February 22, 2016

US inflation and growth rising, even as bond yields fall: something has to give

Commentary by Robert Balan, Chief Market Strategist

"These Treasury rallies pushed prices higher and yields lower not because of changes in economic fundamentals, but because of a massive flight to government bonds, which are perceived as haven assets, amid sharp global equity selloffs over the past few weeks.” Jeroen Blokland, Portfolio Manager at Investment Solutions, February 18, 2016

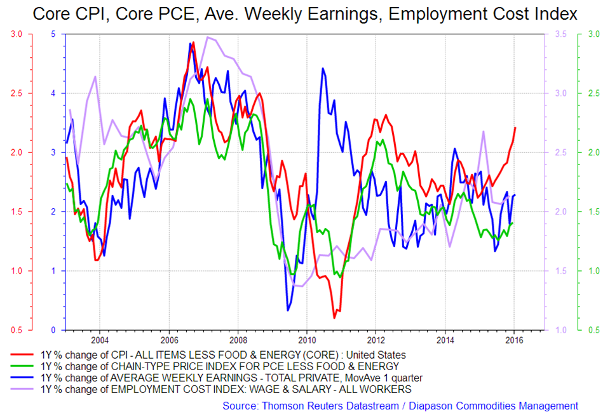

While deflation and negative interest rates dominate headlines, the CPI rose sharply forcing investors and the Federal Reserve to take another look at their inflation projections once again. Last week, Core CPI made a new high year-on-year, rising to 2.216%, up 2.296% on a six-month basis, 2.537% on a quarterly basis, and +0.293% month-on-month. This month-on-month rate is 3.571% annualized, the strongest number since March 2006. Indeed, core CPI is accelerating as we have expected, and we could even make a case that it will accelerate even faster. This may come as a surprise to some investors, who may have had their minds conditioned that this cannot happen with falling energy prices (and they are now declining precipitously) and with a strong US Dollar, which translates into cheaper imported goods. But the simple fact is that US inflation is principally driven by labor inflation, which is in turn primarily being driven by the cost of services. Inflation has been trending below the Federal Reserve's target of 2.0% for the past four years. Low inflation suggests weak demand growth and raises fears of actual decline in prices or deflation (see first chart of the week below).

The January CPI data confirms that the reality of higher inflation is likely to remain in our future. The notion that deflation is some kind of existential threat, and that the powers-that-be are helpless to combat it, is simply sloganeering and defeatist hand-waving. We believe inflation is headed higher, whether investors – and the Federal Reserve – expect it or not. The current meme is that low commodity prices and the strong US Dollar will keep inflation expectations low in the foreseeable future. However, inflation expectations do not drive inflation – it is the other way around – actual inflation powers inflation expectations.

As early as the middle of last year, we began highlighting the strong upward move of US shelter costs which have been pushing up core CPI. But with the January CPI data it became clear that CPI-Shelter is no longer alone as an inflation driver. Now, education, medical care, and rent are all rising sharply. CPI-Shelter made a new post-recession high in January, but the real big move higher in January has been driven by health care inflation, and that is beginning to neutralize the deflation in other core goods. The January data tells us that the temporary pause in medical care inflation is past us.

Observers may note that the Fed prefers the PCE as its gauge of inflation, and PCE is still lower than PCI at this time. But since medical care was a big driver in this month’s CPI report, it simply means that the core PCE report coming out next week will be worse. Medical care carries a much larger weight in core PCE. This was the reason why core PCE has been weaker than core CPI since last year, but that will soon change – health care has a higher weight in the PCE, so the sharp push in core CPI should be, if anything, stronger in PCE. On the other hand, core goods prices are unlikely to ratchet higher suddenly. The impact of Dollar strength, which has been fostering deflationary pressures, will continue to reverberate, which will weigh down on core goods prices for a while longer. However, the core goods part of CPI is less crucial and less persistent, and it is services (driven by housing, education and medical care) which continues to accelerate.

The sharp rise in CPI in January came at a critical time. The Federal Reserve (which is perennially accused of being "behind the curve"), for once, is being accused of being "much ahead of the curve", and that it tightened monetary policy in December even in the face of domestic and global growth headwinds during a period when inflation was not the problem, and that deflation was. The Fed in response has said that they expect inflation to rise towards their target in due time, hence the SEP dots reflected several rate hikes (four, after last December's rate hike) over the course of 2016, with the next hike expected in March. Fed Chair Janet Yellen told Congress last week that prices would rise over the medium term. After global markets swooned early in the year, the Federal Reserve started to move away from the expectation they have fostered, that they could tighten in March.

