April 18, 2016

The global economic cycle is turning - prepare to get aboard

Commentary by Robert Balan, Chief Market Strategist

"There’s a lot more comfort now in the ability of China to keep demand at a certain level that would foster growth” Mexico’s Finance Minister Luis Videgaray, Wall Street Journal, April 18, 2016

During the first six weeks of 2016, risk assets prices fell sharply and sentiment cratered over worries about the sharp decline in oil and commodity prices, China's move to devalue their domestic currency, tighter financial conditions across the globe, rising systemic risks from European banks, and a palpable loss of confidence in central banks' ability to pull the world out of the economic doldrums. It seems to be a repeat of what happened almost every year since 2011 – January starts out badly, and the rest of the year follows more or less. And then something happened – the risk markets turned around, erasing most of the steep losses for the year. The cycle transformed from vicious to virtuous. By the end of Q1 2016, oil prices stabilized then rose, China's economy finally showed the result of a massive stimulus trickling through, the Fed turned less hawkish (many investors say the Fed turned "dovish) and odds of a Fed policy tightening during H1 2016 fell, the US Dollar finally weakened, which took significant pressure off emerging market currencies, commodities and high-yield bonds.

Curiously, the reaction from some safe-haven assets was puzzling. Gold and the Japanese Yen, which have been rallying when most risk assets were falling in early 2016, did not give up their start-of-year gains. It could be that after risk markets rebounded, suggesting that investors are caught between their earlier fears due to the reasons enumerated above, and the signs of an emerging better economic outlook. So investors aggregately played the two radically opposed notions. Indeed, improvement in global fundamentals has been impressive even when the improved data and activity are held against a backdrop of China's very high corporate debt, and the uncertain ramifications of central banks' experiment in resorting to negative yields. Overall, we believe that the recent improvements are typical of further recovery in the late stages of the economic cycle. What short-circuited a likely slide into recession-like state in Q1 2016, were the following: (1) China previous huge dose of stimulus are starting to yield positive results (see the first chart of the week below); (2) crude oil prices seems to have found a bottom; (3) centrals banks remained or even became more accommodative; (4) the US Dollar weakened sharply, providing relief to the long suffering commodities and emerging markets universe, and (5) US and global conditions have eased.

China's loose macroeconomic policy stance over the past several quarters is finally producing some much-awaited positive results as can be seen in the first chart of the week below: (1) a larger-than-expected official PMI increase in the March to 50.2 (consensus 49.4, previous: 49.0), ending a 7-month contraction, and (2) China’s foreign trade data improved significantly in March and exceeded expectations. Exports rose 11.5% y/y in USD terms in March (February: -25.4%), after contracting for eight straight months. Moreover, the Xi government embarked upon a new stimulus in the form of credit, with loans in January-February totalling around 4.2 trillion Renminbi. On that pace, this new credit cycle should easily surpass the 15.3 trillion Renminbi in new bank loan credit for all of 2015. Given that kind of shot-in-the-arm, growth should get in the coming months; property, construction, exports, and retail sales should significantly improve. Improvement in Chinese activity was accompanied by a recovery in crude oil prices. The relentless increase in US oil inventories is finally being redressed by a sharp decline in US oil output. Deep cuts in capital expenditures should accelerate the decrease in production. Moreover, the price of oil is negatively correlated to the valuation of the US Dollar, so the recent Dollar weakness provided another positive factor for the continuing improvement in energy and commodity prices.

Central banks remained or have even become more proactively accommodative. Global central bank policy has also become less divergent, as the Fed decided on a lower trajectory of rate hikes. The European Central Bank (ECB), the Bank of Japan (BOJ), and the People's Bank of China (PBOC) have all been easing monetary policy, and now the Fed lowered the scope of divergence by backing away from tightening. During the March FOMC, the Fed surprised markets by reducing its expected four rate hikes for 2016 to tow, and reducing them by two for 2017. The Fed also noted that "global developments pose risks," so it looks like the Fed has modified its reaction function to include the amelioration of the negative impact of a strong US Dollar. The ECB in early March surprised markets with its announcement of a new lending program that lets banks borrow for four years at between 0% and -0.40%. Essentially, the ECB provided the eurozone banks the possibility of being paid in loans if their lending benefits the real economy. The ECB also increased its QE program to €80 billion per month and expanded the eligible assets to include non-financial investment-grade European corporate bonds. The ECB's purchases of financial assets is significant because it suggests that the ECB is now more focused on reigniting domestic inflationary pressures and credit growth. Therefore it suggests that the ECB is not anymore planning to move deeper into negative yields which could possibly put the health of the banking system at risk.

