April 11, 2016

It is time to refocus on the US Dollar as a key driver of risk-on, risk-off

Commentary by Robert Balan, Chief Market Strategist

"The government has shown clear policy signals to stabilize the currency. This effectively curbed market expectations for further depreciation, and the market has gradually understood" Xu Gao, chief economist at Everbright Securities Co. in Beijing.

Following the recent Fed comments, market participants remain convinced that the US Dollar will have further to go to the downside. The Fed is thought to be dovish; and the market is even more so. Based on this negative currency sentiment, we deduce the following eventualities:(1) the US Dollar (DXY) will probably fall to the area of at least 92.00 perhaps lower; (2) the crude oil price is more likely to go to $45, then to $30 in the short-term; (3) gold prices will likely test $1300 again; (4) base metals could follow through with one more leg up, continuing the uptrend phase which started in February.

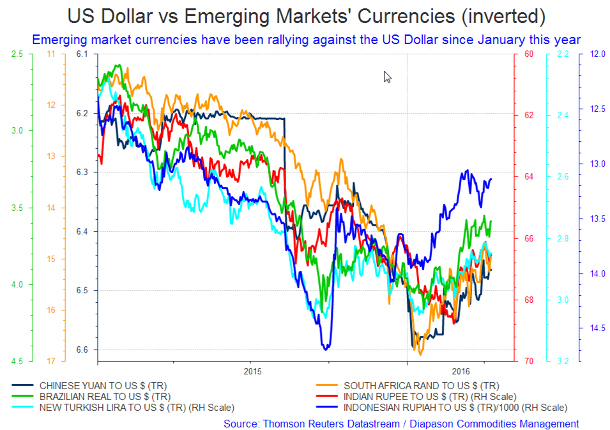

The key factor to all of these is that the market believes the Fed is unlikely to raise rates, even at the tepid pace that they announced after the March FOMC meeting during which they surprised the entire world by not tightening policy. In the press conference after the meeting, Fed Chair Yellen cited slow global growth, specifically in China and other emerging markets, as concerns. It did not matter, that US data support moderate growth (at that time) and there was continued positive trends in employment. In the days after the FOMC meeting, Fed Chair Yellen cited "Greater Gradualism" in a speech at the end of the month, giving notice the Fed won't be fighting the tape of other central banks' easing. There was some dissent on the Federal Reserve voting committee, most notably from James Bullard and Stanley Fisher, as to the slow pace of the rate hikes. But Yellen's speech clearly announced to the markets she was taking charge of the Fed's policy. The market calmed down, and became even more dovish that Yellen – the Fed funds futures market started to price-in only one rate hike, and that is in December. The impact of Yellen’s action are still reverberating positively in the financial markets, therefore setting up another likely wave of risk-on phase until late April early May, continuing the EM reflation process seen since February (see the first chart of the week below).

However, in our view this could set up the market for some surprises. This is not a radical position – this is the Fed's baseline forecast, in contrast to the market position which is only pricing in a 16% probability of the Fed Funds Rate being 1% in December. And a June rate hike is priced at only 21%. We believe that these probabilities should be much higher. It is not that we do not welcome the view of lower rates for longer. The recent rally in commodities, dry bulk shipping, and emerging markets had been largely driven by markets not probably even fully discounting one rate hike this year. And that has provided relief to the resource materials universe which has been hammered for a long time by the US Dollar's strength. However, we also know that market sentiment can change in an instant, if the conditions that have driven Ms. Yellen to the dovish side change as well. And we believe those conditions could change quickly, given another set of factors that are waiting in the wings to become relevant.

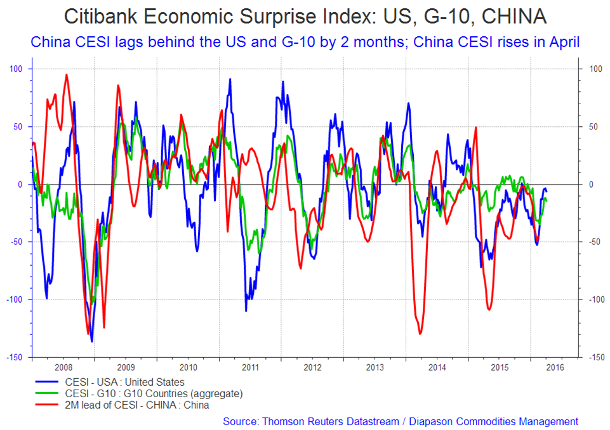

That set of factors is, for now, below the market's radar, but could become quickly relevant: (1) The Fed is bound by their own words to do two rate hikes this year, mainly for academic and political reasons. (2) Ms. Yellen (naturally) does not want to become a one-term Fed chair. It is a foregone conclusion that if a Republican becomes US president, she would be replaced after her first term is up. So it would mean that if the Fed hikes rates at all, the first rate hike would occur as far away from November as possible. And the next hike would be done after the election in November (putting December very much in play). (3) April is probably not in play, and so June becomes the primary focus. As to the Fed being dovish, parse the FOMC statement and it is all about China. China has initial positive activity data, and positive surprises will start cascading in April and May. Take away the recent bad news flow from China, and the Fed becomes more significantly more bullish.

As to why China will improve, positive economic surprises in China usually follow economic surprises in the US and G-10 which had been seen in the past two months; a similar uplift is due in China in April based on this historical relationship (see the second chart of the week below). Once China starts getting more positive, June becomes almost a done deal, and the market will become friendlier to the US Dollar. And the market will not wait for a June policy tightening to bid the greenback up. By May, we should be on the lookout for another USD rally as the Fed governors refocus on a rate hike (they are already starting to do that) – the final USD rally for the year, in our opinion (which could make new highs).

