy next month. The US Dollar beat down came about as the market moved from obsessing with Chinese devaluation to the fall in oil prices, and now to the likelihood of a US recession. But the US Dollar bounced back with the help a fairly robust jobs report. Although the jobs growth headline disappointed, the internal details were constructive: more people were working a longer work week and they were earning more. Also, the participation rate rose, and the unemployment rate (U-3) fell. To further underline the improvement in the labor front, the Atlanta Fed GDP Now tracker rose to 2.2% in Q1 2016 from 1.2% earlier in the month. To us, it means one thing – the US Dollar will probably rise further during Q1 2016, but its continuing dominance is not anymore a given, and it could peak during Q2 this year.

In an earlier piece, we set forth the thesis that recent improvements in the US Capital Account Balance will likely support a USD rally through to Q2. The US capital account has been strengthening in the back of non-domestic capital inflows, a significant portion of which is coming from China, as Chinese investors flee a weakening Yuan being systematically devalued by the government. So we see news of Chinese investors buying prime US real estate and corporations. Chinese corporates have also been paying USD-denominated debts. We suspect that the Yuan devaluation is by no means over, but the process may end in Q2. Hence, pressure from a firming capital account balance may support the greenback a little longer.

The US Dollar has been strongest on a broad trade-weighted basis (where there is heavy participation of EM currencies, including the Yuan), but made only very modest gains against the G7 currencies. We also note that the US Dollar is losing the FX "beauty contest" as the EUR and the JPY continue to make inroads. Not all the macro factors still remain in favor of the US currency. Growth spreads now start to favor the EUR vs the USD. It was also true in the case of the JPY vs. USD. The variance in growth rates has moved to neutral; the US positive growth spread vs Japan has narrowed to almost nil from as wide as 4.5 percentage points. The 2-year US-Japan swap spread has also narrowed sharply, removing one of the allures of the US currency for Japanese investors. In other words, the USD recent dominance is being dismantled one piece at a time, and its uptrend is slowing down significantly. It is accurate to say that the US Dollar TWI may continue to gain in the short term only because EM currencies remain very weak against it.

The longer term outlook is less friendly to the US Dollar. For one, the US Dollar is severely overvalued, and is now becoming a global problem – almost everyone wants the greenback to weaken. The overvaluation has certainly become a huge problem for the Federal Reserve, but undercutting the overvalued currency also depends largely on whether or not the Fed realizes it made a policy mistake by raising rates in December. The Fed has tightened monetary conditions too much and if not alleviated soon, might send the US economy into a recession in the coming quarters. But parsing recent Fed speakers do not give the impression that they consider the December hike a mistake, so the Yellen Fed will remain stubborn for a while and as a consequence, keep monetary conditions tight and postpone monetary easing for some time. All of which will keep the USD firmer for a little longer. But not too long from now, the Fed could dramatically change the course of the US Dollar. Some indications of an emerging "FX Plan B" comes from Bill Dudley, president of the New York Fed, who said that "recent market ructions have led to considerably tighter financial conditions since December and that any further rise in the Dollar could have significant consequences”. Mr Dudley’s comments provide clear hints that the Fed may be having second thoughts about the wisdom of rate rises in the current deflationary world. The offshoot is that the four rate hikes implied by the FOMC SEP dots, may be reduced to two, and a growing consensus say a rate hike may not happen at all. Two rate hikes or none – the US Dollar will likely be significantly lower during H2 2016 than it is now.

Charts of the week: Precious metals vs USD; Gold vs commodities, S&P500, 10 yr bond; Gold and precious metals outperforming commodity index

|

|

|

|

|

|