July 11, 2016

As the Business Cycle stays dormant, weak global credit growth keeps rates low and prolongs hard assets’ risk-on period

Commentary by Robert Balan, Chief Market Strategist

"Citi is especially bullish commodities for 2017. The oil market is treading water for now, but the oil price overshot to the downside earlier this year and this is clearly setting the stage for a bullish end to the decade.” Ed Morse, Global Head of Commodities Research, New York

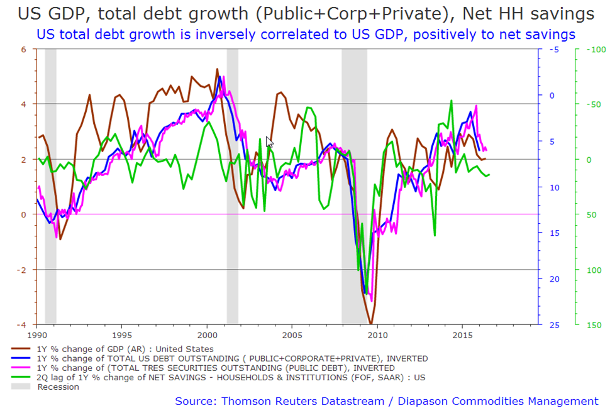

The issues that inhibit growth in much of the developed economies, is that desired savings are rising while desired investment is falling. The US example is useful in illustrating this fact. Credit growth in the US is not strong enough to kick-start growth higher: US households and corporations have become increasingly averse to taking on new debt, causing desired savings to rise, and desired investment to fall. The cause: credit growth is not growing fast enough to sustain desirable rate of economic growth. And that loops back into a higher savings rate by households and corporations fearful of the consequences of yet another growth recession.

As we see from the first fortnightly chart below, credit growth matters to GDP growth. And the lack of progress on that aspect loops back into a higher savings rate by households and corporations fearful of the consequences of yet another growth recession – which, in turn, negatively impacts on aggregate demand.

The situation is exacerbated by the refusal of the governments of many developed economies to engage in fiscal stimulus, or to put it starkly, in deficit spending. The lack of a global "borrower and spender of last resort" – is prolonging the global growth slowdown. This was true in the US as well; after initial fiscal stimulus during 2008-2009 FY sparking growth which was higher than those of other countries, US budget outlays were cut, and growth was held up only by additional stimulus coming from the Federal Reserve (see the second fortnightly chart below).

Fortunately, there is some progress along this front – fiscal austerity is giving way to talks of infrastructure spending by politicians (the new Canadian prime minister actually partly ran on a platform of infrastructure spending, and won), and the obsession with fighting inflation is starting to be replaced with talk of helicopter money (which is basically a Treasury function and in the purview of fiscal policy), and other radical solutions. But those solutions will not come soon enough to prevent further growth stagnation. However, this means that interest rates will remain low, and the risk-on environment will continue for longer. Our practical assessment: it will take another growth recession scare to spur a transition from “talking fiscal stimulus” to “actual fiscal stimulus”. Since we do not expect a recession over the next 6 to 12 months, then fiscal stimulus is unlikely to feature into financial market expectations until probably the end of 2017.

Insufficient credit growth takes away what is, by far, is the most powerful transmission channel of central bank monetary policy – modulating credit – which had been utilized very effectively by central banks until the Great Financial Recession (GFC) of 2007-2009. This had forced central banks to rely increasingly on manipulating asset prices and exchange rates to stimulate activity and growth. The central banks have had plenty of success with the former approach in the years after the GFC.

The other tool of the central banks in promoting growth – manipulating the local currency lower – has had spotty results so far; not all central banks can successfully push their exchange rate down at the same time. At least one central bank has to be willing to take the other side of the FX transaction. The Fed had previously been willing to take that role, but has of late demurred when the strength of the US dollar started to negatively impact domestic and EM (e.g., China) economic activity. The Fed had historically used the relative levels of the US Dollar to tighten or loosen fiscal conditions, when altering official policy rates was not feasible or desirable.

Therefore, many, if not all, central banks (e.g., the Federal Reserve) do not have the wherewithal to tighten policy rates, or tighten them aggressively. As a consequence, over the near-term (6 to 12 months), bond yields will likely stay low and depressed by default. With central banks unable to tighten policy by much, this effectively, means that the conventional concept of “Business Cycle” (BC) may not apply during that period. The "Business Cycle" – it should actually be called the "Credit Cycle" – happens when in a world of vigorous credit growth, there would be periods of upward pressure on interest rates and subsequent decline in rates, so as to bring the demand and supply for capital into balance, and this happens in a more or less regular cadence. But with rates at default low, even negative, levels, the Business Cycle stays dormant, and so the usual implications Business Cycles have on asset prices do not necessarily apply during this period. The conventional view is that it becoming increasingly difficult to sustain the advance in the equity and bond markets because valuations in those markets have become stretched. But we argue that the concepts of valuation being applied at this time have origins in the conventional Business Cycle concept, which we believe do not apply over the near-term at this time.

Therefore we believe that with interest rates at a default setting of low (even negative), and unlikely to change much during the period, risk assets should continue to perform well in the near-term. The risk-on period will likely go longer than what is normally warranted, compared to periods when the financial markets are subject to the normal vagaries of the Business cycle – the liquidity being preferred by the global central banks’ expanding asset balances trumps the BC at this time. We believe that global equities (the US stock markets at least) will trade sideways over the course of summer, then resume the uptrend during the later part of the year, as we expect the central banks of the major developed economies to undertake a new wave of stimulus or further policy easing later in the year.

