April 25, 2016

The Saudis continue to play a high-stakes game of attrition – oil prices may again fall

Commentary by Robert Balan, Chief Market Strategist

"Still-elevated inventory levels, the return of some disrupted supply, further boosts to Saudi and Iranian supply, and increased non-OECD product exports all have the potential to move prices lower over the next several months, especially if broader macro sentiment shifts." Barclays PLC, in a report to clients April 23, 2016

As we wrote last week, the Doha meeting was just a jawboning ploy ("The OPEC Doha meeting: geopolitics triumphed over oil economics; but does it matter"? - Commodities Insight Weekly - April 18, 2016) – bereft of any import insofar as reducing the supply of crude that is coming into the market.

The Saudis, in our minds, are playing a three-pronged game: (1) freeze Iran's output at a lower level (less income for their sworn enemy), (2) smash many high-output, high-cost projects which could grab market share away from them when demand/price rise due to improvement in global economy and the dearth of E&P operational capacity over the next few years due to almost-cataclysmic loss of capex in the sector,(3) by regaining control over market prices (due to their return as oil market swing producers, now that the frackers are all but dead), they could hobble Iran and everyone else from posing further threat to their market dominance, even as they keep the prospects of crude oil as a viable (price competitive) source of energy which could prolong the time before oil becomes an "stranded asset" due to development of alternative energy sources. And if KSA can kill off initiatives in this space due to low oil prices, then so much the better.

Two months of Russian jawboning ahead of the Doha meeting raised oil prices 35 percent and that's probably about as much as Saudi Arabia is willing to countenance at this time. True, the modest price rise allowed many small U.S. shale producers to stay afloat, but these frackers (and their output) are inconsequential. What is crucial is that the big and expensive projects that are in the Saudi crosshairs will not be able to reboot with that relatively small positive delta in oil prices since the February low at circa $27/bbl.

The kingdom launched OPEC on an "Oil War" in November 2014 to decapitate high-cost oil. That initiative has cost oil producers an estimated $315 billion of their foreign-exchange reserves so far. It does not make sense to have poured those billions of dollars down the drain by throwing high-cost producers a lifeline with high prices just as the policy is beginning to devastate many of OPEC's competitors (namely the high-cost producers). Executing the strategy to its conclusion by prevailing in the "Oil Wars" makes sure that the money poured down the drain – and the billions more that will have to be drawn down before the market truly re-balances – becomes an investment in securing future market share for low-cost producers, namely OPEC.

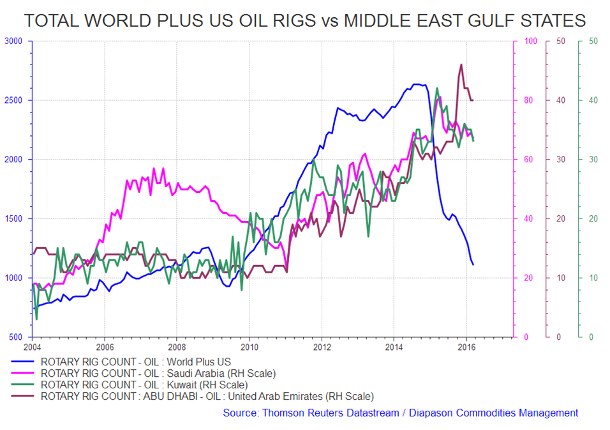

And rebalancing is indeed taking place. The International Energy Agency (IEA) sees non-OPEC oil supply falling by 1.1 million barrels per day between the Q4 2015 and Q4 2016. Six months ago, the oil supply decline was just 400,000 barrels. And in fact, three months before that, in July when it published its first detailed forecast for 2016, non-OPEC output actually rose by 0.5 million barrels per day year-over-year. The bedrock of the KSA's entire slash/burn strategy is that the oil market will eventually rebalance, and the price of oil in the future will be higher than where it is today, perhaps even significantly so. That seems inevitable with the virtual collapse in E&P capex budgeted over the next few years. The general summary is that capex-wise, there is very little to go until 2020. That makes for significantly higher oil prices by 2017 or by early 2018. And here, the Saudis overarching strategy is starting to take shape. Capex is falling sharply around the globe, but Gulf states are already planning, even starting, to raise output capacity to fill the hole left by the lack of investment in new projects elsewhere in the globe. The number of oil drilling rigs are falling everywhere, except in the three countries on the Arabian Peninsula – Saudi Arabia, Kuwait and the United Arab Emirates. These countries are seeing near-record drilling rates (see the first chart of the week below).

