March 14, 2016

The deflationary pulse recedes as commodity prices jump; inflation issues may not be far behind

Commentary by Robert Balan, Chief Market Strategist

"The energy sector will find equilibrium by the second quarter of 2016. And it will not be pretty for those holding bearish trades. It's going to be a short covering rally that rips people's faces off. It's going to be ugly.” Bill Smith, chief investment officer and senior portfolio manager, Battery Park Capital

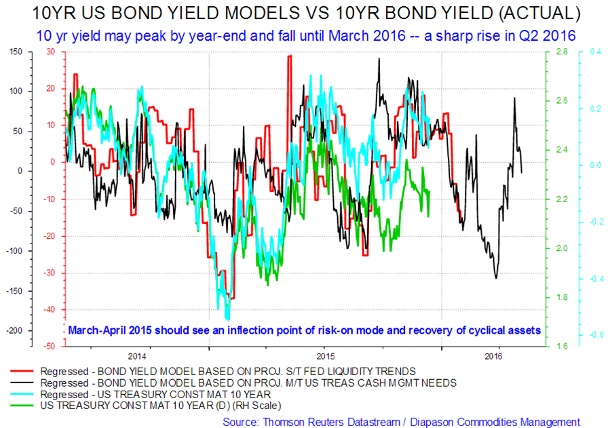

Not more than two months ago, many investors feared that the world was about to dive headlong over a deflationary cliff. The consequence of those fears were devastating: crude oil prices collapsed to $26/bbl, high-yield spreads widened an additional 900 bps, HY energy spreads were just short of hitting 2000 bps, 5-yr inflation expectations declined to 1.0%, the VIX Index soared close to 30, 10-yr Treasury yields fell sharply to 1.66%, and the S&P 500 declined by 15% from its previous high. To sum it up, it was like sweeping the financial landscape of every piece of risk asset – whatever was left from a previous, similarly disastrous period in late 2015 when crude oil prices started to fall sharply. Our bond yield models warned us of the deterioration, and even provided a time frame of likely recovery, which was the following March (see first chart of the week below).

So here we are in March – and what a difference two months can make. Today, all of those ill indicators have recovered significantly. Crude oil is up 45% and has stabilized at just below $40/bbl. High-yield spreads have tightened and is now close to 650 bps, 5-yr inflation expectations have risen back to 1.5%, the VIX has collapsed to 17, 10-yr Treasury yields have risen to just below 2%, and the S&P 500 is merely 60 points away from its roll-over point in late December (at 2078).

The models, which are liquidity driven, suggested that a significant Risk-On phase follows the disastrous January-mid-February catastrophe. What is implied in the models is that a pick-up in systemic liquidity will spark a significant recovery. And that seems to be the case today: 2-yr swap spreads have gone very tight (5-6 bps) – liquidity has become and remains abundant, and systemic risk remains low. Tight swap spreads suggest that financial markets dynamics are working well, and that allows the market to spread risk from those who cannot bear it to those who are willing to. It is heartening to see that the market worked as it was supposed to this time. There was no government intervention, no central bank grease to lubricate the turn of the market wheel. Prevailing price signals (commodities at below cost of production) were sufficient to convince resource producers to stop slashing their own throats by producing well in excess of demand, and bring output in line with demand. Even the base metal producers, who were bent on destroying their competitors (and the metals market in the process) found it necessary eventually to cut output and shutter entire mines. They were well-rewarded by the equity markets for this newly-found wisdom.

The strong-headed oil producers at OPEC also found it necessary to check the urge to torch their competitors (and burn down the house in the process) and started talking about “freezing” output to the levels of January. Never mind that both Russia and Saudi Arabia, the major exponents of the output freeze, are already unable to boost production much further anyway. What is important is that the market saw these oil mega-producers sat down and talk, calming an increasingly nervous oil market, which has started to imagine an “oil war” with no winners at the end.