Nonetheless, equity and bond valuations are indeed deemed stretched by many investors, and that is causing a re-evaluation of other alternative assets that have been left behind, valuation-wise. With central banks still being generous, and will likely become even more generous if the global growth doldrums carry on for longer, investors are starting to have a closer look at commodities and other hard assets. The new interest was raised to a new level with precious metals (Gold) at the start of the year, when US and global growth dropped precipitously, sparking a massive precious metals rally that is still ongoing. Then HY took off, triggering a base metals sector rally in February, when it became apparent that China is not going to implode (see the third fortnightly chart below). And the Agriculture sector followed suit in April when the El Nino started to make a transition to La Nina, an even worse nemesis of the sector. It also helped that some prices in the Base Metals and Agriculture sectors have gone below cost of production, and that has helped curtail further supply.

With the Fed unable to change monetary policy setting much, and the risk remaining to the upside, the US Dollar will tend to trade according to factors other than those related to interest rate differentials and monetary policy divergences. We submit the proposition that a forthcoming sharp rise in oil prices will lead to, or help, in weakening the US Dollar going into the late part of H2 2016 and even further. A sharp rise in crude oil prices, and attendant weakening of the US Dollar, should help spark renewed interest on the Commodities asset class, as well as provide underlying upside pressure on inflation and inflation expectations. The recent sharp rise in oil prices will be factored-in in inflation measures by late Q3 2016. Development in inflation prospects along those lines will loop back, and should further provide boost to commodity prices and add to the downward pressure on the US Dollar.

The improved outlook for hard assets has not gone unnoticed by investors and major investment banks. Returns from commodities trounced those from other assets in the first half as the oil market showed signs of rebalancing, spurring a rally, in the face of U.K.’s vote to quit the E.U., boosting concern about the outlook for growth. Global raw material demand still continues to grow, helped by the U.S. and China, while supply cuts are showing in petroleum and North American natural gas, some base metals and farm products, Citigroup said. “Unlike last year, when commodity markets rallied through the second quarter only to fall sharply come the third quarter as oversupply persisted, this rally looks more sustainable as physical markets have tightened considerably,” Citi analysts wrote. “Global demand continues to grow at a moderate rate while the pullback in capital spending is reducing not just supply growth but total supplies across nearly all extractive industries.” In this environment of rebalancing supply and demand equation, we foresee that the current price rise has much further to go into 2017.

|

Main drivers:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Inflation will become an issue later in the year and in 2017

A day after the FOMC chose to stand pat on interest rates three weeks ago, core inflation pushed back higher to 2.235% and median inflation is about to push above 2.5% for the first time since 2009 (when it was on the way down) – the upward inflation trend continues. The yoy Core CPI has not been above 3% for 20 years. But will likely be in 2017. Of course, there was nothing in this inflation picture that would have changed the Fed’s decision to downgrade tightening expectations even lower. As we previously commented, the Federal Reserve under Janet Yellen fundamentally does not believe that inflation is a threat. And if it is a threat, they believe that a little inflation is benevolent, and allowing inflation to run hot a little may even help the overall economy. The current Fed also believes that if they later decide that inflation does need to be addressed, it can be easily reined in.

We believe that the Fed is wrong on all counts, and we may well be seeing the makings of a colossal error. The only issue there is whether it is only a bad error that is fixable or a colossal error that isn’t fixable without much pain. Why? Inflation is headed higher. The only saving grace for last week’s FOMC decision to stand pat on policy is that it will slow down the near-term rise in inflation since it will keep money velocity from rising more rapidly compared to a decision that pushes policy rates higher. It is a classic relationship from the Quantity Theory of Money.

Money growth at around 7% is a little too fast, even if velocity merely flatlines. Inflation will continue to rise for the balance of this year and into 2017 (at least). The internals of the recent CPI data suggest a 2.4% core inflation number by the year’s end. That’s consistent with what we are being told by Median inflation. Both figures would suggest core PCE, is essentially at or slightly above the Fed’s 2% target by year-end.

The question is what happens next. Whether the Federal Reserve raises the target overnight rate or not, the question of inflation is relevant for markets. And the indicators seem to be fairly clear: the larger and more persistent categories are seeing price increases of around 3% or more, while the main drag comes from a “core goods” component that is highly influenced by the lagged effect of dollar strength. But since we expect the US Dollar to weaken soon, the core goods component will be the next sector to provide inflation push to the upside, all the way to year-end.

The recent sharp rise in crude oil prices, and attendant weakening of the US Dollar will also providing underlying upside pressure on inflation and inflation expectations.). The recent sharp rise in oil prices will be factored-in in inflation measures by late Q3 2016. Development in inflation prospects along those lines will loop back, and should further provide boost to commodity prices and add to the downward pressure on the US Dollar. Given our outlook for significantly higher oil prices in late H2 2016 and in 2017, the Fed may be grappling with inflation issues before the year is over. Those concerns will likely become even more acute for the Fed in 2017. The outlook of higher inflation in late 2016 and in 2017 makes an exposure to commodities take an even more urgent tone today.

Fortnightly charts: US GDP, total debt growth, net HH savings; Difference in US monetary and fiscal policy responses after the GFC; HY, spurred by loose Fed policy, led commodities higher since Feb

|

|

|

|

|

|

.png)

.png)