May 31, 2016

The Fed's reaction function revisited: should we fear the two rate hikes in 2016?

Commentary by Robert Balan, Chief Market Strategist

"It’s appropriate – and I have said this in the past, I think – for the Fed to gradually and cautiously increase our overnight interest rate over time; probably in the coming months such a move would be appropriate.” Janet Yellen, Chair of the US Federal Reserve, May 27, 2016

For several quarters now, the spectre of financial turmoil brought on by the prospects of a series of Fed policy tightening is like a sword hanging over the market's head. There were, and still are, incessant debates whether the Fed should or could tighten policy by 25 or 50 basis points in 2016. The points debated are pro and con, in what is increasingly looking like a theological debate of old about how many angels can dance on the head of a pin. The truth is that 25 or 50 basis points increase in the short-term rates does not matter; there is no common sense reason to think that 25bps or 50bps should make a material difference to the economy or to the financial markets, really. In an age of near-zero interest rates, an aggregate policy tightening of 50 basis points this year does not pose catastrophic economic or financial effects. The most impact such a new monetary policy regime will have, we believe, is mostly psychological but which could precede structural adjustments. It likely signals the beginning of the end of the decades-long bull market in bonds, and it does further underlines the deleterious effects of a "significant" policy divergence between the Fed, the BoJ and the ECB, the stewards of the most stalwart competitor-currencies of the US Dollar, the Yen and the Euro, respectively.

However, the salient point (and our thesis) is that this debating platform of a train has left the station a long time ago, and further argumentation is really moot. A case in point: have a look at the balance sheets of the central banks of developed economies, and then on their monetary policy regimes. Focus especially on the Negative Interest Rate Policy (NIRP) regime in Europe and in Japan. Mix in the fact that the US central bank first raised policy rates in December last year by a diddly 25 bps, after holding them near zero for nearly eight years. The premise that two 25bps hikes by the Fed this year (if they even follow-through on their promise) would constitute an epochal shift on their ultra-accommodative monetary stance, or even serve as a serious blow towards normalization of monetary policy, is wishful thinking on the part of the markets. To say the Federal Reserve "remains accommodative" (as the FOMC is likely to claim in their accompanying statement, following a policy rate raise) is a laughable understatement. The Fed is ultra-accommodative still, and so even a 50 basis-point policy raise this year does not change that fact. An expected cataclysm that will befall the EM and commodities space due to these two 25 bps rate hikes is unlikely to happen. Yes, a stronger USD on a Fed hike is likely to drive down commodity prices and thus facilitate some outflows from EM. But in our view 50bps is really not so material as to precipitate the kind of humongous USD surge and subsequent EM and commodities collapse that everyone fears.