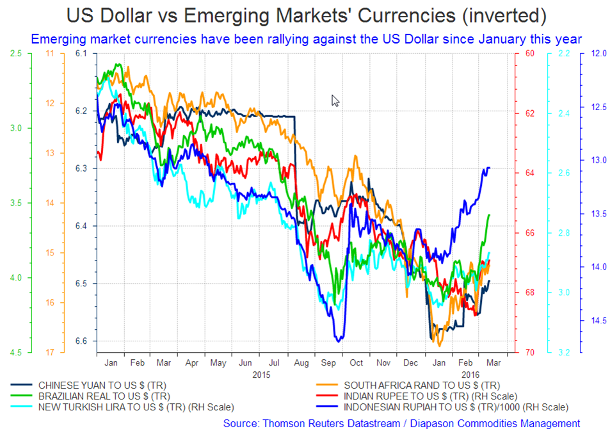

The net result of all these rationalizations, which should have happened much earlier, was that the markets short-circuited what appeared to be an almost sure deflationary collapse. In fact, some market participants, and even central bankers (e.g., the Fed’s Stanley Fisher) started speaking about the return of inflation. With such a spectacular recovery, especially on the commodity universe, the concept of inflation being back is not a forlorn hope. All the measures of inflation, as we know it, are on a tear. The evidence can clearly be seen from the rallies of emerging market countries currencies (see the second chart of the week). EM currencies are the best barometers of forthcoming financial weather in developing markets.

The best news for this new Risk-On phase is that investors began once again going back to EM hard currency debt. Latest news is that during the week leading to March 9, EM dedicated equity and bond funds enjoyed meaningful inflows for the first time since H1 2015. The largest portion of those inflows went into hard-currency funds in particular. While a three-week net inflows period does not yet qualify as a trend, it shows that appetite for larger yields and capital gains potential, given widening EM spreads, is coming back.

A large part of the reversal of the deflationary pulse had been due to the recovery in oil prices. Oil futures traders have previously been preoccupied with rising inventories, but apparently, these traders have shifted attention to falling production. That switch has helped put a floor under oil prices, as the outlook for non-OPEC supply continues to deteriorate. The focus of traders seems to have switched from an immediate surfeit of crude in inventory to a possible future shortage due to huge capex cuts over the next few years. It also helped that the EIA is becoming more pessimistic about non-OPEC output on lower investments and the closure of ageing fields and uneconomic wells. The EIA forecasts that production outside OPEC will fall by 440,000 barrels per day over 2016. That compares with a drop of just 90,000 barrels per day that it foresaw in January. The Paris-based International Energy Agency (IEA) said it also expected non-OPEC production to drop by 750,000 barrels per day this year. That compares with a drop of 600,000 barrels per day anticipated a month earlier.

Higher crude oil prices mean that the headline CPI is likely to be much higher by H2 2016 than many investors have expected. Other commodity sectors, and not only energy, have performed just as well if not better. The DCI® Metals index is now almost 10% above its January lows, supportive of a start of an uptrend. If base metals and crude oil can sustain their rate of advance, then the current elevated gold and TIPS prices are further telling us that the market is worried about the future direction of inflation being up instead of down. With the Eurozone and Japan central banks still have their policy pedals to the metal, during a time that commodity markets are surging ahead, it's not impossible that we could see inflation rising above target before too long.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist and Sammer Khatlan, Oil Analyst

Long term trade: Keep an eye on gasoline spreads

It will be well worth keeping an eye on gasoline (RBOB) spreads in the coming months. The light end refined product was the undisputed leader in 2015’s down trending market, dominating global demand growth as US gasoline sales hit their highest level since 2007 and rapid vehicle sales growth in China supported global cracking margins. We believe that gasoline will continue to represent the largest growth market for refined products globally and could explode by 2H16.

At this juncture of the year, margins across the world have been considerably weaker and gains in gasoline have been muted. During 2H15, refiners had been running at max levels as the economics of storing crude had been unfavourable and demand for products (namely light ends) incentivised runs. The strength in light ends also resulted in refiners reconfiguring their systems to produce more and more gasoline (yield switching) as this was the most profitable trade. As a result, plenty of gasoline came to the market which, as long as demand maintained its strong run, would get quickly snapped up.

However as global refiners maximised gasoline production (particularly Chinese refiners incentivised by higher domestic retail margins) the already huge commercial oil inventories increased in 4Q15. As such, markets began to pull back on demand, particularly as the perceived macro picture continued to worsen due to China’s slowdown. The confluence of these factors fell into 2016 and as a consequence, an oil overhang and weak demand for products (and thus weaker margins) meant that many refiners decided cut runs and/or enter the main maintenance season earlier than usual. Safe in the knowledge that product supplies were seasonally high, refiners could embark on turnarounds and let stockpiles of refined product drawdown until demand returned in the typically busy summer season. As can be expected with significantly high product inventories and weak demand, RBOB prices collapsed.