KSA's confidence for the strategy lies in their understanding that a low-oil-price market will inevitably crush high-cost producers – and they even said so publicly. Ali al-Naimi, Saudi Arabia's petroleum minister, last month publicly told American frackers point blank: the market will crush them - because they don't have the cost structure to survive the on-going price war, especially if oil prices again fall close to $20/bbl.

Meanwhile, the oil market's reality is that oil production is still running ahead of demand. With the high-stakes attrition game coming closer to a denouement, it would be uncharacteristic for the KSA to come to the rescue of high-cost producers. It might even just go for the jugular to finish them off. Hence, the market should not expect KSA to care too much if oil prices swoon one more time; they might even engineer another crisis – that does not bode well for the June OPEC meeting.

These developments basically seem to confirm our suspicions that Saudi Arabia will not let up on the "Oil Wars" any time soon. The Doha brouhaha was not only about geopolitics (e.g., rivalry with Iran) – that has become increasingly clear after some introspection. The reality is that Saudi Arabia doesn't want oil prices to quickly rise to a level allowing new high-cost projects before the oil market is truly rebalanced. This simple reality explains the seemingly capricious actions of the Saudis during the Doha meeting. They truly believe that they can outlast the competition and can overcome the fiscal issues brought about by lower oil revenues – they are not in a hurry to see oil prices rise too quickly. We also have a feeling that instead of weakening the current monarchy, it has strengthened their position as they embark on a transformation of their economy to prepare for the time oil approaches "stranded asset" status, and to strengthen the backbone of the Saudi society as they prepare to confront Iran in an inevitable, future showdown for Middle East control.

These are all speculations now, but even if only a few of these points will be proven true, then in the near future, we cannot expect KSA to provide support or incentives to push further price rises from here. That next OPEC meeting in June might be testy one for KSA, and will also be a crucible for these speculations. Our recommendation – do not expect much to come out of it. This is why:

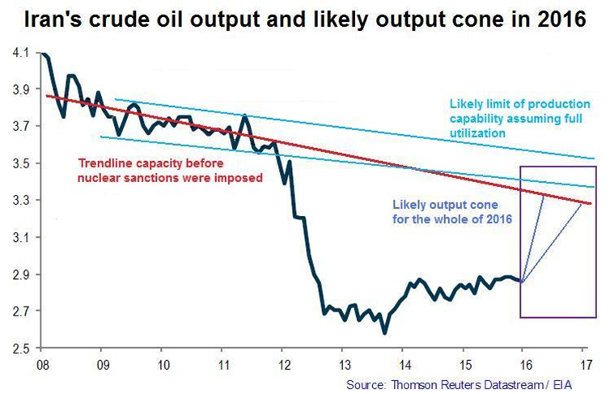

Iran was not interested in freezing its oil output at January 2016 levels. What it wanted, at least what it said it wanted, was between 4 mln and 4.2 mln bbl/d, the production it claimed to have before the oil embargo was imposed. And three months out of the sanctions, Iran says it output is now at 3.5 mln bbl/d and insists it can still ramp up to the pre-sanction capacity utilization. However, we doubt if that will happen. We believe that is mostly bargaining talk because Iran output has been declining even before the sanctions due to operational issues. And we think the 4.0 - 4.4 mln numbers were a negotiating ploy when it comes to the June OPEC meeting. This is a rough analysis of what is technically possible without massive infusion of capex in Iran (see the second chart of the week below).

