May 16, 2016

The US Dollar is being primed for a strong, although brief, rally in summer of 2016

Commentary by Robert Balan, Chief Market Strategist

"The reaction on Friday to a meaningfully weaker-than-expected payrolls was telling: We had a disappointing jobs number and the dollar actually bounced.” Robin Brooks, Goldman Sachs's chief currency strategist

On a trade-weighted basis, the Dollar hit a 15-month low on Tuesday, May 3. Over the course of less than 2 weeks, it has risen by 2.8%. Compared to equity or commodity movements, that is minuscule, but in currency terms, that is significant. On that day, the US Dollar briefly fell after the payroll data, but came back strongly to finish the day at the high. The Dollar’s strong come-back suggests that the financial markets may be having a rethink of the factors that made the Dollar weak over the past few months. Those factors are starting to evolve to produce a more favorable outlook for the US currency, at least in the near-term.

As we discussed in the last Commodity Insights Weekly (CIW) report ("Gold net long positions are overstretched: gold price may correct as the US Dollar makes a short-term recovery", May 9), the previous weakness of the US Dollar was encouraged to a large extent by the flip-flops of the Federal Reserve on their long-sought quest for "rate normalization." The Fed turned “dovish” since they tightened policy in December. Tumult in international financial markets stayed the hands of the central bank hawks, and that allowed Fed doves to gain the upper hand in subsequent FOMC deliberations. Thus far, the ascendancy of the "doves" led the Fed to pause in its rate "normalization" it has always wanted to do, and reduced the expected pace of rate hikes in 2016 by half. That paved the way for a weaker US Dollar and enabled gold and other precious metals to shine. In a previous CIW report ("It is time to refocus on the US Dollar as a key driver of risk-on, risk-off”, April 12, 2016), we made some observation and forecasts, which included the likelihood of the US Dollar (DXY) falling to the area of at least 92.00 and perhaps slightly lower. That event has come to pass, and so we now look at the other side of the coin – a US Dollar recovery over the next few months.

But why and what will make the US Dollar continue becoming stronger from here? To answer these questions fully, we have to first analyse the reasons which caused the US Dollar to sell off from December last year, deviating from its upside trajectory of the past 3 years. There were four main causes of the weakness: (1) the long-feared cataclysm in China has mostly subsided, after recent data suggest that the Chinese economy is bottoming. The price and usage of construction materials and steel bars are rising, the property market is heating up, money growth has accelerated, and industrial profits are recovering; (2) the Fed has turned dovish (as we discussed above) and that has done plenty to weaken the dollar. The March FOMC statement was clearly on the dovish side, as were most subsequent speeches by key Fed officials, as economic conditions in the US deteriorated. Real GDP in the first quarter increased at a measly 0.5% annualized pace, following only 1.4% in Q4 of 2015. In addition, the Fed is now giving more weight to developments outside the U.S. Fed Chairman Janet Yellen had admitted that she and her colleagues "wanted to adjust our thinking about the path of policy" in response to the still-fragile global growth environment, which was the case until the end of Q1; (3) The NIRP (shorthand for Negative Interest Rate Policy) applied by the Eurozone and Japan, resulted in decline in inflation expectations on those areas and put upward pressure on their real rates, leading to unwanted currency strength for EUR and JPY, and corresponding weakness in the US Dollar; and (4) the market sentiment had become too Dollar bullish towards the end of 2015. So the overstretched technical factors helped prime the selloff in the greenback. It was a fact that the bullish sentiment on the dollar had reached highly elevated levels in December 2015, a fact that was echoed in near-record long dollar positioning among currency speculators. Once the fundamental factors that started to favor the other major currencies materialized, the Dollar sell-off accelerated.

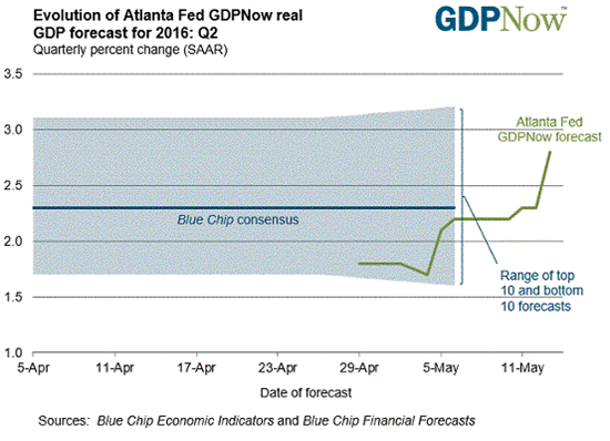

So knowing the reasons for the 2-quarter US Dollar weakness, what do we expect going forward? The primary consideration for the turn-around in the US currency earlier in the month had something to do with changes in market perception about the strength of the US economy, and how it may affect the Fed's evolving stance on policy tightening this year. We believe that the Fed's dovish tone will likely to change in 2H this year. Financial conditions in the U.S. have eased significantly over the past few months, thanks to falling corporate bond spreads, a rising stock market, and the weakened US Dollar. Such easing positively impacts the real economy after a lag of about 6 months, suggesting that the time window of those easier conditions to the real economy is just about to start now. That is in fact visible in the way that US growth has ticked up in the recent weeks (see the first chart of the week below).