The Fed is still ultra-accommodative; no need to fear for EM and commodities

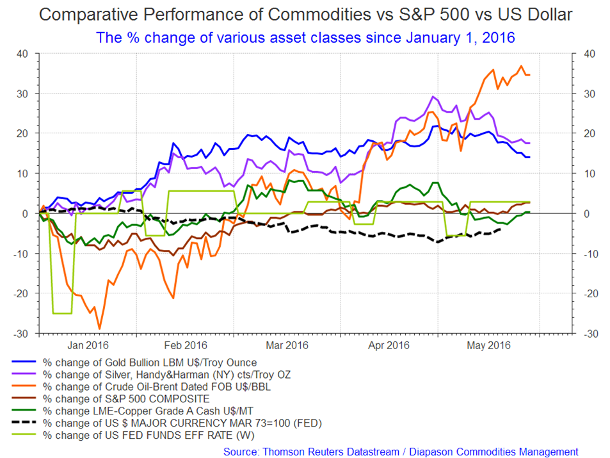

This fear for the EM and commodities is not rational. Here is why: earlier this year, many commodities hit their 21st century lows but have since then recovered strongly, even violently in some cases (e.g. iron ore). And we still have people talking about how aggregate 50bps Fed hike this year would trigger a deeper rout. While it was true that the rapid and strong rise of the US currency was mainly responsible for the commodities rout in the past 3-1/2 years, the movements on the downside had previous counterparts on the upside. Let's not mistake volatility for a secular downtrend. In a sense, commodities just gave back some of their previous gains coming from previous cycle lows. For instance, gold prices fell from $1778 in October 2012 to $1062 in January this year – a 40.26% decline. But that is minuscule compared to the run-up in gold prices from $256 in 2001 to 1778 in 2012 – a 594.53% gain in just 11 years. Another example is crude, the "star" of the news lately: spot oil fell from $124.25 in April 2012 to $29.3 in January this year – a 76.4% decline in four years. But this precipitous fall was preceded by a parabolic rise from $38.8 in January 2009 to $124.25 in 2012 – a 220% rise in three years. There are other examples, which have even better profiles: LME spot copper fell from 9650 in 2011 to 4705 in January this year. It fell 51.25%, which is not a disaster, considering that copper rose from 3199 in January 2009 to 9650 in January 2011, a 201.65% increase. All of these while the Fed funds rate are varying as well (see the first fortnightly chart below). What does this prove? It proves only that commodity prices are volatile, and that a very strong US Dollar could severely impact the valuation of resource materials. If the US Dollar's strength is the prime consideration for the immediate future prices of commodity assets, then how would the resource material universe react to a two 25bps rate hike in 2016?

The negative impact should be muted. As we explained in a previous CIW ("Gold net long positions are overstretched: gold price may correct as the US Dollar makes a short-term recovery", May 9, 2016), "if the Fed tightens policy sometime soon, it should strengthen the US Dollar, and that, mechanically, would weaken the price of gold, precious metals and commodities. But we do not see another overpowering US Dollar performance – we start with the assumption that two rate hikes this year could allow the greenback to claw back circa 50 percent of its losses from its recent highs. That could also undercut gold and commodities prices by the same amount. However, we see a forthcoming "correction" as a "healthy" development from a price discovery point of view. The next uptake in risk asset prices including gold should make back the ground that will be yielded in any short-term correction – and gain even more thereafter." For gold and commodities, a 50% retracement (giving back 50% of previous gains) is not a disaster in any form or manner. The US Dollar's rally is now on its fourth week, and a pause in the trend should be expected soon. By and large, the overall pattern that we expect to see is a sideways range between the recent low and the level representing 50% of declines this year. This kind of activity should not kill off the rallies seen previously in precious and base metals, in energy, and in the agriculture sector but just generate some corrective phase. We expect the US Dollar to substantially weaken further after that, so broadly, by late Q3, the commodities universe should be back in a bull market gearing.

|

Main drivers:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The US Dollar and commodities can rise together if there is growth

There is another less known, but very important, reason why we should not fear for the commodity universe in the forthcoming cycle of monetary policy tightening. During Federal Reserve rate-hiking cycles, history shows that the commodity-US Dollar relationship may even flip to positive; i.e. both the dollar and commodities can rise together. We have seen this occur during the periods of June 1996 – March 1997, March 1999 – January 2000 and June 2003 – December (please see the second fortnightly chart below). These periods were marked by both rising interest rates and stronger global growth. These periods of positive correlation represent 39% of all cases. This 39% can be further subdivided into 23% for both commodities and US dollar rising, and 16% both US dollar and commodities falling. During 61% of the historical period covered, there was a negative correlation between US dollar and commodities.

The Fed's tightening cycle in the US may indeed result in a continued strengthening of the US Dollar. If (still a big IF) this is associated with continued positive economic growth, then both the US Dollar and commodities can go up. If Fed tightening eventually proves to be a policy mistake (and we do not see how it could be given the minuscule adjustments being debated), or if it exerts so much pressure on EM economies that we enter an EM crisis again, (which slows global growth and heightens the demand for the US dollar), then commodities are likely to suffer as the US Dollar soars. The jury is still out on this thesis, but we do think there is a big chance of positive co-movements between the US Dollar and commodities this time around.

The sudden oil supply shocks and a sudden oil market rebalancing

The Canadian wildfires removed about 1 million barrels per day of production from oil markets over the past month. On top of that, unplanned supply disruptions from Nigeria and Libya summed up to a tidy global outages of circa 4 million b/d of production which taken off the market, according to a Reuters tally. This were added to already-high unplanned outages from OPEC states tallied during the previous month. Those sudden supply shocks brought on a sudden and marginal rebalancing of global oil markets.

