June 27, 2016

A post-Brexit summary: what we expect of risk assets and of the global economy from here

Commentary by Robert Balan, Chief Market Strategist

"It’s important that central banks use the dovish tone they’ve done in the past to suppress any financial market volatility. It’s the volatility from the Brexit uncertainty which will harm the real economies in other parts of the world, not the break from the EU itself..” Kallum Pickering, economist at Berenberg Bank in London.

* Risk assets are likely to recover some of the Brexit losses over the coming trading days, but some damage has been done.

* The U.K. vote is a major blow to the cause of European integration. Fears that "others are next" are likely to put upward pressure on peripheral European bond yields, and their spreads with German bond yields.

* The Brexit confirms that globalization is in retreat. This will take a long time to play, but if the Fed takes the correct steps to prevent the US Dollar from strengthening too much, then it will not be such a bad news emerging markets and the shares of large multinational companies.

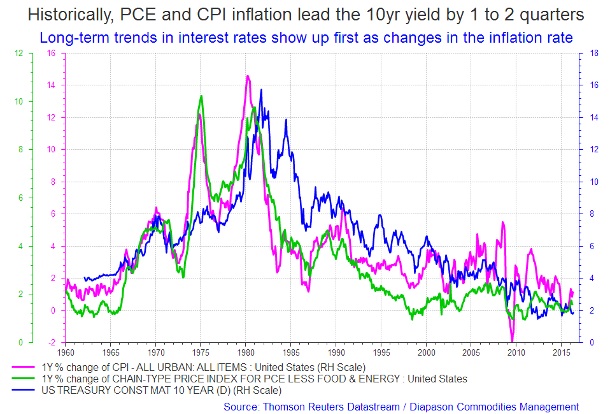

* It could also be inflationary in the long run. Due to the straight-jacket effect of the EUR on monetary policy, inflation may be the only recourse available now to member-states of the EMU to alleviate debt-loads and kick-start their economies; this recourse may be abetted by loosening in the near-future of some fiscal constraints in force in the EU.

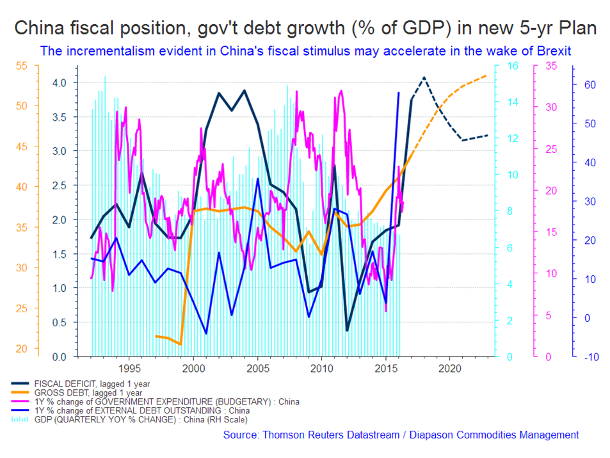

* It's time for Chinese stimulus to deliver now that the global economy needs it most. The Chinese government will be hard-pressed to quicken is traditional incremental time line on fears that Brexit will negatively impact global and domestic demand.

Discussions

From a purely short-term trading perspective, our instinct tells us to "buy the Brexit dip." The plunge in global equity prices, along with the surge in the yen and the rally in gold prices, were likely magnified by low liquidity in many markets and the forced unwinding of speculative positions taken on the premise of Bremain prior to the referendum. Nevertheless, some damage to sentiment has been done. While risk assets may recover some of their losses in the coming trading days, the so-called "reflation trade" that began in early February may take a pause during summer. We expect the reflation trade to resume thereafter, but over the short-term, we see the need to protect cyclical asset from further declines.

This is the time for Chinese fiscal stimulus to step up to the plate. The stimulus has been stagnant since May, as evidenced by declining credit growth, decreased government spending, and falling steel prices. We expect the Chinese government to apply stimulus pressure again, partly due to fears that the Brexit will negatively impact global aggregate demand (in the short-term at least). The Brexit may encourage the Chinese government to accelerate their timeline of the ongoing stimulus program (see the first fortnightly chart below).

