June 13, 2016

The supply and capital shortages should soon decimate global oil production – shale oil won’t be able to fill the outages

Commentary by Robert Balan, Chief Market Strategist

"I think we’re in a newer paradigm for the oil market. OPEC can’t afford to cut production in a meaningful way, so we are back to the market and the fundamentals of supply and demand and cost of production being the driver of price.” Rob Haworth, investment strategist and commodities expert, U.S. Bank Wealth Management

A brief pullback in oil prices expected in the short-term

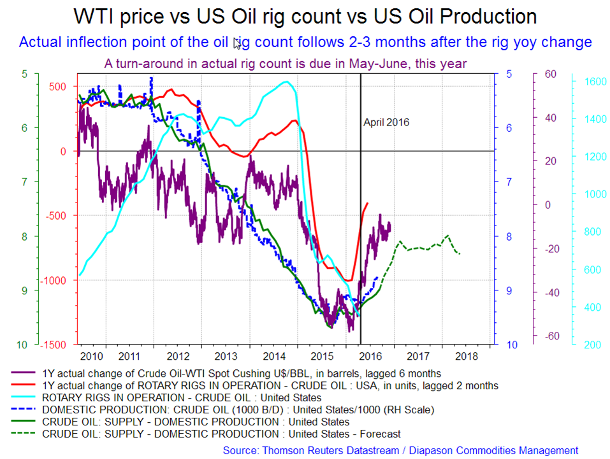

The ongoing oil rally, which nearly doubled crude prices from the lows reached in mid-January, has been primarily driven by momentum and outages, along with the accompanying oil inventory decline, which has gone into a corresponding large build in distillate inventory. We have had a number of unforeseen disruptions, most recently in Canada and Nigeria, with a further deterioration in Libya, which have helped eliminate the "glut" that has driven prices lower for most of late 2015 and early 2016. But we are now seeing signs that the rally may stall in the short-term as the effect of the temporary outages wane. Some oil traders have started to take profits, as the effect of the outage in Canada from wildfires winds down and as OPEC members started to boost production again. Also, the oil rig count has risen in the past two weeks, and it looks like this is a trend that will soon take root (see the first fortnightly chart below). Canadian production has returned, albeit slowly, and will continue to add supply - production there has just risen for the first time in three months on a week-by-week basis. The oil market may soon have to decide whether increasing supply will indeed offset the recent pickup in demand. Therefore, we believe that the oil market, which is still predominantly long, will decide to play it safe, and take some long bets off the table, as it waits for more data. We expect oil prices to be lower over the next couple of weeks or so. What we envisage over the short-term is a normal oil price pullback of less than 10 percent, as some of the bullish factors are neutralized.

Longer term, we remain positive for the oil market. Even the most optimistic oil producer would hesitate to call an end to ongoing US output declines, which we believe will continue for some time. There are some who believe that with the recent oil prices, output in the shale region will start to rise. Continental Resources created some oil bearish buzz, after they announced that they had started fracking wells that they had drilled, but left uncompleted (the "DUCs") as prices collapsed. There were 4,290 such wells in the U.S. at the end of 2015, and some analysts suggested that other producers may follow Continental's lead. We do not believe that this will happen just yet. Our reckoning shows that the oil price may have to rise to $55-$60 per barrel before DUCs are reworked on a larger scale. And then again, there is this lingering issue of just how easy or difficult it is to reboot the DUCs. There is this plausible argument that the shale industry's production of a prodigious number of DUCs was not meant to increase output but to shore up future potential production (on paper), the point being to be able to borrow the maximum amount of money from the commercial banks. The more DUCs the producer has on its asset balance, the more borrowing power it has. That is how the number of DUCs grew and grew; even with investors (and banks) throwing money at the producers during the heyday of the shale industry, the DUCs remained unproductive because they likely served other purposes distinctly different from the actual output of crude oil.