Even assuming a huge effort on Iran's part, we believe that the best they can do this year is circa 3.4 mln bbl/d which they are producing now. What they have accomplished in 3 months is not a miracle, but that their output has been going on at decent pace even during sanctions period because of the complicity of some countries. Nonetheless, we do not believe they will be able to ramp up much beyond 3.5 mln bbl/d, given the state of their oil sector infrastructure. So outlines of a June OPEC meeting fracture is starting to emerge. Iran will ask for 4.2 mln bbl/d and the Saudi will scuttle the meeting rather than allow Iran to get what it will ask for. If that happens, we may see crude oil prices possibly retesting the previous sub-$30/bbl low.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The Silver-to-Gold ratio starts to rise; silver will likely outperform gold soon

In previous articles about the Silver-to-Gold Ratio (SGR), we noted that Silver had severely underperformed Gold, and it was just a matter of time before the opportunity arises as the relationship between silver and gold adjusts to less extreme levels. We believe that this opportunity is upon us – silver should start outperforming gold soon, and adjustments in their relative value via the Silver-to-Gold ratio present a solid investment opportunity for investors.

Since April 1, the price of silver has rallied by 14.4%, and gold rose by 2.47%, allowing silver to close some of the recent valuation gap with gold. The common trough in these two metals also marked what could be the cyclical trough for the SGR. From a ratio of 1.199 SGR closed at 1.375 on Friday, last week. We believe that, bar a so-called “test of the low” in coming weeks, the SGR will continue to rise over the medium-term, as cyclical assets outperform defensive assets. If our thinking proves correct, the SGR could rise to near 2.00 ratio over the next 18 months or so.

What exactly is the Silver-to-Gold Ratio, and why does it make a difference? SGR measures the amount of silver required to purchase an ounce of gold and it is one important metric of the value of silver relative to gold. Basically, it indicates whether gold or silver is undervalued or overvalued relative to each other. When the ratio is high (“high” being above the historic mean) it indicates that silver is overvalued relative to gold, and the opposite is true when the ratio is “low”. The SGR had fluctuated widely during and after the Great Financial Recession of 2008, as investors bought Gold (and dumped Silver) during the height of the GFR in 2008, and did the opposite (bought Silver and dumped Gold) in the sharp reflation of risk assets from early 2009 to the 2011 top of the SGR.

There are indications that the US Dollar may move higher in the short-term after having been generally sideways bound over the past several quarters. But in the longer-run, the US currency is probably due for further declines, and this will help support further rises in the value of silver and the SGR, as silver outperforms gold, during the general uptake of all major commodity sectors. This outperformance has historically happened during instances of broader global growth, low interest rate, and low inflation, environment. In other words, that is when cyclical assets dominate defensive assets.

There are still issues that are preventing a quicker recovery of silver over gold. There is still a tremendous volume of paper silver, a glut in paper contracts, still in place. Some analysts estimated that there is about one ounce of physical silver to over 250 ounces of paper silver. These paper contracts have effectively created a virtual silver supply without putting pressure on the physical silver market. This has helped depressed the price of silver, and is also creating considerable volatility in the silver price – the large volume of futures contracts is creating a considerable disconnect between paper and physical silver.

Nonetheless, even as silver industrial demand grows, there is an increasingly constrained supply situation with miners in recent years investing substantially less in exploration and development. Most silver stock comes as a by-product of base metals mining, and so the depressed prices of copper and nickel have recently moved miners to slash capital expenditures as they seek to shore up balance sheets and protect their cash flows. Consequently, there has been a steep reduction in exploration and mine development activity among some of the world's largest silver producers such as Rio Tinto. Moreover, of the world's largest producers of silver, global miner BHP Billiton (which has also slashed capital expenditures), is still battling the fallout from the recent Samarco disaster in Brazil. Primary silver miners, on top of slashing capital expenditures, are also contemplating shuttering uneconomic production; Endeavour Silver had just announced it will cut production by 25% in 2016.