However, the January CPI is a strong and timely signal that the broad inflation picture is rising and is in fact even accelerating, just as the Fed feared it would. That March possibility has just landed squarely again on two feet – a March tightening is back on the table. This buzz will become stronger when core PCE “surprises” higher this week. We expect a pickup in the core PCE to 1.6% year-on-year, which if confirmed would be the highest PCE has risen to since September 2014. These inflation developments may even become the key argument of hawks on the FOMC that want to see multiple hikes this year. However, a March tightening may be a quarter too soon, as the global markets are still struggling to find a bottom, and the US quarterly GDP for Q4 2015 will likely be close to zero percent, and the Fed will have an idea about those dismal numbers by the time they will convene on March 16. If the Fed finally decides to make a follow-through to the December hike, they could do it in June.

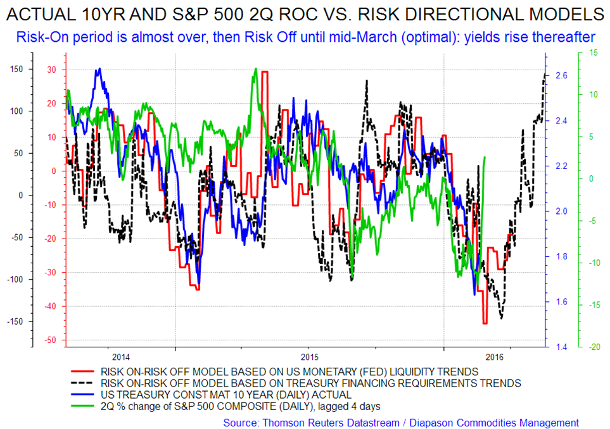

These inflation developments, when coupled with the apparent market misestimating of US growth in Q1 2016, will likely have a profound impact on the bond market in the very near term. The bond market currently sees very low inflation and growth prospects for H1 2016 at least. The 10 year bond yield fell to as low as 1.52% last week, and was trading at 1.7450% at Friday's close. With core inflation coming in at 2.8% in a year if current growth rate is sustained, and Q1 2016 quarterly GDP growth at near 3.0% (based on Atlanta GDP Nowcast trend), there is a wide divergence between the 10 year bond yield level and those two variables. Deutsche Bank said that the market-implied GDP growth rate based on the benchmark 10 year Treasury yield at last week close was a contraction of 1.5% during Q1 2016 – which is far below the almost 3.0% growth that the Atlanta Fed is projecting. Working back based on this relationship, the 10 year yield should be at 2.35% rather than last week's 1.7450% close. That is a 55 basis point spread between the market's growth assessment and the Atlanta Fed's projections. The 10 year yield and the Atlanta Fed's GDP forecasts have had good correlations in the past (at least in the directional point of view), but they diverged sharply in early January, when the turmoil in the global asset markets started. That also triggered a flight to quality, depressing bond yields sharply.

We believe that the Atlanta Fed's case for growth in Q1 2016 is solid given that jobless claims hit a three-month low last week; industrial production rose for the first time since July; and consumer spending, rose in 2015 at its fastest pace since 2005. An adjustment of expectations is very possible in interest rate markets over the next few months, and we expect the 55 basis point divergence will close rapidly, as bond yields will ratchet higher. This is in fact being flagged by our Risk-On, Risk-Off models (see second chart of the week below). The combination of growth and higher inflation should be good for commodities, and the only fly-in-the-ointment is that a sharp readjustment of bond yield higher should also push the US Dollar exchange rate valuation higher against other major currencies. That would not be beneficial to commodities, especially for gold, which has been rising sharply on safe haven, weak Dollar, low interest rate tailwinds of late. Nonetheless, we have seen recently that the Dollar-commodity relationship can be put on hold during "special factors" environment, so a revaluation of the US Dollar in the near term may not necessarily impact commodities severely this time around. But if China fundamentals also improve during the period which we consider as risk-off, then commodities can still prosper.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist and Sammer Khatlan, Oil Analyst

Four producers agree to freeze output: what does this mean for the oil market?

At a meeting in Doha, Saudi Arabia, Russia, Qatar and Venezuela agreed to freeze their production at the levels marked in January 2016 until June. The deal is conditional upon other producers following suit and OPEC members such as Kuwait, UAE and Iraq have declared their support for the deal. Iran’s response was understandably lukewarm, welcoming the deal rather than committing to it, as the freeze effectively keeps its production at pre-sanction levels. Dismissing or rejecting the deal would have triggered a sell-off in front-end prices – Tehran is understandably in a difficult position.

In terms of sentiment, the deal is positive: thinking back to OPEC’s December 2015 meeting, the backstop to the market was essentially removed by the Group as no output ceiling was established resulting in a further free fall in prices and market positioning. This deal underlines that channels are open and dialogue is progressing, laying the groundwork for an output cut in the future when market conditions are more favourable. This will give the bulls hope going forward.

The freeze itself will not help balance the market’s current oversupply. Any improvement on the current overhang will be contingent on demand as all the producers in the deal were pumping at record levels in January 2016. Seasonally we are approaching the main global refinery turnaround session and as margins are so weak, this is compelling refiners to enter the maintenance season earlier than usual. As such, the short term impact of the freeze will unlikely show a drop in inventories. It also worth noting that the January levels are not truly known given the variety of estimates in the market – there needs to be a reliable baseline established before we can effectively assess the impact of the freeze on the crude markets.