The DUCs should not provide significant increases in future oil production

After the Oil Crash, many of those DUCs have become endangered. Borrowing limits have collapsed since the assets have been impaired. The shale producers are currently in a huge bind. They cannot borrow more money, as the value of their collateral (reserves) have collapsed ,and many have lost at least 50% of their borrowing limit, given the unproductive state of many assets, lowering the value of their reserves. It has become a chicken-and-egg situation – the producers can increase the "value" of the "reserves" by drilling a DUC, but no more oil/gas can be extracted until the "relatively minor cost" of fracturing is expended as required by most debt covenants. But they cannot drill or frack until the money is lent to them. Indeed, they can use the money they can borrow to fracture and produce wells, but there is also the attraction of diverting the borrowed money to drill more DUCs, so they can increase their reserves (which increases their borrowing limit), so that they can borrow more. However, for many shale oil producers, their credit limits have been reached, and they have hundreds or thousands of DUCs they cannot frack, simply because they don't have the money. The economics of the DUCs indeed are not straightforward or have become constrained, so we do not really fear the supposed avalanche of oil production from the DUCs even when oil prices rise further. We also suspect that many of these DUCs are not good prospects, otherwise, they would have already been in production. If a DUC is not a good prospect, it will remain a DUC, perhaps forever. So, we likely have the dregs remaining, not the first-class elite wells that would be needed for easy fracturing and high production. The DUCs will not be a strong factor for a significant increase in oil production going forward.

Shale oil is not expected to increase production substantially, even when the oil price is right

The other factor for higher oil prices in the medium-term is because shale oil won’t be able to deliver what it was hyped it can do. Oil output from shale will surely increase when the price becomes right, but shale output is not going to save the world for a few reasons, neither of which is overly complicated, which are as follows: (1) First is scale. The world needs to add 4.5 million b/d to replace natural declines at a 5 percent decline rate, and with no development capital presently available the decline rate is probably more like 10 percent or 9 million barrels per day. The entire US shale revolution added less than 5 million barrels per day, over 6 years and at a cost of something like $500 billion, and much of this capital is being written off. So after years of drilling up sweet spots and half a trillion dollars, how easily will the US add another 5 million b/d, particularly when US output is in freefall now? How much capital would be required to keep production flat and double production? (2) Second, and most critically, there is tremendous variability in quality, thickness, porosity, permeability, of shale regions (like most formations), and they are far from homogenous. Producers find this out eventually, and development happens in the best spots, where economics are best. The fact is almost all previous activity had happened on the sweet spots. This isn't unique to shale, it happens in every play, oil or gas, as it develops. So there may still be a lot of drilling to go in the sweet spots, and some are still not fully understood, but the best spots are obviously pretty well mapped out and had been developed. Future development will have to be outside these sweet spots at some point, with far less spectacular results. Almost all oil and gas formations exhibit similar development patterns. Furthermore, shale sweet spots had been developed with a scorched earth policy. Even the best areas are a one-shot, money-grab attempt to suck as much hydrocarbons out of the reservoir as fast as possible. This typifies much of the thinking in the tight oil business model – it is not a sustainable policy. This is why we believe shale oil will not go back to the glory of old, and will be unable to increase production substantially, even when the price becomes right.

Cancelled CapEx will inevitably push prices higher in the near future

Finally, a lot of analysts dwell on the supply-demand aspect of the oil market, but do not devote much time on the subject of oil well natural decline rates, which is a big omission, but understandable. Natural decline rates (NDR) globally are hard to nail down with great precision – rates vary depending on amounts of maintenance capital available and incurred, for example – but some reasonable assumptions can be made. Most studies to put the number at circa 5 percent, but we get slightly conservative, and pick on 4 percent. That simply means that each year natural declines will take about 3.6 million b/d out of the 90 million b/d production base. Or put in a better context, the NDR of oil wells globally is close to one entire shale-revolution, a revolution that took more than 5 years to develop. OPEC’s decision to drive down prices is drying up Capital Expenditure (CapEx) flows around the world, and so it matters even more now that we put NDR into any calculation we have of future oil supply. Bloomberg recently calculated that $200 billion was removed from global energy Capital Expenditure budgets in 2015, with a similar amount due to be lost in 2016 as well. That amount is likely to grow now that bankruptcies are beginning, but let’s assume those numbers are static. It means that $400 billion that was earmarked to keep global oil production growing roughly in lockstep with demand growth is now gone. And that number will grow, and maybe by a lot, as long as oil prices remain low (as in below $70.00 per barrel).