The outlook for silver is beginning to turn positive, after a few years of being the unwanted cousin of gold. Growing industrial demand, a soon-to-be weaker dollar, the Fed's shallower trajectory towards tighter monetary policy, and supply constraints should all play their part in supporting higher silver prices over the near-term at least. There are still niggling issues, like the large volume of paper silver contracts still extant, which distorts silver’s price discovery process and promotes unwanted volatility. But the market should balance out over the longer term, and those issues should be resolved over time, making now the appropriate time to start acquiring exposure to silver.

No relief for corn prices unless or until the US Dollar weakens

China has decided to end its corn inventory reserve program due to plentiful corn supplies and high existing inventories, a decision which recently hammered international corn prices. That is not the only major issue that is facing corn – the still high valuation of the US Dollar remains a major sticking point – so it is likely that the price of this feed stock will face major barriers going forward.

The world's largest corn producer is the U.S., and corn is America's most valuable crop in terms of Dollar terms. Therefore it is no wonder that the price of corn has significant impact on several sectors in the US agriculture space. Slumping grain corn prices (which also pulled down other grain prices) hit farmer incomes in Iowa and across the Corn Belt, contributing to the current agricultural downturn. That in turn, negatively impacted businesses catering to the sector such as Deere and Co. and Monsanto. Even agriculture traders such as Cargill, Archer Daniels Midland and Bunge face difficulties as demand for corn plummeted (due to a stronger dollar) amid an oversupplied world market. Also, the domestic demand drivers for corn e.g., ethanol, are slowing in the light of lower crude oil prices, which are tangentially competitors to ethanol additives in the US gasoline supply.

The United States is the world's largest ethanol producer and almost all of the ethanol produced in the country starts with corn as a feedstock. The bulk of US corn demand used to go for livestock feed and residual use. From modest beginnings in 1980, corn use for ethanol increased rapidly, due to the relatively steep prices for crude oil during that period. However, in the past decade when concern about the environment started to take root, much of domestic corn demand was driven by increasing ethanol production. Ethanol was mandated by law in many US states as additive to gasoline to help curtail harmful emissions from car and truck exhausts

In 1996, over 70% of U.S. corn demand was for feed and residual use; only 8% was used for ethanol. By 2015, over 30% of the US corn yield was used for ethanol production. There has been a glut of ethanol production, so it remains to be seen whether corn demand for ethanol can be a sustainable demand driver going forward. USDA analysis shows that corn demand for ethanol production will likely decline over the next decade, partially due to declining overall gasoline consumption in the United States. Gasoline being sold at US pumps is mostly a 10% ethanol blend, (E10).

The United States is also the world's largest corn exporter, but no relief is expected to come from this sector soon – exports make up less than 20 percent of demand for US corn. Export demand for US corn has also been negatively impacted by recent strengthening of the US Dollar. Brazil and Argentina, have been making inroads into the world corn market, as demand for expensive US corn declined. Corn exporters in Brazil and Argentina have been helped by their depreciating currencies, which make their corn exports more price competitive. To show how competitive these countries are in the corn export business, note that since January 2015, the Brazilian Real decline by over 20% against the US Dollar, while the Argentine Peso has depreciated by 40% against the US currency. USDA corn statistics show how far the US needs to weaken the domestic currency before becoming completive in the international corn exports business. The two LatAm countries are expected to hold America's share of the world's corn export market to 32% this marketing year, a 5% drop from last year. Already, US corn exports of 42 million tons would be the smallest since the 2012 drought, although still the largest in the world.

This is not the ultimate barrier for higher corn prices. US corn ending stocks are currently the largest in a decade. Even then, US farmers in 2016 have indicated plans to plant the third most corn on record despite low prices. American farmers signalled they would plant 94 million acres of corn this spring, up 6% from last year and the highest amount since 2013. With this as backdrop, only a sharp decline in the US Dollar will provide the wherewithal for higher corn prices in the medium-term.

Charts of the week: World plus US oil rigs vs Middle East Gulf states; Iran’s crude oil output and likely output in 2016

|

|

|

|