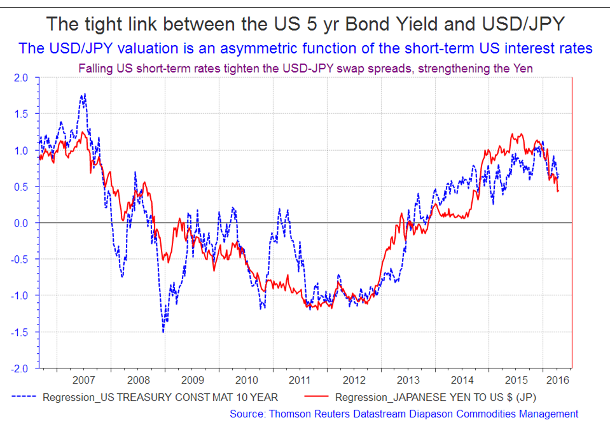

The Bank of Japan (BoJ) in March said that it could cut negative rates even further in order to encourage consumption and investment. Nonetheless, the yen rose sharply, even as Japanese equities plunged, especially bank stocks as investors interpreted the communication to mean that banks would suffer outsized earnings declines in an environment of increasingly lower lending rates. Some analysts were puzzled by the behaviour of the Japanese currency, but further analysis suggests that the Yen’s behaviour is tied up with interest rate differentials, where the trend in US short-term rates is the dominant factor. The recent decision of the Fed to cut back tightening prospects has pushed short-term interest rates lower, and that has correspondingly led to a rally in the Yen (see the second chart of the week below).

The Peoples’ Bank of China (PBoC) late last year sought to boost lending by allowing banks to use loans as collateral to borrow cheaply from the central bank and then lend to small and private businesses. This was on top of recent multiple interest-rate cuts and multiple reductions in banks' reserve requirements. It was just a matter of time before the positive effects trickle down to the economy. And finally, the economic picture in China makes a turn higher, and is no more positive looking than it was one year ago. We believe that China's comeback will be the bright star for the global economy during H2 2016. A more positive environment in China will also kick-start the EM and commodity spaces, especially the base metals sector.

The weaker Dollar also helped the EM currencies as well. A fall in the US Dollar makes US Dollar- denominated debts less costly, and improves the outlook for commodity exporters, as a weaker US currency pushes commodity prices higher. There is a brief period where the sharply falling US Dollar may bounce back over the next few weeks, but that may be the last uplift for the US Dollar during 2016, and the trend thereafter looks more likely to the downside. Finally, global and US financial conditions have started to ease. "Financial conditions" is a general economic condition which includes inputs such as volatility, leverage, currency strength, oil prices, and asset prices in equity and credit markets. The January 2016 rout in assets was due to concerns that tighter US financial conditions were stressing the economy by increasing the cost of borrowing, reducing liquidity, and eroding confidence. With the ongoing rally in risk assets (especially hard assets like commodities and precious metals), along with reduced Dollar strength, that concern has diminished, and should allow risk assets, including commodities, to appreciate in the near-term at least.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The OPEC Doha meeting: geopolitics triumphed over oil economics; but does it matter?

The Doha meeting of 16 oil OPEC and non-OPEC oil producers concluded on Sunday, without agreeing to an oil output "freeze" or moratorium. The long-awaited meeting failed after Saudi Arabia demanded the participation of Iran (which did not send a representative) to any production freeze agreement. Iran has been on record before the meeting as saying that it will not participate in any output moratorium. The non-agreement further underscored the political rift between Saudi Arabia and Iran, and that ultimately doomed any hope of an agreement.

Saudi Arabia, Russia, Qatar and Venezuela oil officials agreed on an advance draft to be put forward to the main group, but the Saudis changed their stance on Sunday morning. This was confirmed by Russia, whose representative said that "some meeting participants changed their minds at the last minute". Iran was reported to have planned sending their OPEC minister, but he stayed away after Qatar was said to have insisted that all attendees would also be signatories to any deal. The baseline was that the political tension between Saudi Arabia and Iran trumped the beneficial oil economics which will accrue to oil producers if a deal was done.

It was supposed to be a "trust building" exercise

This meeting and an expected positive outcome was supposed to build market confidence that an oil market rebalancing was close at hand. Saudi Arabia said earlier that it was a "trust building exercise" among oil producers for possible future cooperation and coordinated action to cut oil output. Viewed from this perspective, the meeting was a complete failure/disaster. With most of the oil majors which attended (e.g., Saudi, Russia) producing oil at elevated levels, the meeting, many media commenters say, should have given an opportunity to accelerate the market rebalancing process (although we have reservations about this claim).

The success of the meeting was critical to some producers who are facing declines (Venezuela, Qatar, Algeria). The failure of the Doha enclave revives market speculation (similar to what happened after the failed December 2015 OPEC meeting) that OPEC's relevance in the oil market has faded, if not gone altogether, as it seemed incapable of coordinating action even among OPEC members. Sentiment regarding a faster oil market rebalancing takes a knock as an agreement, media commenters claim, would have accelerated the process. The producer countries are scheduled to meet again at the OPEC meeting in June, but given the hostile state between Saudi Arabia and Iran (which should further deteriorate after this new flare-up), the market now puts little stock on any positive outcome from that meeting as well.