The Bremain camp did not prevail, and these are likely to weigh on investor sentiment in the coming months. But Brexit risks have little to do with the U.K. itself. The damage to the U.K. economy is likely to be fairly modest considering that foreign tourists now benefit from a cheaper British pound. The resulting boost to net exports should offset much of the drag from diminished business confidence. A weaker currency now will likely prove to be a blessing in a few quarters. In fact, we like the near-term outlook for GBP better than a similar outlook for EUR over the next few quarters.

The bigger problem is the consequent response of rest of continental Europe to Brexit. If the U.K. can leave the EU, why can't France, where a recent opinion poll showed that 61% of French voters support "Frexit?" And if France can leave, why can't Italy or Portugal? These imponderables will likely weigh on the EUR for some time. We expect EU/USD to drift lower the rest of summer and test the previous 1.0800 support area.

The problem with the Eurozone is that the redress available to a sovereign currency issuer is not available to its member-states. They can not devalue their currency - the Euro -- in order to make their economies competitive. The experience with of the British pound in the early 1990s illustrate this point. Britain abandoned the European Exchange Rate Mechanism in the early 1990s to refloat the pound, an episode which illustrates the effectiveness of the exchange rate as an adjustment mechanism. Not shortly thereafter, the UK's economy grew, and it was in large part due to the beneficial spillovers of a free-floated currency.

The rest of the EU which are bound by the straight-jacket effects of the EUR have one last option, which is to try to engineer higher inflation. A higher inflation rate will reduce the real rate of interest, even if nominal rates do not budge. Engineering higher inflation means higher nominal yield in the euro area. However, a concerted move to raise inflation in the euro area will likely require the adoption of helicopter money policies - policies that are Treasury (e.g., fiscal) operations, which the ECB regards as firmly outside its purview. That notion could change, but it may take more economic pain before the stewards of EU fiscal policies – the Germans – relent, and allow fiscal policy loosening as redress.

The real meaning and consequence of the Brexit

Protectionism and isolationism are on the upswing and globalization is in retreat, and Brexit underlines that trend. This, offhand, is bad news for emerging markets. It is also bad news for the equities of multinational companies which are benefiting from the steady dismantling of barriers to the free flow of goods, capital, and labor. But if the Fed manages to prevent the US Dollar from strengthening in a big way again as de-globalization takes place, then EM economies will get a reprieve.

The globalization backlash should lead to higher bond yields down the road. Globalization (e.g., China low-priced exports) is a highly deflationary force, while protectionism is mechanically inflationary. The “Great Moderation”, the primary impulse for the large-scale decline global bond yields, will come to an end – and with that bond yields may have to rise everywhere. In addition, the fear of further voter revolts is likely to cause policymakers to abandon fiscal austerity in favor of stimulus. This, too, means a bit more inflation in the coming years as governments try to protect their collective behinds. Thus, ironically, while Brexit has led to a plunge in long-term bond yields in the short-term, the longer-term outcome could be higher yields and higher inflation globally (see the second fortnightly chart below).

Investment considerations

The Brexit results will impact the outlook for the global economy and the financial markets in the short run at least. While a partial recovery in risk asset prices is likely over the course of the next few trading days, equities may consolidate further during the course of summer. Use any improvement in sentiment to reduce equity and cyclical assets’ risk exposure.

However, we are not calling for a bear market in stocks and cyclical assets. The Brexit selloff is likely to put the Fed on hold for some time, at least until September. Although this will not prevent the dollar from creeping higher, that benign pause should provide underlying support to risk assets.

The US dollar should benefit from firmer US growth in 2Q 2016 and from safe haven allure, but the Fed’s looser stance could circumscribe further strength. We do not expect much higher US Dollar over the next few months, but it may enough to dampen demand for precious metals.