Tightening labor market slack will also likely push up actual inflation and inflation expectations over the coming months. The unemployment rate has fallen to 5%, just a smidgen off the Fed's estimate of full employment. Job growth is strong and consistent, and jobless claims are still on a clear downward trajectory as it has been for several years. Broader measures of labor market slack (the U-6 rate) support the proposition that the output gap has nearly closed. Conventional measures such as average hourly earnings are distorted by the inflow of low-skill workers back into the labor market, creating the impression that there is no wage inflation. But more refined measures such as the Atlanta Fed's Wage Tracker do show a clear acceleration in wage growth. In addition, with the household debt-to-asset ratio now approaching levels last seen in the 1990s, consumers have plenty of capacity to ramp up their borrowing. At the same time, the cost drag on inflation is set to diminish as the oil price stabilizes, and the dollar’s recent softness implies further inflationary pressure. On core inflation (excluding the food and energy components), the trend suggests that the Fed is falling behind the curve. Core CPI is at a post-crisis high, having risen 2.3% year on year in February, 2.2% in March, and by our reckoning, another rise in April. Moreover, inflationary pressures will likely mount as the year progresses.

Therefore, domestic progress since the horrible economic circumstances of early Q1 puts the Fed, with a newly-adopted international mandate, in a difficult position. The Fed was and still is essentially trapped between a US economy that increasingly justifies normalization of monetary policy, and the interest of the global markets – in which about 60 of the world’s transactions are Dollar-denominated – that had driven the Fed into its current dovish stance. For the reasons discussed above, we believe that the Fed will abandon their dovish stance soon. To assume that the central bank will in fact ignore their domestic mandate for longer, and continue to remain solicitous of international markets (which have already significantly improved) and not tighten policy for the whole year, is not a very viable hypothesis to bet money on. As we see it now, the Fed is being primed by the current benevolent financial markets and financial conditions to change the tenor of their story. We can not be complacent that a July hike will not happen -- we believe that it is still pretty much in play. If the Fed changes its tune, as we believe they would, it should strengthen the US Dollar, and that, mechanically, would weaken the price of gold/ precious metals and other commodities. Nonetheless, we do not see another overpowering US Dollar performance – we start with the assumption that reinstatement of the outlook of two rate hikes this year (whether they would actually happen or not) could allow the greenback to claw back circa 50 percent of its losses from its recent highs. Our US Dollar TWI model shows how the US currency may perform over the course of summer this year. But by late Q2 2016, the US Dollar may be downward abound again, and so would allow hard assets, including commodities and precious metals, and strong finish for the year.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Could it be that the commodity ship has finally turned around and is now heading north?

This is the question that is increasingly being asked by many investors. While a definitive answer is not yet warranted, recent positive developments in commodity prices suggest that it may be time to tackle this question. The biggest bugbear insofar as this price issue is concerned has been the extent of the commodities bear market.

It began in 2011/2012. In 2015 and early this year, many commodities in raw materials sector hit multi-year lows, and in some cases, they moved to or even below production cost. Part of the reason, aside from the usual balance of supply and demand, has been the fact that commodities have higher volatility profiles than all other assets. They tend to perform according to the Dornbusch overshoot principle. This was first developed by economist Rudi Dornbusch, and is a theoretical explanation for high levels of exchange rate volatility.

This principle rejects the view held by classical economics that ideal markets should reach equilibrium and stay there. It explains the often seen phenomenon that the foreign exchange market (the US Dollar) will initially overreact to a monetary change, then moves back to achieve a new short run equilibrium. While the principle has been adopted for the FX markets, the inverse relationship between USD-priced commodities and the US currency suggests that any USD overshooting will mechanically be transmitted to commodities. And commodities, with their higher volatility profile, will amplify those moves -- when they go down, they plunge; when they appreciate, they go through the roof. Overshooting established lows or highs is not an exception for these raw material markets - it is normative behaviour. We call those instances of overshooting, "blow-offs". Overshooting clears the deck, and it was particularly true on the downside for many commodities. Prices fell to levels that were blow-off lows late last year and early this year, signalling important bottoms in the bear market cycle. During the first two months of 2016, the commodity ship began to turn north starting with gold, and many other commodities followed.