But does it matter if there was a "freeze" agreement? Not really

But does it really matter whether an output freeze was negotiated yesterday, or if one is forthcoming in June? From our perspective, not really. The output of oil major producers are now close to capacity, and freezing production just cements and perpetuates what is actually happening now at the oil field. The fact is, the aggregate output of the Doha participants’ production had slightly declined since the Russians brought the issue to the forefront in January, and collectively has already fell 130,000 barrels per day. Only Kuwait, Qatar, Russia, Mexico, Ecuador and Indonesia are producing slightly more than they were in January, but said before the meeting that they were prepared to go back to those levels. Only Iran has significantly produced more – circa 350,000 bpd more than in January and has been on record for some time that they intend to raise output much higher. Iran has been saying this for months, and had even called the idea of a production freeze “ridiculous” last month.

Therefore, a moratorium agreement would have merely been a bone thrown to the market, which could stabilize sentiment and perhaps prevent further price deterioration in the interim while market supply-demand fundamentals churn their way towards a better balance. A freeze would not have done much in accelerating that process towards an actual balance – only a cut or decline in output will do that. The issue was, and still remains, the fact that the increment in total global output remains larger than the increment in global demand – too much oil is still being produced in the world relative to the level of global demand. Looked at it this way, the Doha meeting was just another ploy to further jawbone the market to push oil prices higher, without really sacrificing output in the major producers' quest to maintain or even grab market share. In other words, the Doha meeting was called with prior empty promises, and it is just fitting that the producers came out of it with empty hands.

Sugar ends the price consolidation as El Niño drought effects hits Asian growers

There are three tenets in commodity investing that some investors lose sight of, but are essential to success in commodity investments: (1) Uncertainty, which in most cases is bad for paper assets, could actually benefit commodity and hard asset prices. This is especially the case for agriculture products, when the market experiences an unexpected supply shock. (2) Commodity futures prices do not rise just because investors’ sentiment improves over a bullish trend cycle. Investors who find solid fundamentals might find themselves in a better investment position. (3) Agriculture products are subject to the vagaries of the weather and seasons, and sometimes strong seasonal tendencies in supply or in demand can skew the fundamental balance for a while, or even for a long time.

Commodity prices are primarily a function of supply and demand, and the effect of market balance in pushing price rallies and declines seems to be more straightforward and more easily recognizable relative to distinguishing between the real and fake stock market rallies. Nonetheless, the equation is not always obvious and simple, and investors should remember that even seemingly obvious supply and demand exercises could become puzzles. The reason is that many agriculture staples are deeply bound with the idiosyncrasies of the domestic currencies of the largest producers. For instance, it is not only enough to understand the supply-demand balance for coffee, but also to understand the trends of the Real, the currency of Brazil, which is among the largest coffee producers in the world. Also, when investing over a longer time frame, it might be prudent to focus on particular commodities for which demand is less cyclical, and preferably, would continue rising regardless of seasonal tendencies that impact the price trend.

The key is finding this ideal investment vehicle, and we believe there is one choice we can make right now in sugar. For one, the difference between supply and demand in the sugar industry is widening at an accelerating pace. The sugar industry is forecast to experience a supply shock of a scale which had historically driven prices significantly higher than they are now. Sugar prices bottomed in September 2015, and the 30% move higher since then may not be adequate to compensate for the supply issues the industry is expected to have in the near future. For supply-side issues this year, the focus should be India.

Sugar production and planting in India, the world's second largest producer, has been negatively impacted by below-average rainfalls this year due to El Niño. In terms of specific data points, only 215 mills were operating as of March 31, 2016, compared with 366 a year before due to a lower amount of cane to crush.

The Indian Sugar Mills Association (ISMA) expects this marketing year's (October-September) production to reach only 26 million tons, which is 8.13% lower from the same time last year. Current production (as of March 31, 2016) stands at 23.7 million tons, which is about 4.44% lower than in the previous year. By the beginning of the next season, ISMA expects inventories to come down to 7.5 million tons, and the association is somewhat pessimistic regarding the country's future exports. Also, domestic prices have been rising for some time, and that becomes a source of additional physical demand and incentive to increase sugar inventories on the expectations of higher prices. Moreover, even if the final production figures might strongly differ from the March data, the current production shortfall in excess of 1 million tons suggests likely negative impact on Indian sugar inventories if the trend continues. That certainly looks bullish for sugar prices, at least in the short-term.

The cane output of Thailand, a major Asian producer, is also expected to fall below 100 million tons, the lowest in 4 years. The Thai Sugar Millers Corp. says that sugar production in the first 91 days of the current season accounted for only 7.19 million tons vs. 8 million tons a year before. Thailand's Office of Cane and Sugar Board also said that Thai sugar cane production is expected to fall below 95 million tons both this year and the next. Reuters reported that the issue has something to do with inadequate water supply -- drought is in effect -- due to the effects of El Nino. Reuters reported that certain sugar farmers from the central Thai province of Ratchaburi lost 20-30 percent of their output this year due to the drought, with expectations for the next year's output diminishing as well. In addition, sugarcane became less sweet as a result of dry weather conditions, and more sugar cane is now needed to produce the same amount of the product. The country's 2015/16 exports are expected to decline 20.23% to 7.1 million tons. Given the supply issues brought about by El Nino to Asian producers of sugar cane, sugar prices will likely head higher again later in the year, after ending the consolidation over the past several weeks.

Charts of the week: China growth factors; the tight link between US 5 year bond yield and USD/JPY

|

|

|

|