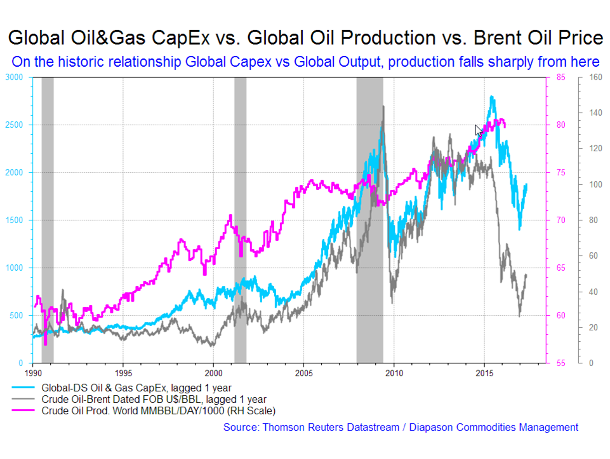

Oil industry experience shows that it costs $40,000 per flowing barrel – that is what it costs to add new production on a global basis. Given those numbers, the production shortfall from the CapEx gaping hole would be 10 million b/d. For purposes of being conservative, let’s reduce the production shortfall to “only” 5 million b/d, or one entire shale-revolution. Reconcile those numbers with this: in two years, natural declines will remove somewhere around 7-8 million b/d from global production, and possibly a lot more if uneconomic wells are shut in. Included in this would be 5-10 million b/d that will never even show up because of budget cuts. Add those, and we have a 15-20 million b/d hypothetical shortfall as a result. Even a quarter of those numbers will be disastrous, and will send the price of oil skyrocketing. Even now, part of the rise in oil prices has come from production declines that have resulted from CapEx and Opex (operational expenditures) cuts. The decline in global crude oil output will likely accelerate over the next few quarters based on the historic relationship between global CapEx and global oil production (see the second fortnightly chart below). Based on the chart below, and our other models, there should be a sharp uptake in crude oil prices as from late Q3 until year-end. The rise in crude oil prices could be sustained by the various reasons explained above – we could be looking at an oil price reaching $80 per barrel by 2018.

|

Main drivers:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Commodities are back – with a vengeance

There has been a buzz about commodities that has not been heard for a long time – Bloomberg trumpets that commodities, as measured by the Bloomberg Commodities index (BCOM) has risen more than 20%, meaning that commodities have entered a bull market. The numbers are very enticing. At the end of May, the Diapason Global Total Return Index gained a total return of 1.84%, making it the third consecutive positive month for the index. This is the first time commodities have gained three months in a row since the period ending April 2014, and this is the biggest three-month gain, 15.9%, for commodities in the index since the period ending in July 2009. Although the industrial metals sector lost 7.1%, posting its worst month in a year, and the precious metals sector lost 6.96% in its first negative month of 2016, the energy sector, currently comprising near 70% of the index, gained 3.71% in May for a three-month return of 20.78%. It's the biggest three-month gain for energy since the period ending June 2008. Also, agriculture gained 2.92% in May, which added to the performance. Moreover, what is interesting is that the roll return (measuring backwardation in the sector) turned positive in agriculture for the first time since May 2015. Likewise, roll returns in energy improved from -5.6% in February to just -1.5% in May. There has not been an increase in roll yield this quickly in energy in seven years since May 2009.

Year to date, the total return of the DCI is positive 11.33% and has gained 26.74% off its bottom in February. Commodities are now outperforming stocks for the first year since 2007 – the bear has turned bull. There were several reasons for this rapid transition: current low interest rates and a still weak dollar were significant contributing factors. Another less mentioned factor is the fact that the sharp down/move in commodities has brought prices below the cost of production, and subsequent defensive reaction from producers shifted prices higher to seek a market balance. For example: crude oil fell to lows of $26.05 per barrel on February 11, 2016. Copper hit lows of under $1.94 per pound in January. In December 2015, gold fell to $1046 per ounce and silver which peaked at over $49 per ounce in 2011 dropped to below $13.7 in December last year. The four-year bear run brought the asset class to the level of producers' pain-threshold, and started cutting back on production. A furious recovery in many commodity prices ensued over recent months. Gold rose from $1046 in late 2015 to $1306 at the beginning of May – an increase of 24.9%. Silver rose from $13.635 in December 2015 to $18.06 on May 2, 2016, it appreciated by 32.5%. The price of soybeans has rallied over recent weeks along with many other agricultural commodities. Sugar, which was trading at 10.13 cents per pound, last August, reached highs of 18.79 by month-end May, an increase of almost 86% from the lows. Most dramatically, crude oil futures have exploded from $26.05 on February 11 to $50.21 per barrel on May 26. The price of crude oil had increased by 92.7% in less than four months. Commodities are back, with a vengeance.

Fortnightly charts: WTI price vs. US oil rig count vs. US oil production; Global oil and gas Capex vs. global oil production vs. Brent oil price.

|

|

|

|