Gold's allure as safe haven may therefore suffer in the near-term. Whatever highs we saw this week or early next week should be faded. Gold will likely consolidate as well in the near-term. July could be a down month for the precious metals.

Crude oil prices were sold-off in the wake of the Brexit. There is no reason for oil to have sold sharply. We could still see a pop; but nonetheless, oil will also affected by a general pullback in cyclicals over most of July and even in early August. Look for optimum level to position in oil, looking forward to a sharp uptake in prices in late Q3-early Q4.

|

Main drivers:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Global oil demand will grow faster in H2 2016

Global oil demand had surprised to the upside over the first five months of the year -- growing at a rate of 1.6 MMb/d –- and will continue to do so over the balance of the year. Global oil supply, on the other hand, is tempered by somewhat slower-than-expected declines in U.S. shale-oil production and higher OPEC production (due solely to a faster recovery in Iran) that is being neutralized by faster-than-expected supply destruction in China, and a spiral lower in Brazilian production. Taken together, these factors add incremental volume to the oil Q2 2016 balance. Even so, rising demand will make a difference in our opinion, and so we expect markets to be in slight deficit by Q3 2016 – roughly 500 thousand barrels per day (Mb/d) – which would allow oil inventory to begin drawing significantly.

Global oil demand is abetted by supply destruction

Most reports and analyses coming out recently vastly understate the positive development in oil consumption worldwide. And an illustration: in Q1 2016, year-on-year (yoy) global demand was growing at a rate of ~ 1.35 MMb/d, or just under 1.5% yoy. By May, global growth had accelerated to a rate of 1.61 MMb/d, or 1.74% yoy. And is does not seem to be a fluke – demand is being led by three of the largest consumers of oil (US. India, China). U.S. demand is growing at a rate of circa 1.9% yoy, after a warmer-than-normal winter-heating season, which depressed distillate prices (heating oil) and kept inventories elevated.

Moreover, refined product demand in the U.S. now grows at more than 3% yoy post-Memorial Day driving season, continuing the 3.5% collective surge in yoy demand in April and May. Indian oil-demand growth also surprises to the upside this year by coming in 8.3% higher (yoy) in the January – May period. In terms of absolute level of demand, India is running at just under 40% of China’s expected 11.7 MMb/d consumption this year. However, in terms of growth, both countries converge at 400 Mb/d yoy growth toward year end. China’s oil consumption also picked up more than expected yoy – ~ 400 Mb/d growth (+ 3.5%) vs. 300 Mb/d earlier this year. The fiscal and monetary stimulus policymakers are putting into the economy is helping to make this happen.

Widespread supply destruction is also helping usher in the oil market balancing. Although slightly lower than expected, revised U.S. EIA data continues to show output losses in the shale-oil plays to be still huge, but production remains at levels that were higher than we expected. In fact the shale oil plays may be responding quickly (much quicker than we thought) to the recent increase in oil prices – we now have expectations of slightly higher output in the seven major shale plays by December, but should still be down 1.1 MMb/d yoy. Nonetheless, the U.S. shale continues to bear the brunt of the global supply-side adjustment to the previously lower oil prices.

The oil market tightens further in H2, and prices will rise

The combination of supply destruction and increasing demand to significantly tighten markets over the next few quarters. Globally, analysis of balances suggests markets will require ~ 500 Mb/d from storage in H2 2016. As a result, the still-high OECD storage levels will get worked lower. This should help flatten the futures curve and push it into actual backwardation by early 2017. Capex cuts highlighted by oil consultants Wood Mackenzie, who forecast cuts will eventually exceed US$1 Trillion, are most severe this year and next, which accounts for ~ 40% of the total. This is the key element for our call for sharply higher prices in Q4 2016 and H1 2017. That the market does not focus on these numbers involved in the short-term will make the impact on prices even more later in the year.

Fortnightly charts: China fiscal position; Historical lead PCE and CPI inflation

|

|

|

|