It is in this rationale that we believe RBOB could throttle back more aggressively than many would assume in the second half of the year. A feature of 2016 thus far has been the rising level of unplanned outages: with the majority of refiners having cut runs or in turnarounds, the few remaining operators left with the burden of supplying the market will be further squeezed resulting in stock deteriorating far more rapidly than expected. The crude market is also starting to show signs of life as Brent spreads have not only held, they have strengthened: in a market where margins are weak and refiners are in the maintenance session, this usually implies one thing – there is not enough crude in the market. Global crude supply disruptions rose in February as Nigeria’s Forcados and the Kurdish pipeline both went offline with estimated returns not expected until late March/early April – this will take off an additional ~400mb/d from the market. Add this to disruptions in Mexico, North Sea and Colombia (where two key pipelines were bombed), crude outages are likely to reach over ~2.5mmb/d whilst refiners are in planned works. Of course, one must also consider the likelihood of necessary upstream maintenance across all the major basins going into the summer.

When refiners return to the market, their main input cost, crude, will be more expensive: given the scale of inventories at the beginning of the year, markets may not realise the scale of outages, maintenance and depleted balances until much later in the year (i.e. too late). At this point, crude spreads will be pushed even higher. As we get closer to summer, demand for gasoline should get stronger: as inventories have been so high, prices have collapsed which will further incentivise drivers to increase their mileage on their automobiles. As such inventories will continue to draw down and refiners will need to contend with reconfigurations for summer grade and much more expensive crude to run. This will all provide a window where a significant gasoline shortfall and robust demand should push prompt RBOB spreads swiftly to the upside.

Tin hits an 11-month high as the base metal sector stages a spectacular recovery

The entire base metals sector has risen since February and so far many metals are still slightly short of the 20% which will classify their recovery as "bull markets". One of the exceptions is tin, which is starting to adopt a bull market stature. The metal hit an 11-month high in early March, decisively breaking through $16,500 per metric ton, a resistance area which had previously kept the price from going higher.

There are fundamental reasons for the sharp recovery in tin. Exports from Indonesia have been falling throughout this year. Indonesia's February exports of refined tin totalled 4,505mt, a fall of 25% year on year. February's fall in exports followed a 63% year-on-year decline in January. Both monthly export declines stem from recent flooding on the island of Bangka, a major source of tin ore. There were also delays in exportation as Indonesian exporters struggle to receive new certifications. There were other allied, commodity-themed reasons for the sharp uplift in tin prices over the past few weeks. One of them is the ongoing recovery in oil prices, which have risen close to $40 per barrel. The rally in oil prices provided an across the board rally to the rest of the base metals and to the rest of the commodities complex.

The US Dollar also fell sharply in February and that also contributed to a price increase across Dollar-denominated commodities. Tin was further boosted by the failure of the US Dollar to secure a boost from the ECB's QE stimulus program. The European Central Bank's decision to cut its main interest rate to zero will continue to play a big role in the currency markets over the next few weeks. The EUR had ironically gone stronger after Mr. Draghi's QE announcement, but the wide interest differential in favour of the US Dollar will reassert shortly, which could interrupt the base metals’ advance. Tin was one of the worst performers in both 2014 and 2015, and so it makes sense that it should shine in 2016. Even after this recent huge rally, tin prices are still low relative to historical levels. That provides reasonable value; hence its recent outperformance.

There are some data we should however be on the lookout for. Tin ore imports from Myanmar in January soared to an all-time record of 72,436 mt (gross weight), a 239% year-on-year increase and a 66% rise from the tonnage imported in December, according to Custom's data. Myanmar's surging supply could make up for Indonesian's falling production, and would serve to moderate prices. Tin's rally should be seen in the bigger context of base metals staging one of the more spectacular recoveries in recent years. For instance, steel billet prices in Tangshan, China are up 15% in just three days with price increases across the board. Traders have been restocking in anticipation of further rises. The price recovery came not long after a clear policy message from Beijing which says that that the government would increase fiscal spending and monetary easing to help boost growth. Reuters also reported that China's copper imports have surged 50% in February compared to a year ago, to 420,000 metric tons. This follows on from 440,000 mt of refined anodes, alloys and semi-finished copper products in January. Both episodes clearly suggest that the base metals are back.

Charts of the week:Bond yield model vs. bond yield actual; US Dollar vs. emerging currencies

|

|

|

|