Saudi’s policy has not changed – it remains unwilling to cut production unless others join in. However this deal does indicate that Riyadh is willing to come to the negotiating table. OPEC’s next meeting is in June and Gulf-OPEC will hope to point to a heavily distressed US shale industry following the spring redetermination period – this should provide greater clarity on US shale’s financial health/trajectory going forward. Involuntary declines in production will also continue to filter through, namely from the FSU, Asia and Latin American producers, which along with any slowdown in the US, will go some way towards balancing the market before a cut occurs. At this stage, we believe this is more likely to happen in December 2016 rather than June. The difference of these extra months between June and December could be key for OPEC if the Group wants to truly reassert its control on the oil markets. Given that we are at record levels of inventory, the potential of an extra 4/5months of output declines in key non-OPEC combined with the production freeze will hasten the draw on the crude overhang and give OPEC more influence to substantially impact market prices.

Iran remains the elephant in the room and it is clear that the ‘freeze-deal’ members will need to offer concessions to Tehran to get them on-board. Given that sanctions have only recently been lifted, agreeing to an output freeze is unlikely to materialise. Concessions could include being allowed to ‘voluntarily’ restrict exports until June or December, a cap on any production increase in 2016 or the option to raise output first if/when prices rise. By June, there should be a clearer picture about Iran’s true upstream capabilities – this will be important as Iran is the only nation with any significant spare capacity to substantially increase production from current levels.

For non-Gulf OPEC (Iran aside) and Russia, the freeze will have been a very welcome step forward from Saudi, even if the ball has been very quickly returned to their side of the court. Saudi has been in this situation before where Russia has said the all right things but failed to follow through with any meaningful action, leaving Gulf-OPEC to shoulder the burden of balancing the market (e.g. the late 1990s, early 2000s and 2008). There is plenty of work to be done from here and the possibility of a collective cut is not straight forward – however this is important step forward providing certain players pass the initial test of trust; doing so will mean more confidence can be brought to the table once cuts are properly on the agenda.

Rationalizing recent copper price trends

Some large mine operators claim to have cash costs at around $1.00, compared to other smaller operators who have substantially higher costs. 25% of the world's copper – 90 mines out of a total of 250 – is said to cost more than $2.00/lb to produce. Why then does the price of copper remain resilient and not suffer the fate of iron ore? RIO and BHP executives have been quoted as saying they wanted the price of Iron to drop as low as possible in order to force out competition. Does that game plan extend to copper as well? BHP was recently reported to be set to increase overall copper output to 1.7 million tons per annum at an average cash cost of $1.08/lb. Some other large mines with low cash costs are said to be, in theory, capable of producing copper at a price of $1.50/lb and still make some profit. So why is the copper price holding steady over the past 3 months near 4,500/ton?

Copper demand is indeed in small deficit at this time, but few thousand kilo tons in a market of 22 million tons can be considered as a rounding error. This is perhaps one of the reasons why copper prices have been steady – the market is not being swayed with that slight surplus. There is also the case that concerned institutions are taking steps to protect copper prices. Chile recently announced they will purchase the copper output of their smaller producers at a higher price over the market prevailing price. The subsidy is booked as a loan which will have to be paid back when prices improve. The purpose was to keep the small producers going, which would otherwise fold and close shop. Large producers have also rationalized some of their mine holdings, and have ordered several mines to close temporarily and lay off personnel. This has also helped copper maintain a steady price level.

The price of copper is highly dependent on Chinese demand. China consumes nearly half of all copper that is being produced – their needs and buying pattern has a disproportionately large impact on copper prices. Chinese demand, at this point, is something that is in a flux. The massive infrastructure projects that created a commodity boom have significantly moderated. But China's rising domestic demand for goods means there are rising sales for all sorts of domestic appliances, gadgets and vehicles. China is transitioning into a consumption society with a large middle-class, with relatively high purchasing power.

The market for electric cars is booming. China is also expanding its national electricity grid which will consume 1.3 million tons over the next few years. The Chinese have been buying slowly and at smaller quantities so as not to create a price spike. These slow, but steady purchases are what have been causing a practical floor in copper demand, steadying the price. If the Chinese economy picks up, then demand for metals like copper will also rise. There are definite signs of growth. The Chinese central bank is taking steps to increase financial liquidity and this has been met with improved bank lending and total social financing spending. The Chinese government is also ratcheting higher their national fiscal outlays. The impact may not be seen in a few more months, but there is no doubt that activity in China will pick up soon. The Chinese government is also restarting some of the infrastructure projects that they either have frozen or delayed. With these developments, copper prices will likely improve over time.

Charts of the week: CPI, CPE, weekly earnings employment cost; Risk-on risk-off model

|

|

|

|