Any discussion of a revival in the commodity asset class hinges on the expectations of what the US Dollar will be doing during the period under consideration. We expect the US currency to strengthen in the short-term, but that should be followed by broader weakness by Q3 this year. Even then commodities play such an important role in the global economy that the flow of causation can also reverse sometimes, and so price developments in the commodity space can also impact expectations for future US Dollar exchange rates. So that bounds the asset class to the US unit even more tightly. However, it does not mean that supply and demand issues can be completely forgotten. The US Dollar as a prime mover is some sort of a "mystery" and it is often easier to understand how the market balance (between supply and demand) of a commodity should forecast the future price. There are also other factors that could help in the price determination – especially that have implications on the current state of demand. The Bulk Dry Index (BDI) is an important metric when it comes to assessing demand for dry bulk commodities. By April 27, this shipping index has risen to 715; it had increased over 146% in a little over two months. Lately, the index has been ceding some previous gains and closed last week at 579, which is still double that of the February level.

The commodity market has been on a good run. Gold lifted off from multi-year lows early in the year. Crude oil has so far rallied 80% from its February lows. Iron ore rose from below $40 to over $60 per ton in 2016, and other commodities have rallied 10-20-50% or more over short periods. The price of sugar has rallied from 10.13 cents per pound in August 2015 to 17 cents as of Thursday, May 12 - an increase of 68% in ten months. Soybeans have rallied from $8.49 per bushel in March of this year to highs of $10.82 last week - an increase of 27.4% in a little over two months. Many other commodity prices have moved higher in 2016. Platinum has appreciated from under $900 per ounce at the end of 2015 to over $1050 as of last Friday. Lumber has moved from around $250 per 1,000 board feet to over $320 as of last week. There are so many other examples of commodities that have recovered dramatically in 2016, particularly since the middle of February. Higher lows and higher highs are on the horizon for the raw materials on which the world depends. When that happens, then we can categorically come out and say that commodities have bottomed, and they are finally heading north.

The USDA and nature gave soybeans reasons to celebrate

The United States Department of Agriculture issues its World Agricultural Supply and Demand Estimates (WASDE) report every month. The report provides data and projections for supply and demand on agricultural markets in the U.S. and around the world. This month, the WASDE provided fireworks for the grain markets. The report implied that even as inventories of all agricultural commodities remain high, there are some signs that prices had fallen to breakeven levels for many farmers over recent months. It was particularly bullish for soybeans. The May 10 WASDE was the most bullish soybean USDA report in years. The market expected a carryover to new-crop beans this year of 405-550 million bushels but the report undercut all those expectations and reported only 305 million bushels. Moreover, the lower carry-over number assumes that all goes well with planting, which is not yet a done deal the report also assumes that the weather cooperates this growing season. The reaction in the soybean futures market was fast and furious -- July soybean futures contracts rallied from $10.2350 in pre-WASDE trading to highs of $10.9150 at the end of the session - an increase of 68 cents per bushel or more than 6.6% on the session. The sharp uptake can better be appreciated when one remembers that the July futures was trading at $8.62 on March 2. In a little over nine weeks, the July soybeans rallied by 26.6% by Friday, May 12 closing at the $10.65 per bushel level.

Nature was partly responsible for the quick uptake in prices. The rally in beans started to move higher last fall due to El-Nino related weather problems affecting palm oil supplies. Asian demand for soybean oil, a substitute, therefore began to rise. Then, drought conditions struck Brazil, and floods in Argentina decreased soybean yields in South America over recent months. The first to move was soybean meal -- it began its ascent in early April. Raw soybeans quickly followed in its wake. In the interim, there was a decline in raw soybean inventories. That and the fact that the weather has caused lower soybean product supplies led to the price explosion. This will likely continue for a while because soybean products are continuing to outperform the raw beans. Almost like the situation in crude oil, soybean products are what users/consumer buy, not unlike the distillates that are cracked out of crude oil. If the demand for the end-product is strong, there is genuine pressure on prices because it is not an inventory building exercise, as it would be if the market is buying raw beans for stockpiling reasons. In what could have been a perfect bullish storm for the soybean market, the U.S. dollar had also weakened in recent weeks. A weakening of the US currency usually provides a good lift for all the commodities.

While the May WASDE was super-bullish for soybeans, the supply news for corn and wheat was not great at all. There is still record inventories of corn and wheat which continue to weigh on prices. The reaction of these grains to last week's WASDE was muted at best. Corn was trading at $3.68 before the report, and it closed last week at $3.88 per bushel – an increase of 5.4% in post WASDE trading. Not bad, but underwhelming in the light of the fireworks in the soybeans pit. July corn rallied from the $3.5125 lows on April 1 pulled along by the wake of the soybeans rally, and the push provided by a weaker dollar stimulated the export market. Increasing gasoline prices also provided support for the alternative corn-based ethanol additives. More than ample wheat inventories and a glut of hard red winter wheat hobbled the grains; wheat appreciated from $4.5525 before the May 10 report to close the week at the $4.67 per bushel level. The WASDE report also has hidden positives – global demand for both corn and wheat is rising. Moreover, the prices of both corn and wheat remain close to production cost, and that could be bullish news for the weeks and months ahead. In the case of corn, late season bean planting due to the price increase could decrease corn yields this crop year. For now, the lead in the grain and oilseed market firmly belongs to soybeans.

Chart of the week: Evolution of Atlanta Fed GDPNow real GDP forecast

|

|