But if you take out the Canadian wildfires, the oil market would have remained in surplus by approximately 1 million b/d, exactly equal to volume taken out by the wildfires. These conditions should not last long, however – Canadian production will likely be mostly back on line next month. Exports from Canada remained relatively stable, as storages were emptied in Canada to keep volumes flowing to the U.S. refining market. Canadian H2 2016 output could still be around 3.3% over H2 2015 output of 4.6 million b/d. If it were just the Canadian story, the oil price would not have run up as it did. As it were, the sudden rebalancing of global supply and demand pushed the oil market to move towards $50/bbl or perhaps even slightly higher before the momentum is over. And that is because of price pressures coming from elsewhere. For one, continued supply destruction, particularly in the U.S., and a pick-up in global crude demand (on top of the sudden supply stoppages) will likely push the oil market into a slight deficit in Q3 2016, as we have long expected.

There are several points to worry about, if one is hoping for further price appreciation, and from anecdotal stories, the market remains long the oil market. Here is one: Genscape says that crude oil stocks in Cushing, where the WTI futures deliver, were at a record 71 million barrels in mid-May. Fortuitously, at the same time, stocks in western Canada declined 1.223 million barrels to less than 25 million barrels, following a 951 thousand barrels fall at the beginning of the month. Also, the lost Canadian production was not totally offset by inventory draws, as total Canadian exports to the U.S. in mid-May dropped to 2.6 million b/d, down 366 thousand barrels per day from the beginning of the month, according to Genscape. However, the biggest prime mover of the recent rally in oil prices seems to be the news coming from US oil production. U.S. output had, and will, continue to significantly fall this year, with overall production down close to 9% year-on-year in 2016 to an average of 8.6 million b/d.

Losses in U.S. tight oil (shale) production account for the largest share of this decline in output, at circa 600 thousand b/d year-on-year for 2016. By December 2016, some estimates put US production to be down more than 1 million b/d in the seven major plays in the U.S. shales to 4.22 million b/d.

Even within OPEC, the non-Persian Gulf producers comprise the weakest segment of the oil cartel and are bearing the full brunt of pain from lower oil prices. Non-Gulf OPEC production has been estimated to fall to 8.10 million b/d, down close to 500 thousand b/d year-on-year, in 2016. This contrasts with the 4% increase year-on-year for the OPEC’s Gulf producers to 24 million b/d. The non-OPEC universe has also been providing some right-tail supply shocks. Notably, deeper production was recorded in China, where crude-oil production was down close 3% year-on-year in the first four months to 4.11 million b/d. In Brazil, that country’s oil production regulator reported oil output was down 6.2% year-on-year in March. If you add dubious supply to improving global demand profile, then the price rally make sense so far. Global consumption is now expected to rise 1.26 million b/d year-on-year in 2016, up from expectation last month of 1.18 million b/d. Stronger U.S. demand has been strong, and it will lead OECD consumption higher this year – it is expected to increase by 0.61% to 46.5 million b/d. Higher demand in China will also contribute to a 2% year-on-year increase in non-OECD demand, pushing it to 48.5 million b/d this year. US inventory has seasonally peaked, and builds will begin to draw down as refiners ramp up production, which will further flatten the WTI and Brent curves, and push them into backwardation in Q3 2016 as we long expected. This comes about as storage holders have, and will, become even more incentivized to part with their barrels in the spot market, and that producers will be hedging deferred revenue in the back-end of the curve.

How about our expectation of stronger US Dollar TWI over the course of summer? Despite our expectation for a strengthening USD until Q3 this year, all else equal, the fundamental oil market move towards rebalancing will keep the price recovery at least sideways at recent ranges, at the worst. Only a sustained, strong surge in USD (if it makes a new high) will bring back sub-$35/bbl oil prices, which we do not expect (for now). The sideways range will also be dictated by some impediments to price, both upside and downside. On the one hand, upside price risk will be restrained by hedging if deferred prices print in a range of $52/bbl in 2018 to $54/bbl by 2020, and more than $58/bbl in 2023. On the other, downside price risk will be constrained by the physical supply deficit, as well as the constant threat of geopolitically-induced supply loss. Supply surprises are possible out of Libya and Iran – although the odds of these showing up over the course of summer are not high, and are not our baseline case. In summary, we expect that the recent oil price run is now running into a distribution phase, a prelude to actual decline in prices. However, there are factors which should keep oil prices from falling far. Upside price risk will be restrained by hedging; downside price risk will be restrained by the physical supply deficit. Short-term, trading the prices ranges should be a better strategy until the end of the Q3 2016.

Fortnightly charts: Comparative performance of commodities vs. S&P 500 vs. US Dollar; The USD and commodities during periods of rising rates and growth

|

|

|

|