Our more benign view of H2 2016 has a lot to do with the improving outlook in China. The CNY devaluation episode earlier in the year unnerved many investors for various reasons, even if we could present evidence that much of the capital outflow which triggered further currency depreciations (in a feedback loop) has had legitimate reasons to leave the country, as in the payment of US Dollar debt. The rapid erosion of China's currency reserves was a major worry for global investors at the start of the year. Between November and January, the country's foreign exchange reserves fell by nearly USD 300 billion, almost equivalent to Brazil's entire stockpile. That pace of decline raised concerns that China was losing control and that even more capital flight would eventually push the yuan sharply lower.

This threat to the currency reserves has been receding, and indeed continued to abate in March, when China's reserves climbed for the first time since October. And at USD 3.21 trillion, the stockpile is comfortably above the USD 2.6 trillion level the International Monetary Fund considers safe. On top of this, a tightening of capital controls by the PBoC over recent months has reassured markets that it wants to avoid unsettling currency moves. The central bank unsettled global markets in August 2015 when it announced that it was moving to a more flexible currency regime. Many investors at that time saw the step as heralding a sustained devaluation. Now, it may prove to be a good alternative to the simple, sliding peg the CNY had with the US Dollar. The domestic currency would now be less in the thrall of US central bank monetary policy, which is heading for tightening, at a time when that course is inimical to Chinese financial conditions. Domestic activity is also starting to pick up in China, as shown by the series of positive economic surprises in recent weeks. With Chinese stability and actual pick up in growth, commodities, especially the base metals sector, should benefit from improved demand. Modest growth in China should also trigger further improvement in sentiment towards EM economies, and should see gains in local currencies.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

El Niño and La Niña: One goes out, and the other makes an entrance

It is the right time to revisit this theme, as El Niño is starting to make an exit, while La Niña is about to make an entrance. "El Niño" is usually the term applied to the warm phase of the El Niño Southern Oscillation (ENSO) in the South Pacific, during which unusually warm temperature anomalies are recorded. These periods of anomaly typically occurs, on average, for nine to twelve months. La Niña however, is not the identical opposite of an El Niño, although some people attempt to describe them as opposites. While El Niños can last up to one year, La Niñas typically last longer, and is usually more devastating – the impact lasts from one to three years of varying severity.

El Niño and La Niña have their signature effects on the agriculture sector, as these ocean temperature anomalies cause massive shifts and irregularities in global weather patterns which have historically affected the price of many agricultural commodities. Many analysts have studies these anomalies and the variation of commodity prices during those weather events. An IMF study conducted by Allan D. Brunner found that "over 20 percent of the variation in these [commodity] prices are accounted for by ENSO shocks." The International Research Institute for Climate and Society at Columbia University, on the other hand, found that fifty percent of the variation in local weather conditions globally can be explained by variation in the ENSO cycle.

Historically, most El Niños occur as a pair with La Niña. "La Niña" refers to the cold phase of the ENSO during which unusually cold temperature anomalies are recording in the South Pacific. This is the exact opposite of El Nino. The occurrence of the pair has been recorded to occur dating back to 1876. During a La Niña, sea surface temperatures across the Eastern Pacific Ocean drop roughly 3-5 °C, resulting in significant changes in global weather patterns which can affect the price and production of certain commodities. Together, the El Niño and La Niña form the phenomenon collectively known as the El Niño Southern Oscillation.

The agriculture commodities affected by the pair vary. El Niño is usually identifies with drought and hot climate conditions. The majority of the world's cocoa beans come from the Ivory Coast and during dry El Niño episodes, cocoa output will likely be adversely impacted and the same extreme dryness will affect the coffee yield in Columbia. When Southeast Asia is hit hard with extreme dryness, it greatly impacts production of coffee, rice, palm oil, rubber and sugar. Brazil, the top sugar exporter, on the other hand, historically experiences heavy rains during El Niño. This cause delays in harvest of sugarcane and lower levels of sugar yield per crop. The weak monsoon season will harshly hurt the Indian agricultural market, as the dry conditions hurt output of cotton as well as sugar. Dryness in Indonesia adversely impacts the mining of copper and nickel. On the other hand, Peru historically experiences flooding which coupled with the shutdown of two major mines, which causes increases in the price of Zinc.

The increased wetness due to La Niña from excess rains threatens to cause massive flooding in Australia which greatly threatens the production of coal, cattle, iron, bauxite, and petroleum products. Western Australia exports 20% of the world’s Bauxite and as one of the world's top producers, will negatively impact the output for the year. Tropical cyclones to China as well as the formation of tropical storms and heavy rains over Southeast Asia are also seen during La Nina, threatening the production of rubber, palm oil, coal, and tin as flooding and heavy rains create poor conditions. In the inverse, droughts and lack of rains in Central America and southern South America damages the production of soy beans as well as corn while the heavy rains and flooding in north South America threaten the production of Columbian Coffee. As they pertain to the US, the Department of Agricultural Economics at Mississippi State University said that significant reduction in corn yields in the Western and Eastern Corn belts in the past can be attributed to both El Niño and La Niña, although the impact had been stronger during La Niña events than El Niño oscillations.

Commodities markets investors are in general unsure of future outlooks, so many have fled the markets. But the global weather impacts of the cycles of the ENSO effect are generally patterned, predictable and understood, so there exists a time window when the predicted variations do deliver the effect that have been seen historically. Moreover, large deviations from the expected observable weather changes during a ENSO cycle are highly unlikely. Therefore, the incoming rotation between El Niño and La Niña should provide a venue for opportunistic investing in the agriculture sector.

Charts of the week: US Dollar vs emerging market currencies; China CESI lags behind US and G-10 by 2 months—rising in April

|

|

|

|